Before going on to the suggestions for the Advisory Committee to the Finance Minister (ACFM), it may be appropriate to make a couple of comments.

First, this is not at all like the Council of Eminent Persons (CEP) set up by then prime minister Dr Mahathir Mohamad in May 2018 after the Pakatan Harapan victory, with former finance minister Daim Zainuddin as head and four others which also included current ACFM chairperson Mohd Hassan Marican.

The scope is much smaller now compared to the wide-ranging powers that Daim had and which he used to make some rather questionable decisions, some of which appeared to be aimed at settling old scores.

As it should be, the powers of the new ACFM will be restricted to making recommendations to Finance Minister Anwar Ibrahim, who is also the prime minister. In other words, there will be no executive powers, unlike the CEP, which seemed to have more power than the cabinet.

Another welcomed announcement is that Anwar’s daughter Nurul Izzah has stepped down from her post as senior economics and financial adviser to the prime minister to jointly head the secretariat of the advisory committee. This would help to reduce the decibel level of the excessive outcry over her appointment earlier.

The ACFM had its maiden meeting last Friday, chaired by Hassan (above, left), who is also an adviser to Petronas, and was attended by the other members: Sarawak Energy Berhad chairperson Abdul Hamed Sepawi, FPSO Ventures Sdn Bhd executive chairperson Ahmad Fuad Md Ali, Universiti Malaya economics professor Rajah Rasiah and Sunway University economics professor Yeah Kim Leng.

Post-meeting, the ACFM said its main roles are to advise the finance minister on:

Increasing the nation’s revenue base and reducing the operating expenditure.

Reviewing and restructuring existing subsidies, and the provision of more holistic social protection.

Government-linked companies (GLCs), including their relevance and consolidating them where appropriate.

Matters related to national debt and good governance.

Note that the advice is entirely financial in nature and does not include ways and means to strengthen and revitalise the economy, which is correct given that it comes under the Economy Ministry helmed by Rafizi Ramli.

Also, at this stage, it does not include any representatives from the government. That would be a pity because the recommendations will then have no input from senior government officials.

This can be easily rectified by co-opting selected officials from the Treasury, Inland Revenue Board and Customs.

Let’s take in turn each of the four areas mentioned.

1. Increasing revenue and reducing expenditure

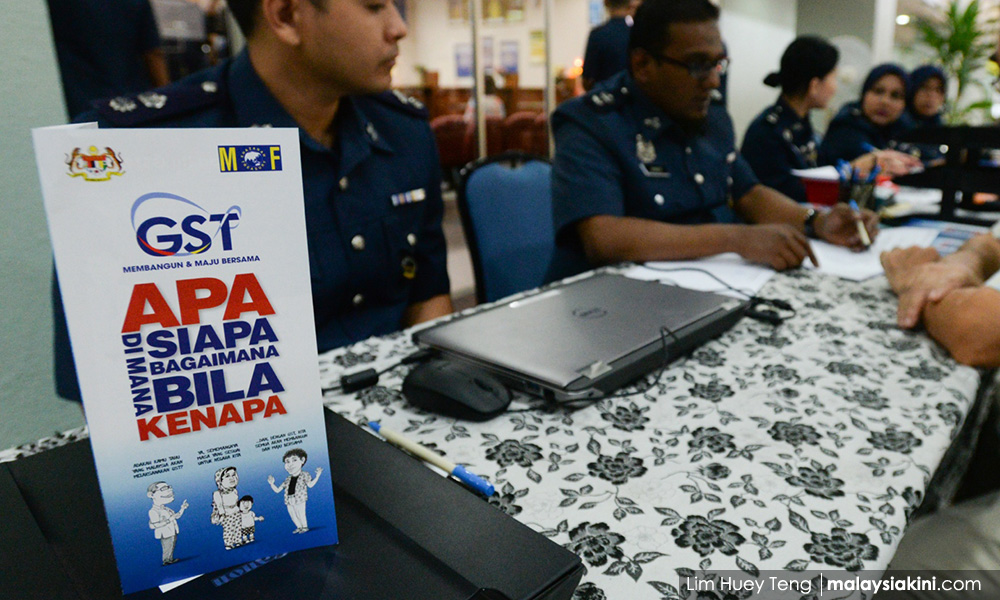

One way to increase revenues is to widen the tax base. The goods and services tax or GST is a good way of doing this. Being a value-added tax, it is designed to tax consumption, the more you consume, the more you pay.

It, therefore, recovers some of the money lost through tax evasion. It also requires more information to be given for tax refunds, thus reducing evasion through cross-checking.

It can be reintroduced with little impact on inflation because a list of some 200 essential goods was already tax-exempted when it was introduced in April 2015.

Other methods of increasing revenue would include reducing tax evasion. Much of the informal economy is not taxed because the income received is not declared or is insufficiently declared. One way of doing this is to investigate those who have a lot of assets but pay little or no taxes.

Other ways of increasing revenue would be to impose estate taxes and increase taxes for higher brackets and lower tax ceilings so that more people can pay taxes. Needless to say, such moves will be unpopular, even if they are necessary.

Ways to reduce expenditure will include cutting or removing subsidies, opening competitive tenders and contracts, cutting needless expenses, and cutting government staff by attrition to reduce salary expenditure. That takes us to the next topic on the list.

2. Reviewing subsidies and more holistic protection

Fuel and gas subsidies make up the bulk of subsidies which amount to around RM80 billion. There is considerable room to reduce or cut these blanket subsidies which help everyone, rich or poor. Instead, part of the amounts saved by cutting subsidies can be channelled directly to the poor through targeted subsidising.

This is something that has been talked about for a long time but no government so far has the guts to do it. There may be one-off inflationary pressures, however, which need to be accepted as part of the price for reform.

3. The relevance of GLCs

It must be remembered that many GLCs are large - often profitable - companies and even if one wants to divest them there may not be enough takers. And in the long run, the government may even lose money.

Imagine if Petronas had been privatised - the amount of revenue and profit lost would already have been in the hundreds of billions.

The trick is to make sure the GLCs compete on an equal footing with no special privileges and to put the right people in place.

However, there are problem areas with respect to many GLCs owned by states. Many of these companies need to be revamped or even closed down. But there is the question of how this can be done for states not controlled by the unity government.

4. National debt and good governance

One has to accept that part of the reason for a rapid increase in debt is the reflating measures and aid dished out during Covid 19. But now that’s over, it will be time to start reducing the debt figure to more manageable levels.

Even before this takes place, someone needs to look at the contingent liabilities which are likely to materialise and include that in the working definition of debt instead of all the liabilities. That will give a better handle on the debt problem.

There are many GLCs that have a lot of debt, including Petronas. Not all of their liabilities are a danger to the government’s finances.

Ultimately, recommendations can be made but if they are not adopted by the government, then the whole exercise is of no consequence. One hopes that all reasonable recommendations from the ACFM will eventually be adopted by the government. - Mkini

P GUNASEGARAM is a former editor at online and print new publications, a head of equity research, an independent writer, analyst, and consultant.

The views expressed here are those of the author/contributor and do not necessarily represent the views of MMKtT.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.