KUALA LUMPUR: The ringgit traded lower against the US dollar today amid increased demand for safe-haven assets, particularly the greenback.

Bank Muamalat Malaysia Bhd chief economist Afzanizam Abdul Rashid said the latest move by the People’s Bank of China to cut its policy rate by 10 basis points had reinvigorated the notion of a slowing global economy.

“Moreover, possible monetary tightening by the Bank of England on Thursday would cement the view that restrictive global monetary conditions would soon take a toll on global growth,” he told Bernama.

He also said the smaller-than-expected contraction in Malaysia’s May exports indicated that the diversity in the country’s export mix may have helped mitigate the impact of heightened global uncertainty.

“The US dollar-ringgit (rate) was hovering around RM4.6280 to RM4.6398 during the day,” he added.

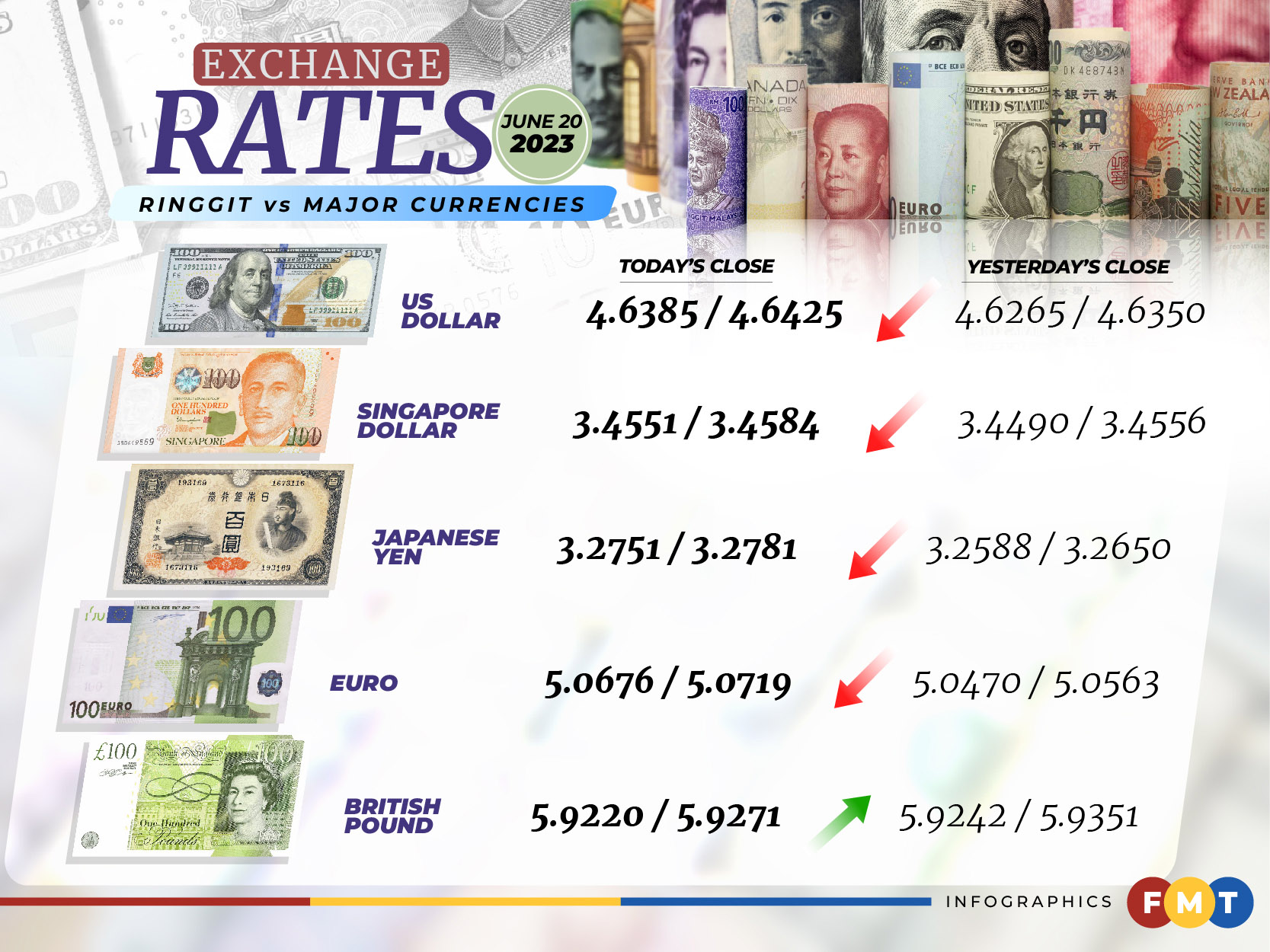

At 6pm, the local note ended at 4.6385/4.6425 against the greenback compared with 4.6265/4.6350 at the close yesterday.

Meanwhile, the ringgit was traded mostly lower against a basket of major currencies.

At the close, it appreciated versus the British pound to 5.9220/5.9271 from yesterday’s 5.9242/5.9351, but fell against the Japanese yen to 3.2751/3.2781 from 3.2588/3.2650 previously and eased vis-a-vis the euro to 5.0676/5.0719 from 5.0470/5.0563.

The local note also weakened against other Asean currencies.

The Indonesian rupiah and the ringgit led losses among major Asian currencies versus a broadly strong US dollar today as China’s first benchmark rate decrease in ten months failed to appease investors looking for more stimulus.

The ringgit eased versus the Thai baht to 13.3486/13.3666 from 13.2926/13.3236 yesterday, fell against the Singapore dollar to 3.4551/3.4584 from 3.4490/3.4556 previously, slipped vis-a-vis the Indonesian rupiah to 309.0/309.5 from 308.5/309.2, and dropped against the Philippine peso to 8.35/8.36 from 8.30/8.32 yesterday. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.