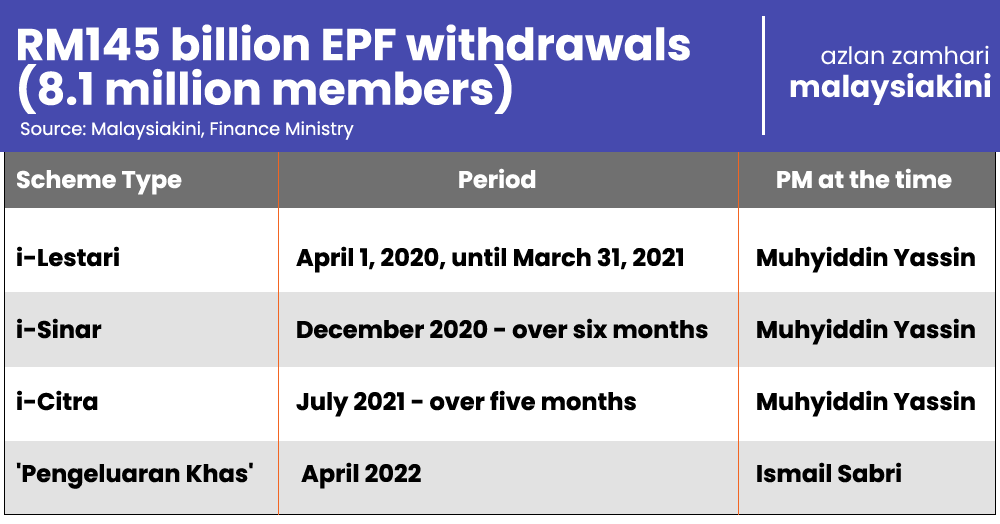

Among the worst things the backdoor governments led by Bersatu’s Muhyiddin Yassin and Umno Baru’s Ismail Sabri Yaakob did was to allow humongous withdrawals of Employees Provident Fund (EPF) savings of RM145 billion. Yes, RM145 billion!

Under various schemes forced upon the EPF, a huge amount of retirement savings was withdrawn, reducing the savings pool of 8.1 million members, more than half the workforce. The withdrawals amounted to about 15 percent of EPF’s funds.

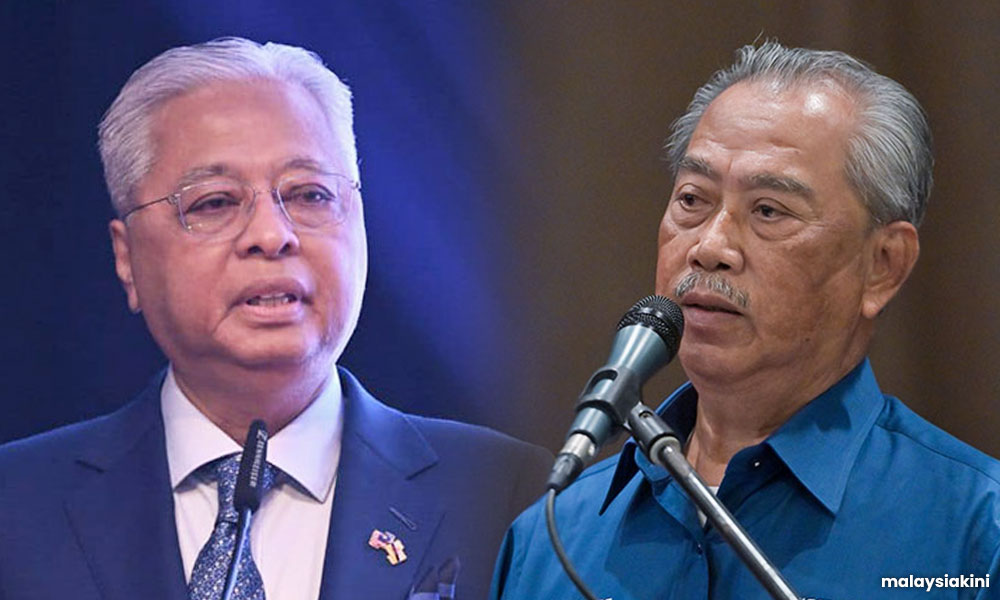

Most of it was during the tenure of the first backdoor prime minister we ever had, yes, Muhyiddin, who wanted to put money in the hands of people so they could feel good about the new government.

He was the same one who imposed an emergency to stay in power.

When he got kicked out by his Umno Baru partners, who paradoxically are Pakatan Harapan’s main partners now in the new federal government, Muhyiddin’s new backdoor successor, Ismail Sabri announced a “special withdrawal” to further burden the future of most Malaysians.

Both of these backdoor PMs must go down in history as the two leaders who pawned the future of the rakyat merely to ensure they stayed in power by giving back retirement money - prematurely - to them, thereby ensuring they have much less in future.

I have had the occasion to write at least two articles about these scams perpetuated by the two PMs. The first was when the scheme was introduced during Covid-19 in April 2020. I called it the RM60 billion scam.

To my astonishment, this continued with a second, third and fourth scheme to fill the pockets of workers with their own retirement money well before time, and spend the workers did, all RM145 billion of it.

Substantial EPF savings were gone - forever. If that money was kept in savings with a return of six percent per year, in just 20 years, the RM145 billion would have ballooned to RM465 billion.

In other words, 8.1 million workers and their families would be RM320 billion poorer in 20 years.

Economy grew and inflation with it

What a terrible travesty by governments that don’t care two sen about the rakyat.

This is despite all their talk and bluster as champions of race and religion but they are concerned only about keeping themselves and their cronies in power so they can line their pockets with wealth that will take many lifetimes to spend.

Ever wondered why the economy grew a huge 8.7 percent in 2022? Why, because of the RM145 billion stimulus injection into the economy, of course, from savings of people who could ill afford to spend them.

Ever wondered why inflation rose? The surge in demand for goods and services financed by retirement savings was a strong contributory factor.

If this was necessary to save the people from Covid-19, then it can be justified, but it was totally unnecessary and contrary to the reasons why the EPF was set up.

Every retirement fund is to provide a safety net for the people - to protect them from themselves by saving a portion of their earnings on their behalf. The employer provides a matching amount or slightly higher than that.

But instead of allowing only those who lost their jobs to access their savings, the government irresponsibly allowed everyone to withdraw their funds, whether they lost their jobs or not.

Even for those who lost their jobs, it may have been better to offer direct assistance such as grants, rather than to take it from retirement savings which they will need later.

After all, the government offered billions to companies for not retrenching staff, part of which was no doubt abused.

Allowing the employed to withdraw EPF

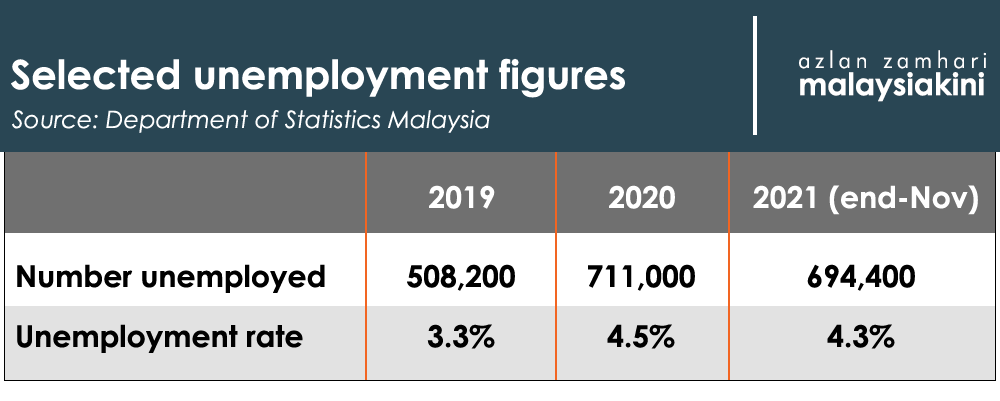

Selected employment figures showed that during the brunt of Covid-19, unemployment only increased to 4.5 percent from 3.3 percent.

The number unemployed at the end of 2020 was just 711,000, compared to 508,200 at the end of 2019, an increase of just 202,800. Yet, eventually, 8.1 million workers, 40 times the number actually unemployed, were allowed to withdraw their money.

By the end of November 2022, unemployment had fallen further to 3.6 percent or 580,000 people, or an increase of a mere 71,800, but the number who withdrew EPF savings was 8.1 million, an overkill of 113 times!

This is high stupidity, surpassing moronic levels. The only explanation is that those who decided to withdraw did so anyway knowing full well the government’s intention - to give a feeling of well-being to millions by letting them freely spend hundreds of billions of their own savings, hoping the government will return to power.

And to think that at one time, even PKR chief Anwar Ibrahim lent his voice, albeit reluctantly, to EPF withdrawals ahead of the Johor state polls while his DAP counterpart at the time, Lim Guan Eng, said pretty much the same in March last year. That did not stop them from losing Johor - badly.

It’s good to see that Anwar, as PM, has changed his tune and one hopes he will not succumb to pressure, especially to sentiment whipped up against him and his government by Perikatan Nasional headed by Muhyiddin. Play this one straight, Anwar!

As for those NGOs that demonstrated at the PM’s Department last week in favour of EPF withdrawals, I can only say they do not know what they are talking about and have probably been taken in by political ploys.

Draining EPF dry

The truth of the matter is that many EPF members do not have enough funds to withdraw their money anymore.

Consider what Deputy Finance Minister Ahmad Maslan said last week: The median savings in the EPF accounts of all Malaysians more than halved to RM8,100 in 2022 from RM16,600 the year before the pandemic. Imagine, half of your savings gone in a flash!

He added that Malay EPF contributors, who number more than seven million members, had an average median savings of RM16,900 in April 2020 but are now only left with about RM5,500.

Over 20 years, my calculations show, median savings are reduced by about RM37,000 as a direct result.

He said the median savings of EPF members of other bumiputera groups, which comprise 1.4 million members, fell to RM3,300 compared to RM10,600 before the pandemic.

Malays and other bumiputera, some eight million savers, had their savings slashed by about two-thirds as a result of their withdrawals. That’s seriously bad news as the numbers show.

It’s good that Harapan and Umno are united on this but they need to communicate the numbers to the public and show what a lousy coalition PN is - a coalition that doesn’t care at all for the people it purports to serve.

What worse things can political parties do than empty the retirement savings of the poorest segments of society which will leave them destitute, devastated, and dangerously deprived in their old age?

What kind of human being does that willingly and knowingly for mere political gain?

P GUNASEGARAM wants voters to severely punish those who would erode their retirement savings to score political points.

The views expressed here are those of the author/contributor and do not necessarily represent the views of Malaysiakini.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.