KUALA LUMPUR: The government has announced a RM1.5bil fund to accelerate the digitalisation of micro, small, and medium enterprises (MSMEs) nationwide, with the goal of boosting business competitiveness.

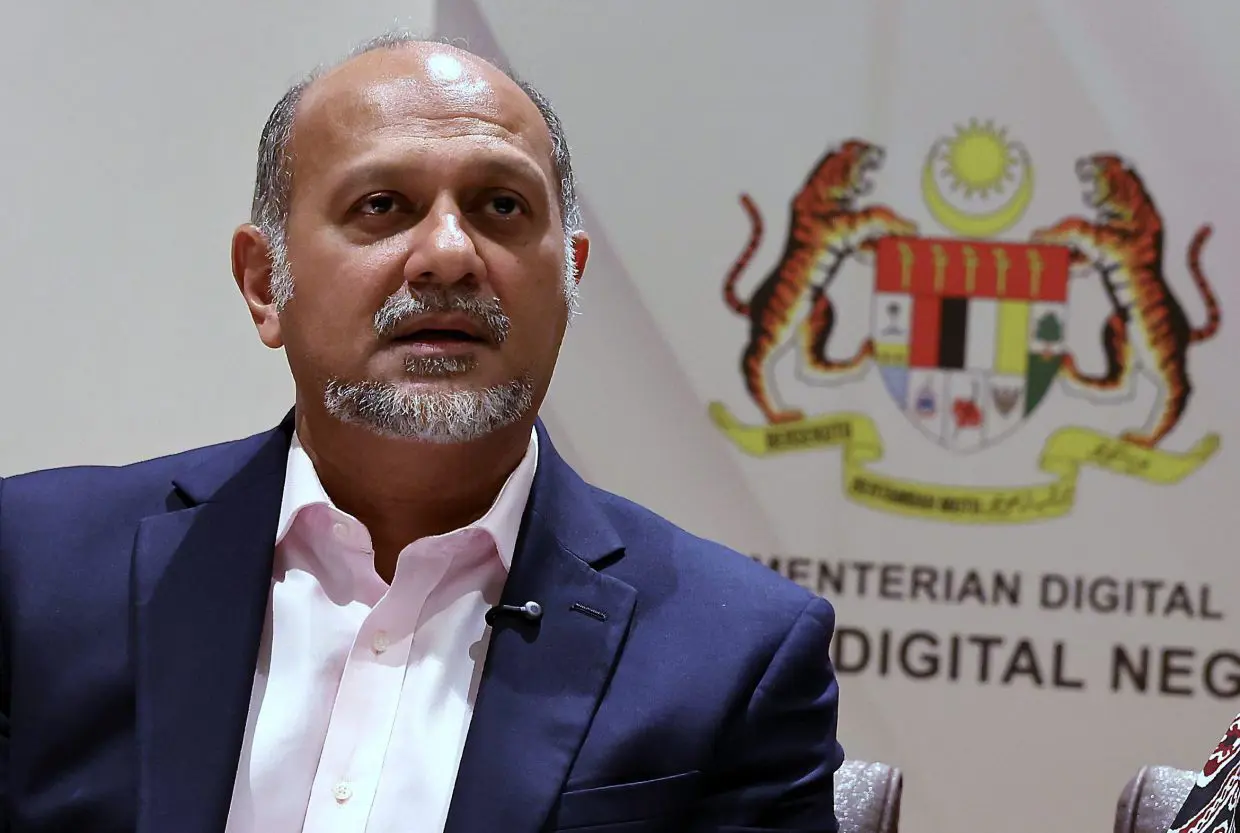

Digital Minister Gobind Singh Deo (pic) said the fund, supported by government agencies and private sector partners including financial institutions, digital banks, peer to peer (P2P) lending platforms, and local service providers, aims to help MSMEs adopt digital solutions and access financing for their operations.

"Competitiveness in today's business landscape hinges on leveraging digital technology across sectors such as retail, food service, tourism, manufacturing, services, and agriculture to drive revenue, efficiency, and productivity.

"I acknowledge that some businesses face high implementation costs despite adopting digital technology, which is why this initiative was introduced to ease those barriers and extend the benefits of digitalisation to more entrepreneurs," he said at the launch of the Business Digitalisation Initiative (BDI) programme here, on Tuesday (March 25).

The BDI programme, spearheaded by the Malaysia Digital Economy Corporation (MDEC) under the purview of the Digital Ministry, provides MSMEs with financial aid, training, and mentorship to accelerate digital adoption by granting access to subsidised solutions such as e-commerce platforms, cloud computing, and artificial intelligence (AI)-driven business management tools.

At a press conference after the launch, Gobind highlighted that a significant number of MSMEs have yet to digitalise due to limited awareness, lack of technical skills, and financial constraints.

"One of the key challenges is a lack of talent, in the sense that many are not fully aware of how digitalisation can empower their businesses, while others do not have the necessary skills to adopt these technologies.

"Over the past four months, MDEC, in collaboration with SME Corporation Malaysia (SME Corp), have been running intensive training programmes to help MSMEs navigate digital platforms, use digital banking systems, and integrate technology into their businesses," he said.

At the event, MDEC formalised several Memoranda of Understanding (MoU) with SME Corp, financial institutions, digital banks, P2P lending platforms, and local service providers to expand MSMEs’ access to funding, digital tools, and training needed for digital adoption.

As part of the initiative, 21 MDEC-accredited e-invoicing service providers will offer free and low-cost e-invoicing solutions for MSMEs. - Bernama

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.