PETALING JAYA: The ringgit eased against the US dollar for the second consecutive day amid continued sell-off after strong US retail data propelled bets on the Federal Reserve (Fed) hiking interest rates further.

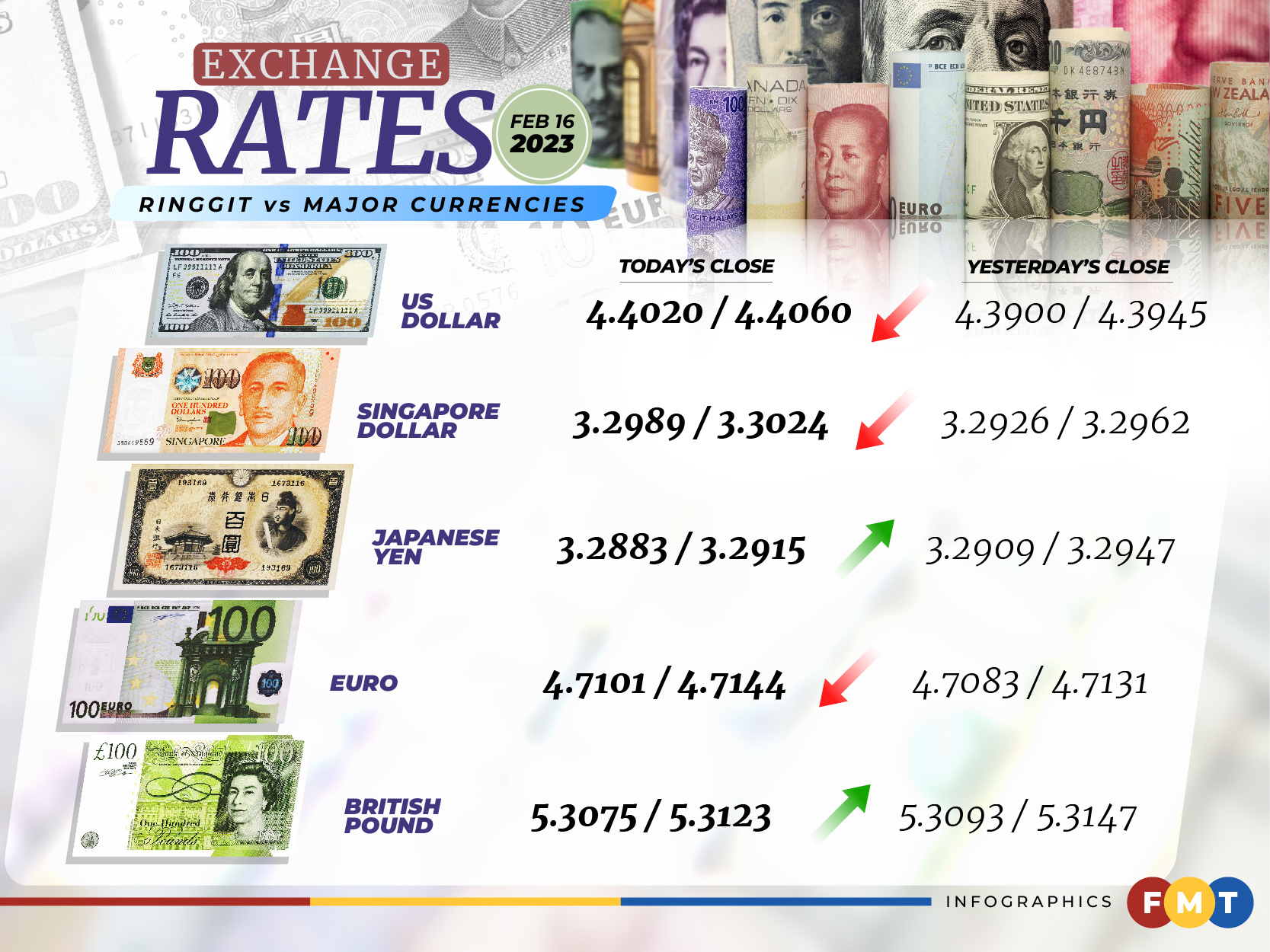

At 6 pm, the ringgit dropped to 4.4020/4.4060 versus the greenback from Wednesday’s closing of 4.3900/4.3945.

SPI Asset Management MD Stephen Innes said the higher US yields continued to move like a wrecking ball through local assets after a “very strong” January US retail sales print compounded a still sticky US inflation outlook.

‘’While the Fed’s response to this stronger run of US data is uncertain, the interest rate markets have materially reduced US rate cut expectations and priced in a higher peak federal funds (fed funds) rate.

“At this stage, we would need to see some weaker US economic data to halt the ringgit sell-off,” he told Bernama.

The markets are awaiting US data that include weekly initial jobless claims, January housing starts, and Producer Price Index later tonight.

Innes projected that the fed funds rate could reach a peak of 5.25% to 5.50% due to the lag effects of current US interest rate hikes working their way through the economy.

‘’While it’s always difficult to pick a bottom or top on currency moves, I think we are reaching a point where investors who missed the first reopening bounce could now start buying some local risk as expectations for the US dollar to still weaken remain entrenched in the market sentiment,’’ he noted.

Back home, the ringgit ended mixed against a basket of major currencies.

The local unit strengthened against the Japanese yen to 3.2883/3.2915 from 3.2909/3.2947 at Wednesday’s close and marginally improved versus the British pound to 5.3075/5.3123 from 5.3093/5.3147 previously.

However, it fell vis-a-vis the Singapore dollar to 3.2989/3.3024 from 3.2926/3.2962 yesterday and slipped versus the euro to 4.7101/4.7144 from 4.7083/4.7131. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.