A recent Singapore interview highlights that it is time for Prime Minister Anwar Ibrahim to revisit and reopen the controversial Goldman Sachs settlement reached with the Malaysian government over 1MDB in July 2020 when Muhyiddin Yassin was prime minister and Tengku Zafrul Abdul Aziz was the finance minister.

Tied in with this is a horrendous allegation which, if true, will mean that one prime minister benefited from an attempt to negotiate a settlement in the billions of dollars with one of the world’s largest financiers and wheeler-dealers caused by the crooked dealings of another.

Just imagine the enormity of the crimes - one PM - Najib Abdul Razak - causes the loss of as much as RM40 billion through the self-styled strategic development company 1MDB.

Then another PM, Muhyiddin (above), compromises a settlement with one of those complicit in the crime - Goldman Sachs - which may run into billions of ringgit.

This is no concoction - it may well be true and only a thorough and impartial investigation by those who are honest and competent will eventually reveal whether it is or not.

For a start, Anwar must forthwith make public the settlement with Goldman Sachs and all payments made, especially since Kuang assemblyperson Sallehudin Amiruddin said in March 2021 that the authorities should investigate allegations that an RM500 million donation was made to Muhyiddin’s party, Bersatu, by a prominent lawyer handling the settlement with Goldman Sachs.

Press reports at the time said Malaysia was represented at the talks with Goldman Sachs by Attorney-General Idrus Azizan Harun and then solicitor-general II Siti Zainab Omar.

They were reported to have been assisted by Rosli Dahlan and DP Naban, the two senior partners of Rosli Dahlan Sarvana Partnership and also “chief legal trouble-shooters” for Muhyiddin Yassin.

The amount paid to the lawyers was never disclosed, and the non-disclosure agreement with Goldman Sachs was used as an excuse.

Goldman Sachs was represented by Kumar Partnership in Malaysia.

Recovering the country’s money

Anwar was put on the spot in a Bloomberg interview on Tuesday in Singapore, where he was asked about the 1MDB crisis and his response to Goldman Sachs publicly declaring Malaysia was under-declaring assets it recovered from the 1MDB crisis.

Apparently, Goldman Sachs was baulking from making a scheduled payment of US$250 million because of Malaysia’s alleged under-declaration of recovered assets bought with money stolen from the bond issues arranged by Goldman Sachs. Anwar merely asked Goldman Sachs to honour its obligations.

The crux of the matter, however, was that Malaysia under Muhyiddin as PM and Zafrul as finance minister did a rather bad deal with Goldman Sachs, as I explained in detail in this article titled “Not so fast, ‘US$3.9b’ deal with Goldman another lousy one”, written after the deal announcement.

That deal was done in July 2020, barely five months after the fall of the Pakatan Harapan government in February of that year.

The first major problem was that the deal, even if Zafrul’s claim that it was US$3.9 billion was true, is substantially lower than the sum claimed by the previous Harapan government of US$7.5 billion from total losses of an estimated US$9.6 billion, including interest payments.

The second problem was that it involved a cash payment of only US$2.5 billion by Goldman Sachs. The remainder of the US$1.4 billion was an undertaking to make up the shortfall if not enough assets bought with the money raised from the relevant bond issues were recovered.

If US$1.4 billion of assets were recovered, Goldman Sachs would not have to pay a sen!

Zafrul claimed at the time that the settlement of US$3.9 billion (but only US$2.5 billion without the guarantee) was much higher than the US$1.75 billion that Goldman Sachs had claimed in 2019.

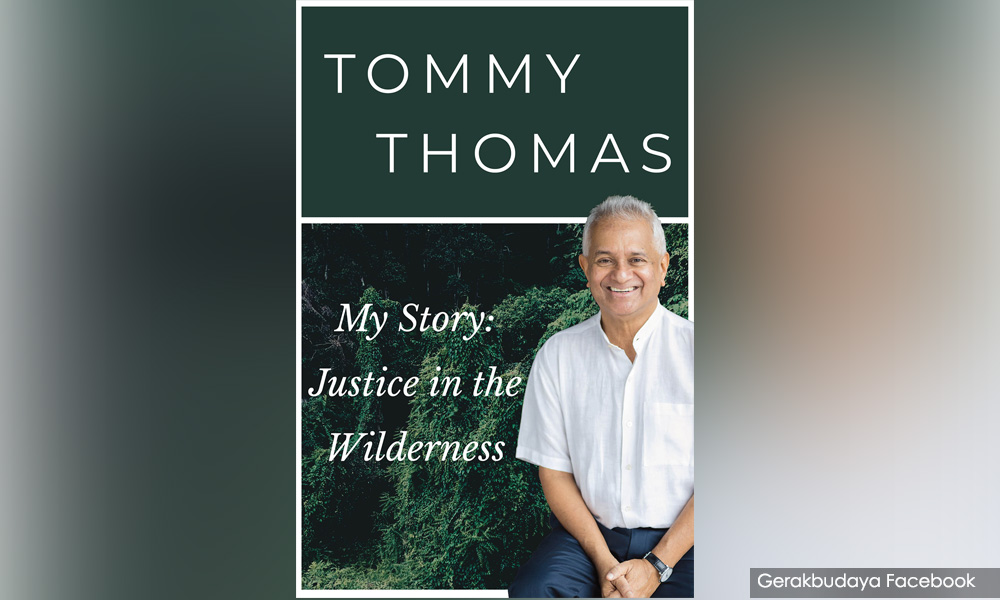

However, former attorney-general Tommy Thomas in his book, published in January 2021, had a different story to tell.

On page 317, he said: “At meetings in Kuala Lumpur in May 2019, the DOJ (the US Department of Justice) informed us that they intended to seek a direct payment from Goldman Sachs to Malaysia of US$3.4 billion. That when added to the estimated value of assets to be recovered, from Goldman Sachs bond proceeds, would mean that Malaysia could expect to receive about US$4.4 billion to US$4.7 billion. I replied that I would expect much more and that we would negotiate with Goldman Sachs directly.”

Thomas further said: “I was confident of recovering a sum closer to Malaysia’s actual losses of US$9.6 billion.” Further, he revealed that the DOJ was amenable to a sum much closer to what he was seeking.

“Hence when I resigned at the end of February 2020, Malaysia was wonderfully placed to turn the screws on Goldman Sachs… I would never have advised prime minister Dr Mahathir Mohamad to accept a cash payment of US$2.5 billion. I had sights on a much bigger sum.”

But we settled instead, effectively, for a paltry US$2.5 billion. Why, oh why? And why the hurry to settle - five months after Muhyiddin came to power?

Did not all the brains involved, Rosli and Naban included, think of asking for Thomas’ thoughts on how much they should ask Goldman Sachs?

Did he not initiate the lawsuits, the criminal cases against Goldman Sachs, and was leading the negotiations at the time with Goldman Sachs? What would have caused our negotiators to make such an error?

The US$3.9 billion was a misleading figure because out of that, US$1.4 billion was merely a guarantee that Goldman Sachs will make up if other 1MDB recoveries did not reach that sum. Goldman Sachs only paid US$2.5 billion in cash. That’s why they are kicking up the fuss about the undervaluation of the assets.

Questions from Muhyiddin-era settlement

By the time the Harapan government fell in February 2020, actions initiated by Tommy Thomas, including criminal charges filed against 17 key officials and other contemplated charges, had given Malaysia the upper hand in negotiations.

Yet, the government made such a lousy deal. And it covered things up too. Despite a question over this by MP Wong Chen, then de facto Law Minister Takiyuddin Hassan, in November 2020, refused to disclose details, citing a confidentiality clause.

Why should the government of Malaysia agree to such a clause in the first place? What was it hiding?

These are all serious questions that need to be answered, in addition to the very worrisome issue of the alleged RM500 million payment to Bersatu. If indeed that was the case, how much did the senior lawyers get paid for one week of work, which is how long the finance minister said it took to close the negotiations?

One must say that this particular deal by the Muhyiddin government was very quick, uncharacteristically much quicker than normal. Why? Also troubling is the fact that Zafrul is still in the cabinet, as is Idrus in the AG’s seat with all these still not explained.

There is no choice but for this federal government to be united in investigating this case to its conclusion, bringing all culprits to book and making the results public. Anything less will lead to an immediate loss of trust, faith and credibility in this government, which is less than three months old.

Investigators this time should take the trouble to read Thomas’ book, especially the 23-page chapter simply called “Goldman Sachs” - the best account of Goldman Sachs’ complicity in crime in the 1MDB issue I have read. And, yes, interview him - he has a wealth of knowledge on the topic.

Thomas’ book has far more value than to be merely probed by a Royal Commission of Inquiry. It can save billions of US dollars for the country and bring to book many more criminals. - Mkini

P GUNASEGARAM is the author of the book ‘1MDB: The Scandal that Brought Down a Government’ which explains the mechanics of how 1MDB was used to defraud the Malaysian people.

The views expressed here are those of the author/contributor and do not necessarily represent the views of MMKtT.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.