There have been many and varied comments made on the decline of the ringgit and its reasons, with the perplexing question being the weakness of the ringgit given a rosy economic outlook which predicts growth of 5-6% and a strongly recovering economy.

But is the ringgit really weak?

The surprising answer to the question is that the ringgit is not really weak but the US dollar is strengthening against almost all currencies. That has important implications for monetary policy at Bank Negara Malaysia and the question of whether interest rates should continue to be increased.

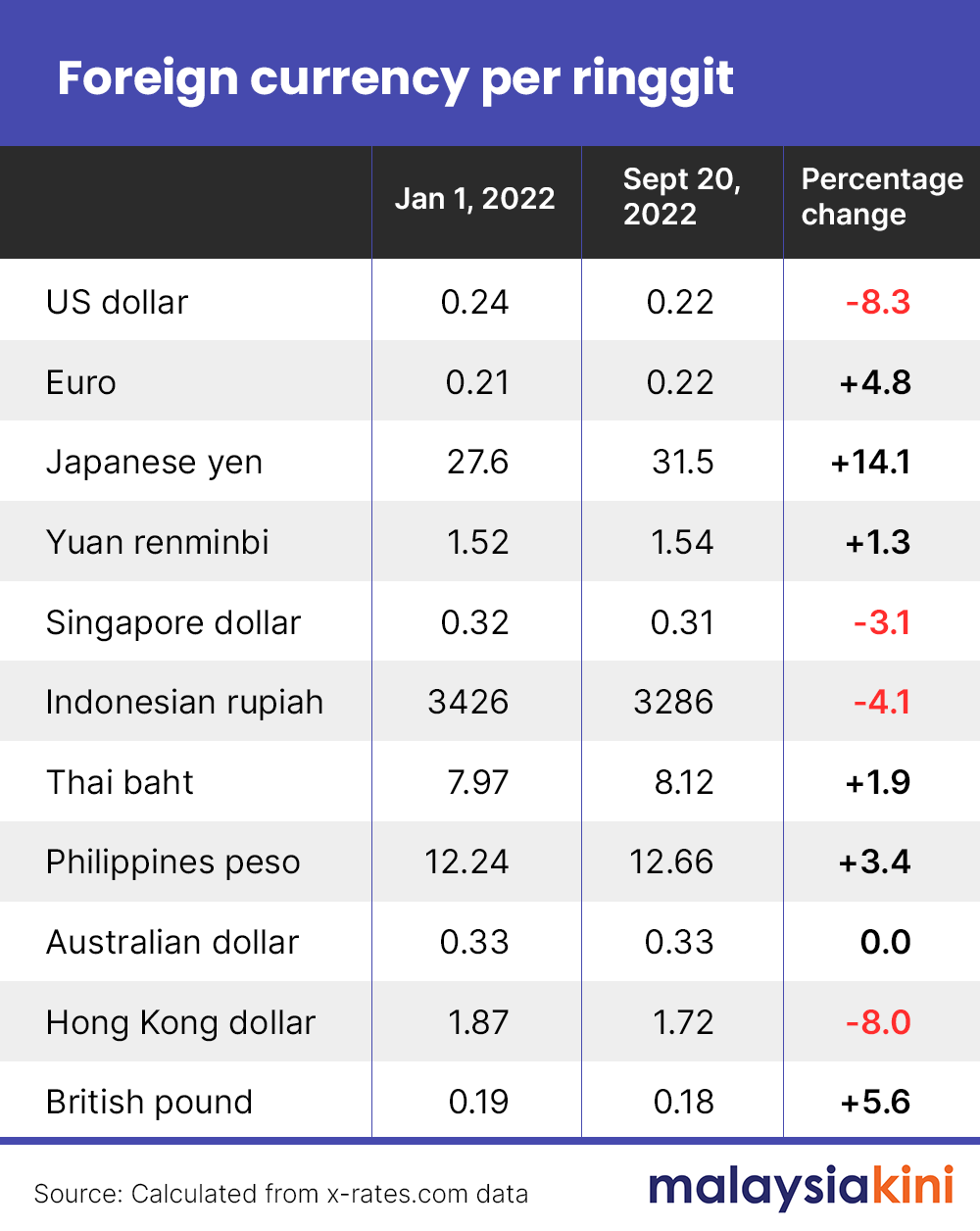

But first let’s look at the movement of the ringgit. The table below gives the movement of the ringgit against selected currencies for this year.

It is very clear from the table that it is the US dollar’s appreciation which is the main concern here, with the ringgit declining by 8.3% against the dollar so far this year. Countries whose currencies are pegged to the US dollar such as Hong Kong and Singapore have also appreciated against the ringgit which declined by 8% and 3.1% respectively.

It should be noted that the ringgit has appreciated this year against major currencies such as the yen (up by a huge 14.1%), euro (up 4.8%), the British pound (up 5.6%) and the renminbi (up 1.3%). It’s up 1.9% and 3.4% against the Thai baht and the Philippines peso.

Hong Kong’s stated monetary policy objective is to maintain a stable exchange value of the Hong Kong dollar. It says: “Hong Kong is a highly externally-oriented and open economy without imposing foreign exchange controls. Maintaining a stable exchange rate is therefore very important for Hong Kong.”

Thus, it is likely that Hong Kong is intervening in the foreign exchange markets to maintain currency stability, as with Singapore in the face of an appreciating US dollar because of short-term movements due to rising US interest rates.

The Monetary Authority of Singapore states that it “implements monetary policy by undertaking foreign exchange operations to keep the Singapore dollar nominal effective exchange rate within a policy band consistent with ensuring price stability”.

What is surprising is the rupiah’s strength against the ringgit, with the ringgit depreciating 4.1% against the currency but Indonesia too actively manages its currency. In its monetary statement for August, it says one of its moves is: “Strengthening rupiah stabilisation policy as part of the measures to control inflation through foreign exchange market intervention…”.

Imported inflation

Thus, it appears that it is the lack of intervention to support the currency by the central bank, Bank Negara, that is contributing to currency weakness.

At its meeting on Sept 8, the Monetary Policy Committee (MPC) of Bank Negara decided to increase the Overnight Policy Rate (OPR - the reference interest rate) by 25 basis points to 2.50 percent. The ceiling and floor rates of the corridor of the OPR were correspondingly increased to 2.75 percent and 2.25 percent, respectively.

That is an attempt to set interest rates higher to reduce the interest rate gap between the US and Malaysian interest rates to help reduce the pressure on the ringgit - liquidity is not an issue. But that has not helped the country so far, with continuing depreciation against the US dollar.

Inflation in the US and the euro zone is high, coming in at 8.3% (against the targeted 2%) for the US and some 9% for the euro zone. At the time of writing, the US Federal Reserve is expected to raise key interest rates by a further 0.7 to 1 percentage point, which will no doubt put pressure on the rest of the world to do the same.

However, the Malaysian inflation rate is only 2.8% although it is expected to go up further - mainly because of imported inflation caused by the decline of the ringgit against the US dollar. An estimated 70-80% of international trade is conducted in US dollars.

It could be time to intervene in the market to keep the ringgit from going down further as is being done by Hong Kong, Singapore and even Indonesia for their currencies. Especially since we do not have a serious inflation rate problem because oil prices and some other prices are controlled. The additional pressures created by a declining ringgit against the US dollar remain.

In its last public statement, Bank Negara’s MPC said it “is not on any pre-set course and will continue to assess evolving conditions and their implications on the overall outlook to domestic inflation and growth.” It is time to do so now.

Also, it is time to examine if trade with Japan and China can be done in yen and renminbi which will reduce price pressures. With a 14.1% appreciation against the yen, it seems rather strange that imports from Japan (cars and electronics amongst others) don’t seem to have declined at all.

Overall, it's time to be a bit more innovative and inventive about monetary policy, especially when the objectives of US monetary policy are now so divergent from ours. The US has to bring down inflation from 8.3% to 2% - we have no such target.

If we get this wrong, it will cost us a lot in terms of imported inflation from the decline in the currency as well as the possible snuffing out of a nascent economic recovery because of increasing interest rates. - Mkini

P GUNASEGARAM, a former editor at various online and print news publications, and head of equity research, is an independent writer and analyst.

The views expressed here are those of the author/contributor and do not necessarily represent the views of MMKtT.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.