The government’s RM1.1 billion investment in Sapura Energy Bhd is a crucial lifeline for vendors grappling with severe cash flow challenges due to outstanding payments, amounting to approximately more than RM10 million, offering a much-needed boost to the local oil and gas ecosystem.

Speaking to Bernama, Keyfield International Bhd chief operations officer Mohd Erwan Ahmad said the outstanding debts had caused severe cash flow issues for the company, mainly when the non-payment from Sapura Energy occurred in the second half of 2021, during the peak of the Covid-19 pandemic.

"We had our payment obligations to meet and it was tough. But we gritted our teeth and are glad we did not have to resort to any layoffs.

“We had to scrape through to make sure our projects were not delayed because of this non-payment," he said.

Erwan believed that the government’s intervention in Sapura Energy was both timely and necessary for the survival of vendors, given the significant amount involved and the large number of affected vendors.

“It (the injection) will restore much-needed confidence in the entire supply chain, all suppliers will continue to work with Sapura Energy to contribute towards the local oil and gas industry development,” he added.

Post-pandemic woes

Meanwhile, Classic Marine & Services (M) Sdn Bhd managing director Muhammad Khairul Rijal Khalid said his company understood that many industries were affected by the Covid-19 pandemic, and companies like Sapura Energy were no exception.

“The late payment to vendors, including us, has had a major impact on the industry ecosystem,” he said, adding that Sapura Energy still has arrears of about RM11 million to Classic Marine for the vessel’s lease period from 2021 to January 2022.

He said his company was fortunate as the vessel's owner chartered by Classic Marine & Services from Singapore understood the situation and did not impose a penalty for late payment.

Otherwise, the company’s situation will definitely become more difficult, he added.

Settle debts

On March 11, Sapura Energy secured RM1.1 billion in investment from Malaysia Development Holding Sdn Bhd (MDH) through the latter’s subscription of the company’s nominal value of redeemable convertible loan stocks (RCLS).

MDH, a special purpose vehicle of the Minister of Finance (Incorporated), has specified that proceeds of the subscription are only intended to be used for the settlement or payment of liabilities owed by Sapura Energy to Malaysian service providers operating in or supporting the oil and gas sector in Malaysia.

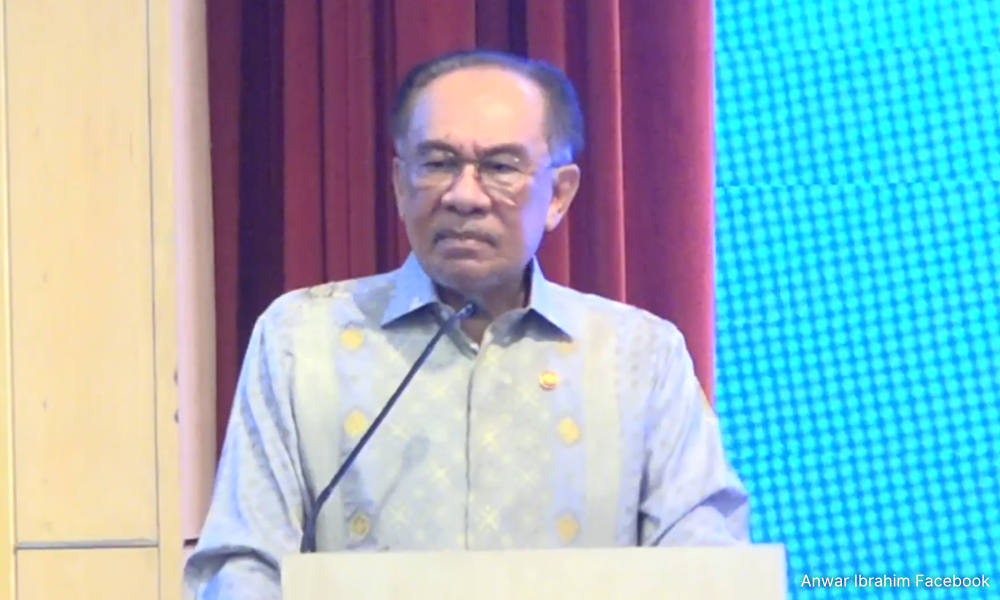

On March 13, Prime Minister Anwar Ibrahim said the RM1.1 billion injection is solely for settling Sapura Energy’s debts with vendors, involving 2,000 local oil and gas small and medium enterprises, mostly bumiputera companies.

"This funding is part of Sapura Energy’s restructuring and aims to support local workers who have gone unpaid for an extended period.

“It is also crucial for preserving the local oil and gas industry ecosystem,” the prime minister said.

Erwan said that when it was first reported in early 2022 that Sapura Energy would seek court protection and stop paying creditors and suppliers for completed work, they lost trust in the company.

“However, as time passed by and with a new management team, we gradually regained our faith and confidence because Sapura has delivered on their promises since 2023.

“We are now even more confident in Sapura Energy’s ability to sustain payments and contracts going forward, with the injection of capital to settle old problems and debts,” he added.

With renewed confidence in Sapura Energy, he said Keyfield International intends to continue working closely with the company.

Important step

Meanwhile, Khairul, who described the government's injection of funds as an important step to ensure the survival of the local oil and gas industry, acknowledged Sapura Energy's major role in assisting the company's growth since its establishment in 2012.

He said this was especially so when about 80 percent of vessel leasing contracts in 2012 came from Sapura Energy

He explained that although the figure had decreased between 60 percent and 70 percent due to the increase in new clients, Sapura Energy was still a major contributor to the company’s operations.

“The oil and gas industry is high-risk, and the main issue is that not many investors are willing to take risks.

“In fact, banks also find it difficult to provide financing due to the uncertainty in this industry,” he said.

Hence, Khairul said the government’s injection of funds is the last hope when no other party dares to invest, and if not, the oil and gas industry would be dominated by foreign companies as local companies are not brave enough or competitive enough to survive.

Cash flow impacted

Meanwhile, Ruhm Marine Sdn Bhd general manager Captain Rajendra said the company’s substantial outstanding dues disrupted operations, with prolonged payment delays severely impacting cash flow.

“While we managed to retain our workforce, we were compelled to implement cost optimisation measures. This, in turn, affected both our capital and operational expenditures,” he said.

As a company that relies heavily on the local upstream oil and gas sector, he said Ruhm Marine believed the government intervention is essential to preserving the sustainability of Malaysia’s oil and gas ecosystem, ensuring the industry’s resilience and continuity.

Rajendra also expressed that the investment injection could help restore confidence in the industry, ensuring project continuity and stabilising vendor operations.

“However, concerns about long-term financial health and systemic issues in the sector may persist.

“It is essential for Sapura Energy to reflect on its past challenges and apply the lessons learned to strengthen its future operations,” he added.

- Bernama

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.