DAP chairperson Lim Guan Eng has called for the adoption of urgent structural economic reforms to arrest the ringgit’s rapid decline.

Lim cautioned against “adverse repercussions” on government debt held in US dollars, among other things.

“Whether this depreciation of the ringgit value against three of our major trading partners is considered by the government to be a crisis or not, the government must adopt structural economic reforms immediately.

“(This is) to arrest the ringgit’s rapid descent or else there will be adverse repercussions on inflation to businesses, cost of living to the rakyat, and our government debt denominated in US dollars,” he said in a statement today.

Yesterday, the ringgit had dropped to a historic 24-year-low of RM4.54 against the US dollar.

The former finance minister said at that exchange rate, the government will now owe an extra RM7.7 billion on the principal sum of the 1MDB debt.

This is because of three tranches of bonds that Goldman Sachs had arranged for 1MDB - which totalled RM29.5 billion.

The bonds, Lim said, were issued in 2012 – US$1.75 billion at 5.75 percent per year and US$1.75 billion at 5.99 percent per year. The last tranche of US$3 billion was issued at 4.4 percent per year.

He said the first two tranches are due this year, “when the strength of the US dollar is at its highest in 24 years, and the third tranche in 2023.”

“At RM3.35 to the US dollar when the 1MDB dollar bonds were issued, the principal sum in three tranches of US$6.5 billion would come up to about RM21.8 billion.

“At the current exchange rate, the principal sum due is RM29.5 billion, or an extra RM7.7 billion,” he added.

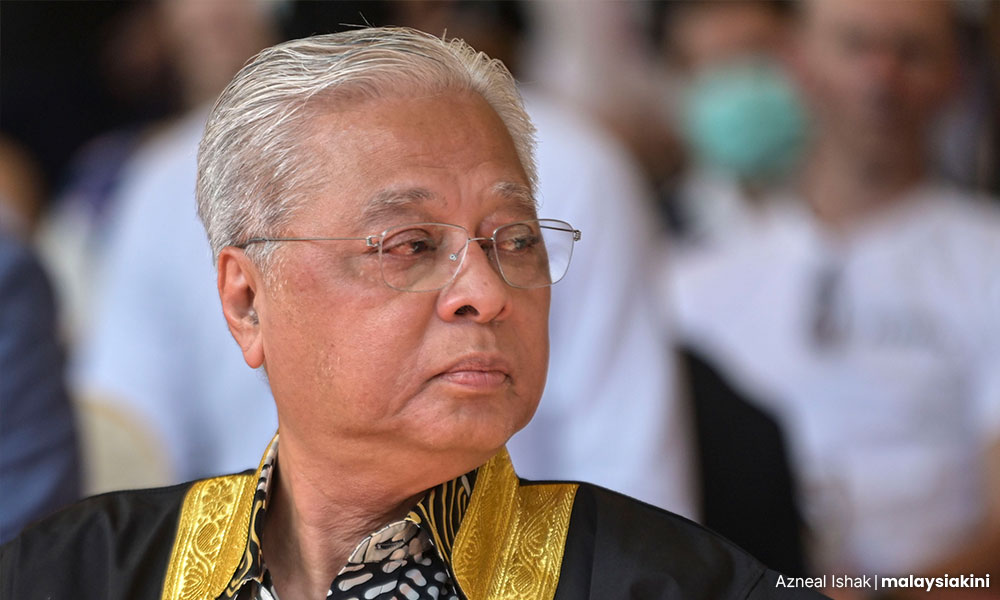

The Bagan MP questioned why Umno leaders and Prime Minister Ismail Sabri Yaakob have kept mum on the issue.

“Why do Umno leaders and the prime minister choose to remain silent about these huge billion ringgit losses from the depreciating ringgit?”

According to Lim, the cumulative interest would be more than RM1 billion per year.

“A weaker ringgit this year means the annual interest cost is around RM1.5 billion instead of RM1 billion.”

The ringgit is also said to have dropped to a historic low of RM3.26 against the Singapore dollar.

Similarly, the Indonesian rupiah has appreciated against the ringgit by more than 4 percent this year. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.