KUALA LUMPUR - While Asian economies have attracted global capital on a large scale owing to the fact that it is still the hottest region in the world to invest currently, this is not always a good sign though Malaysia’s Barisan Nasional (BN) government may beg to differ.

Asia’s capacity to withstand capital flight is now once again being put through a much sterner test than the 1997 and 1998 financial meltdown as large scale withdrawal of capital from the region begins to disrupt the orderly flow of investments.

The sell-off of assets in Asia’s emerging markets has led to a decline in the value of currencies in the region. The cause for this is phenomenon is because the withdrawal of capital is heading from the Asian emerging markets back to developed countries notably the United States.

While India and Indonesia have witnessed their rupee and the rupiah respectively crash in the middle of this month, Malaysia, the third-largest economy in South East Asia is not insulated to the capital outflow as evidenced by the movement of the ringgit.

Bank Negara Malaysia (BNM) governor, Zeti Akhtar Aziz has reportedly assured Malaysians that the destabilizing capital flight from Malaysia can be overcome by the fact that the country has the strength and capability to manage the current volatility.

Zeti states that Malaysia has strong and sound financial intermediaries operating in a well-developed market. She adds that the country’s robust foreign exchange reserves level, which stood at US139.9 billion as at Aug 15 this year and low levels of foreign currency debt at around 1 to 2 per cent of the country’s GDP should serve to protect Malaysia from the effects of disruptive capital flows.

Zeti is assuring but is the finance ministry toeing the line

This is because what Malaysians suspected and feared all along prior to the 13th GE became a stark reality when Fitch Rating’s revision of the country’s outlook was downgraded from “stable” to “negative” in late July 2013 that gave the clearest indication that international investors have run out of patience.

In response to Fitch’s downgrading, a visibly shaken Najib Tun Razak said early this month that the forthcoming Budget 2014 on Oct 25 will contain strategies to reduce Malaysia’s fiscal deficit.

But analysts contend that Malaysia’s mounting debt burden is worrisome and difficult to reduce owing to much off-balance sheet nonsense and bad procurement practices by the government as often highlighted in the Auditor-General’s report.

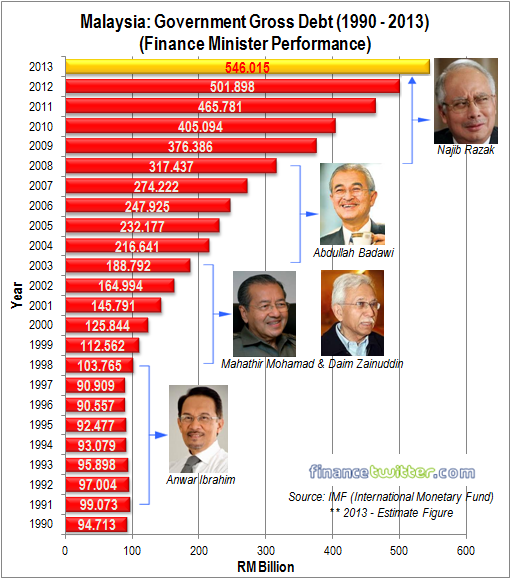

A burgeoning debt burden

In all levels of the strata of Malaysian society from households to corporates, the state and federal government, there is to be found and discovered much debt and the figures are escalating as spending is more than earnings due to the easy availability of credit and a great lack of financial discipline.

Instead of facing up to the facts the finance ministry has been busily introducing pump priming measures as a large number of households are finding it difficult to deal with the rising cost of living forcing the government to continue with its multi-billion ringgit subsidies and other handouts thus causing the debt of the federal government to soar even higher.

In reality, it really is a vicious cycle. But the actual reason for this debt phenomenon is due to the fact that the BN government’s corrupt ways in the mismanagement of public funds and projects have created a ripple effect of creating waves of debt to rise.

This certainly doesn’t augur well for the future of the nation. What is envisaged is an impending collapse of the financial system that will cause Malaysia to regress and degrade the Quality-of-Life unless serious bids and measures are made to eradicate corruption, mismanagement of funds and projects and the use of austerity drives.

These are measures the BN government are loathe to use as it goes against the grain of their governance and will cause much hurt and suffering among the people whom the government envisages will cause them to lose further the popular vote.

The domestic debt crisis is set to deepen

It doesn’t take a genius to figure out simple math. For example Agensi Kaunselling Dan Pengurusan Kredit’s (AKPK) records show that the number of cases of financially distressed individuals is on the rise lending credence to the fact of the mounting debt burden Malaysians bear.

Household debt has been on the rise at a worrying pace since 2009. Since that year it was 70 per cent of GDP. But four years later it has risen to 83 per cent. According to BNM, household debt grew at an average annual rate of 12 per cent over the last five years.

This has led to bankruptcy cases to go on the rise. In 2012, the number of insolvency cases rose 2.1 per cent to 19,575. The 2012 annual report by the legal affairs division of the Prime Minister’s Department highlights that the majority of bankruptcy cases were due to car and home purchases at 27 per cent each while 17 per cent were due to personal loans.

While AKPK contends that the younger generation is getting wiser in avoiding the pitfall of falling into debt, the numbers that are already bankrupt are a real cause of worry and concern and have already caused great misery for Malaysians.

What about the coming months?

These economists state that Malaysia should work hard to preserve the country’s fundamentals and Zeti herself is reassuring by the fact she mentions that BNM will closely monitor the current challenge to ensure orderly movement of the ringgit.

While Zeti is confident that the financial markets and currency would eventually move to reflect the country’s macroeconomic fundamentals, it is really the domestic debt burden borne by the federal and state governments and households that is set to cause Malaysians a whole lot of suffering and misery.

Imprudent financial practices and measures adopted by an over-zealous finance ministry is the prime mover and cause for the domestic debt burden borne by Malaysians as they are completely in the dark as to the way and manner in which the finance ministry handle Malaysia’s treasury funds.

While Zeti and BNM look set to be able to weather the financial meltdown that is currently on going, whether the country can stave off the challenge posed by the rising debt burden awaits to be seen as the mixed signals given by the finance ministry sends us Malaysians a chilling message that BN has most likely lost control of the domestic debt situation.

Malaysia Chronicle

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.