KUALA LUMPUR: The ringgit extended losses against the US dollar for the third straight day after another hot US inflation report reinforced the possibility of a ‘higher for longer’ interest rate path.

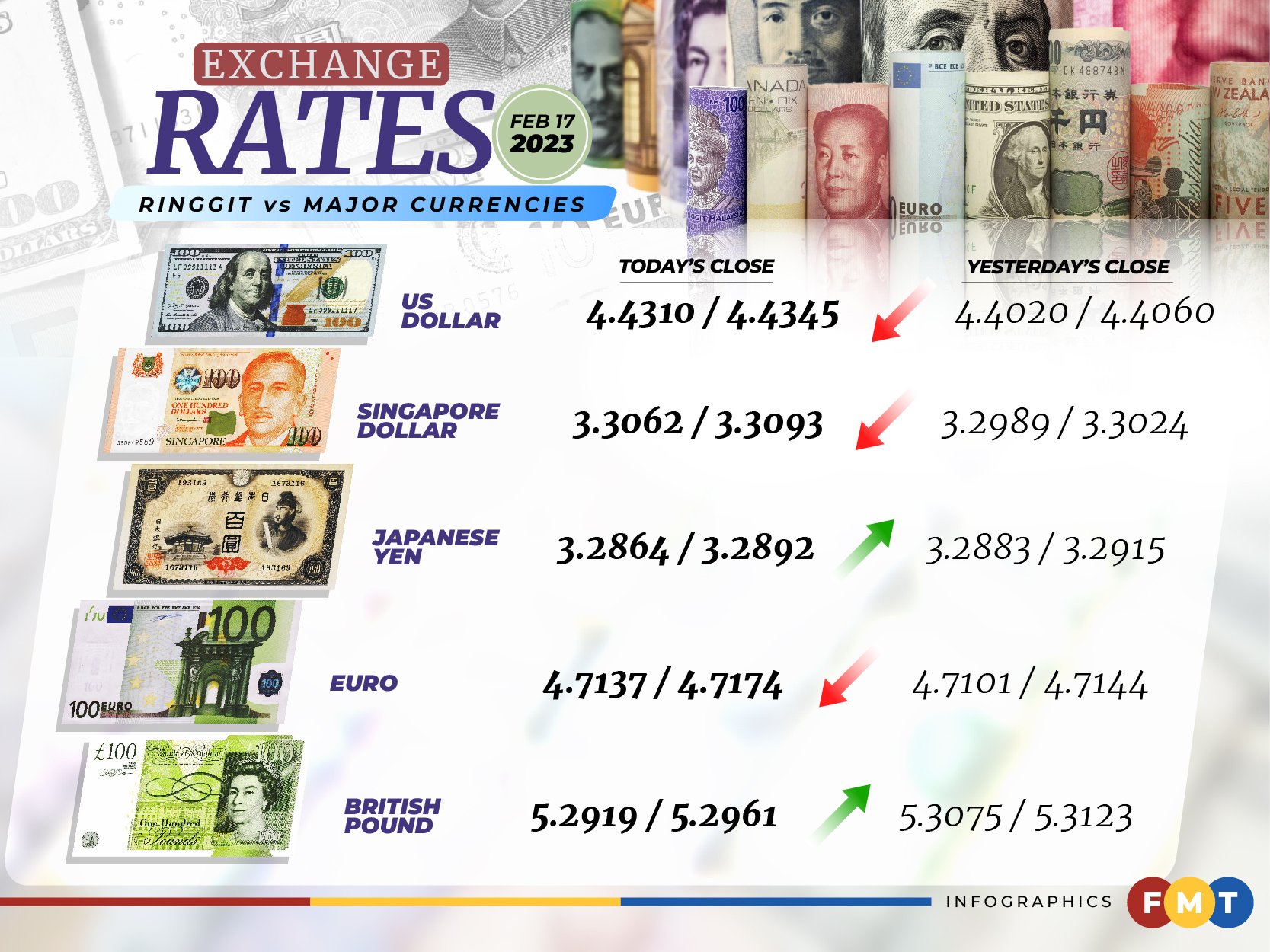

At 6pm, the ringgit fell to 4.4310/4.4345 versus the greenback from Thursday’s closing of 4.4020/4.4060.

SPI Asset Management MD Stephen Innes said the US dollar has been in demand as the continued strength in inflation data suggests the Federal Reserve’s monetary policy tightening will continue to persist.

“On the heels of a hotter-than-expected Consumer Price Index (CPI) print, Thursday’s Producer Price Index (PPI) scorcher confirmed ‘higher for longer’. This sets the bearish tone for the ringgit today,” he told Bernama.

The US PPI rose by 0.7% in January, stronger than the expected 0.4%, while the annual figure slowed to 6% from 6.5%.

Innes said the ringgit sell-off has come a long way and for sentiment to turn there has to be some sign of weaker US growth and an easing of inflation angst.

Meanwhile, the ringgit was traded mixed against a basket of major currencies.

It rose versus the British pound to 5.2919/5.2961 from 5.3075/5.3123 at Thursday’s close and improved against the Japanese yen to 3.2864/3.2892 from 3.2883/3.2915 yesterday.

However, it fell vis-a-vis the Singapore dollar to 3.3062/3.3093 from 3.2989/3.3024 yesterday and weakened versus the euro to 4.7137/4.7174 from 4.7101/4.7144 previously. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.