Just a while ago a friend sent me a message saying the USD was now at RM4.53.

So I checked again and it has hit RM4.54.

This is very bad news. There is a slow and steady slide of the Ringgit. I also received this a few days ago. Dont know who wrote it but it is relevant:

The Ringgit has not declined in value just recently. It has started a downward trend since the last 20 years. Today, the Ringgit has declined by 32% against the Singapore Dollar, 30% against China and Thailand, 21% against Europe, and 15% against the US Dollar.

So it can be concluded that the fall in the value of the Ringgit currency is a long-term trend that continues. The question is, why does this happen?

One of the reasons is the decline in Foreign Direct Investment (FDI). From 2000 to 2020, Malaysia only managed to attract 8% of the total FDI coming to the ASEAN region, compared to 24% before 1997.

Now, Singapore emerges as the biggest FDI attractor with 55% of the total FDI coming to the region.

In addition, Malaysia's export structure has also not been upgraded. Our industrialisation policy has failed to trigger the export of high-value goods, instead relying on cheap electricity and low-paid foreign workers.

This has resulted in our economy being more dependent on commodities: palm oil, oil and gas only. And we are aware that this unrenovated sector is not capable of bringing Malaysia to a better level in the next 20 years.

The cause of all this is poor governance, a business environment that is not stimulating and widespread corruption, as well as incompetent leadership.

My Comments :

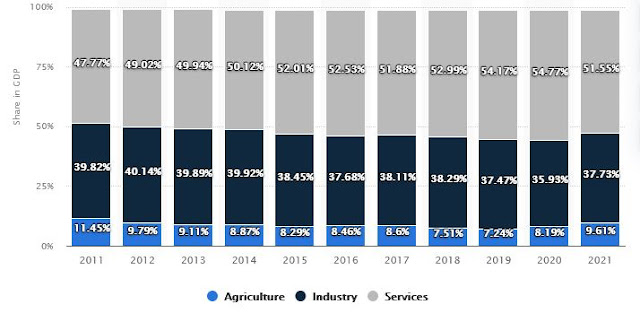

The plantation sector (palm oil, rubber) contributes about 2% to the GDP. Total agriculture contribution to GDP is just over 9%. So it is not much.

Industry contributes over 37% - and the figure is increasing.

Malaysia's export of electronics last year was over RM450 billion. That is a very large portion of the entire industrial output of the country.

Obviously it is still not "value added" enough to push up the value of our currency. The Ringgit is still falling. A lot of money especially stolen money has also left the country. All this will cause the Ringgit to fall.

But at the end of the day a (higher) value of the Ringgit, like for any other currency, depends on the demand for the Ringgit. If there is less demand for the Ringgit, its value will fall.

Obviously we as a nation of 32 million people are not producing enough goods and services, especially for export, which is perhaps the most important factor in raising the value of the Ringgit.

We need to produce more, export more and earn more foreign exchange.

Folks, the government does not know what I am talking about. They will have a rough idea but they do not know what exactly to do.

If we stop exporting then our Ringgit will fall. For example if we ban the export of chickens to Singapore, there will be less demand for the Ringgit. It will fall.

If we destroy vegetable farms, durian plantations (which can export to China and Singapore) then our Ringgit will fall again.

If we make stupid rules and regulations which increases the cost of starting a business or starting a factory in Malaysia then our exports will decrease and the Ringgit will fall.

If we impose stupid taxes like windfall taxes, restrictive GST taxes (and fine and jail people if they do not follow the rules) then all that will impede our businesses and industries. All this will have an impact on the Ringgit.

The government people will not understand all this. Plus this is written in English.

The Ringgit will continue to fall.

The views expressed are those of the writer and do not necessarily reflect those of MMKtT.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.