Data from Dewan Rakyat is Newsgraphy’s flagship data journalism series that transforms complex parliamentary data into accessible insights for the Malaysian public, making legislative information more transparent and comprehensible to citizens.

The content below is republished with Newsgraphy’s permission.

The National Higher Education Fund Corporation (PTPTN), established in 1997, has provided educational loans to millions of students over the years, helping them complete their higher education.

However, recovering these loans from them has become a major challenge.

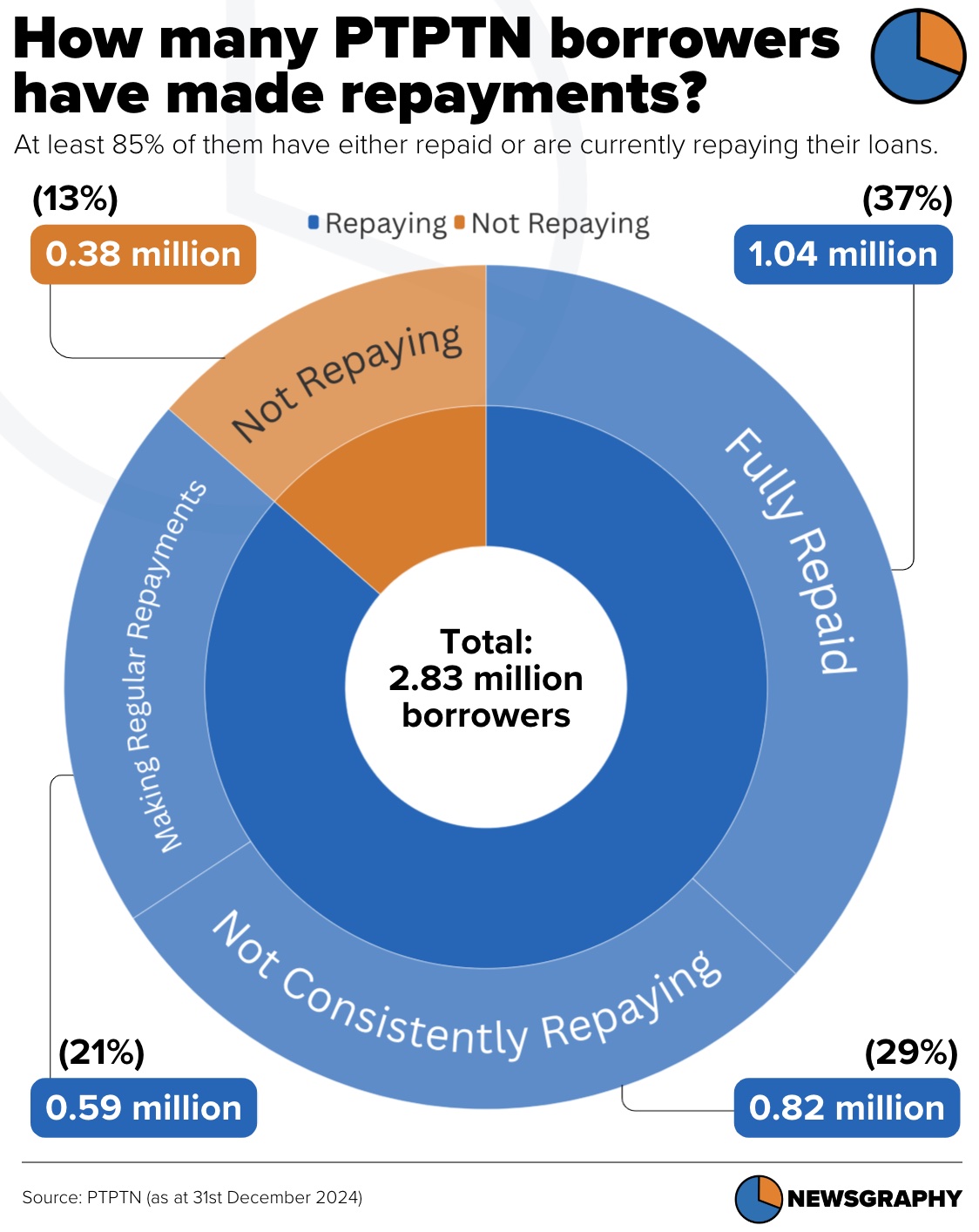

In a written parliamentary reply from the Higher Education Ministry, as of Dec 31 last year, out of 2.83 million borrowers nationwide, 1,044,595 (37 percent) have fully repaid their loans, 585,638 (21 percent) are making regular repayments.

Meanwhile, 817,872 (29 percent) are not consistently repaying their loans, collectively owing RM5.8 billion.

Another 383,637 (13 percent) have never made any repayments, with their debt amounting to RM5.25 billion.

Collectively, this means that 1.2 million borrowers have overdue payments totalling RM11.05 billion.

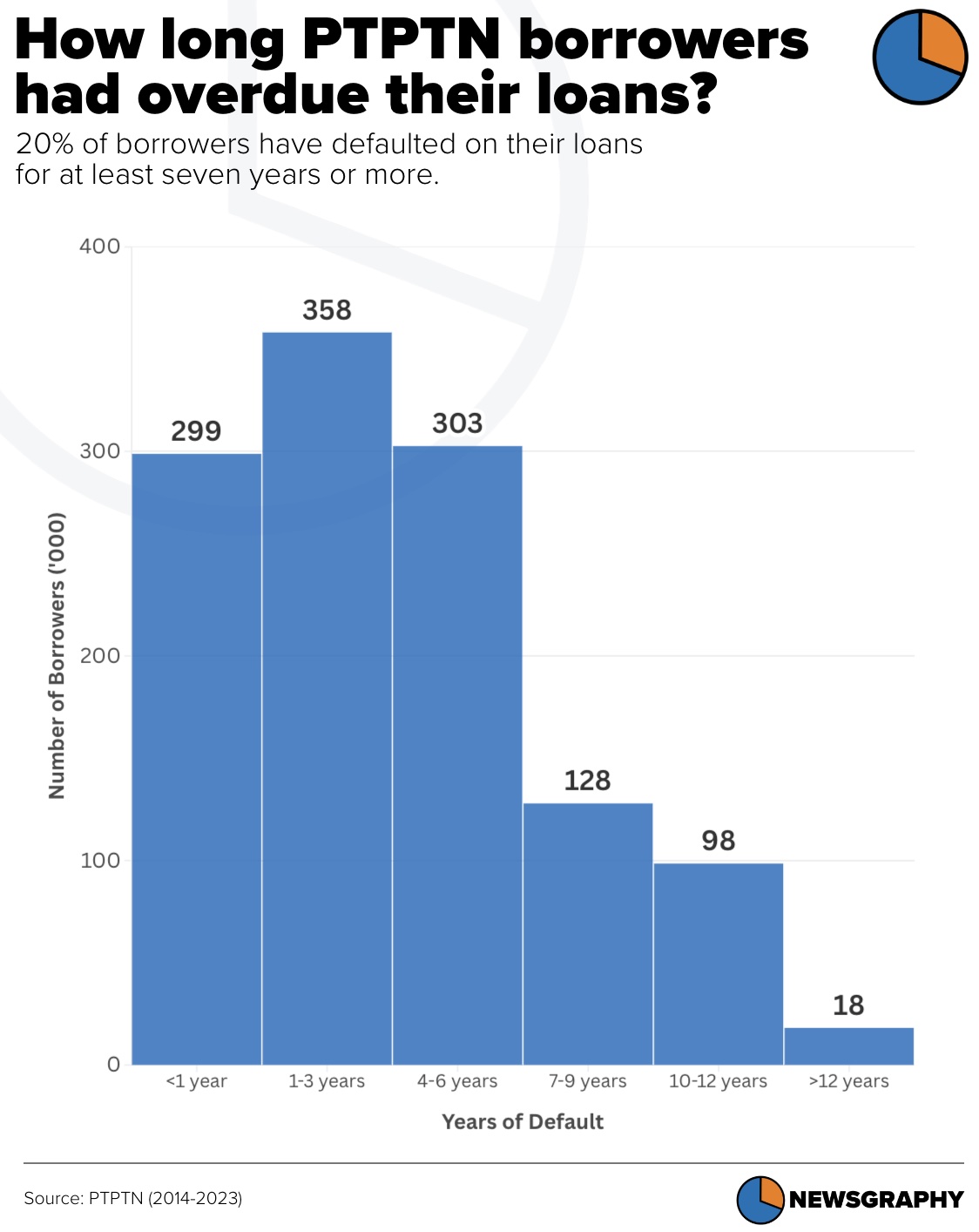

Among them, 20 percent of borrowers have defaulted on their loans for at least seven years or more, involving RM5.68 billion.

The Auditor-General’s Report Series 1/2025 warned that failure to recover loans would put PTPTN at risk of funding shortages, affecting future loan disbursements to eligible borrowers.

For those who have yet to repay their loans, PTPTN has implemented various measures to collect outstanding debts, but how effective were they?

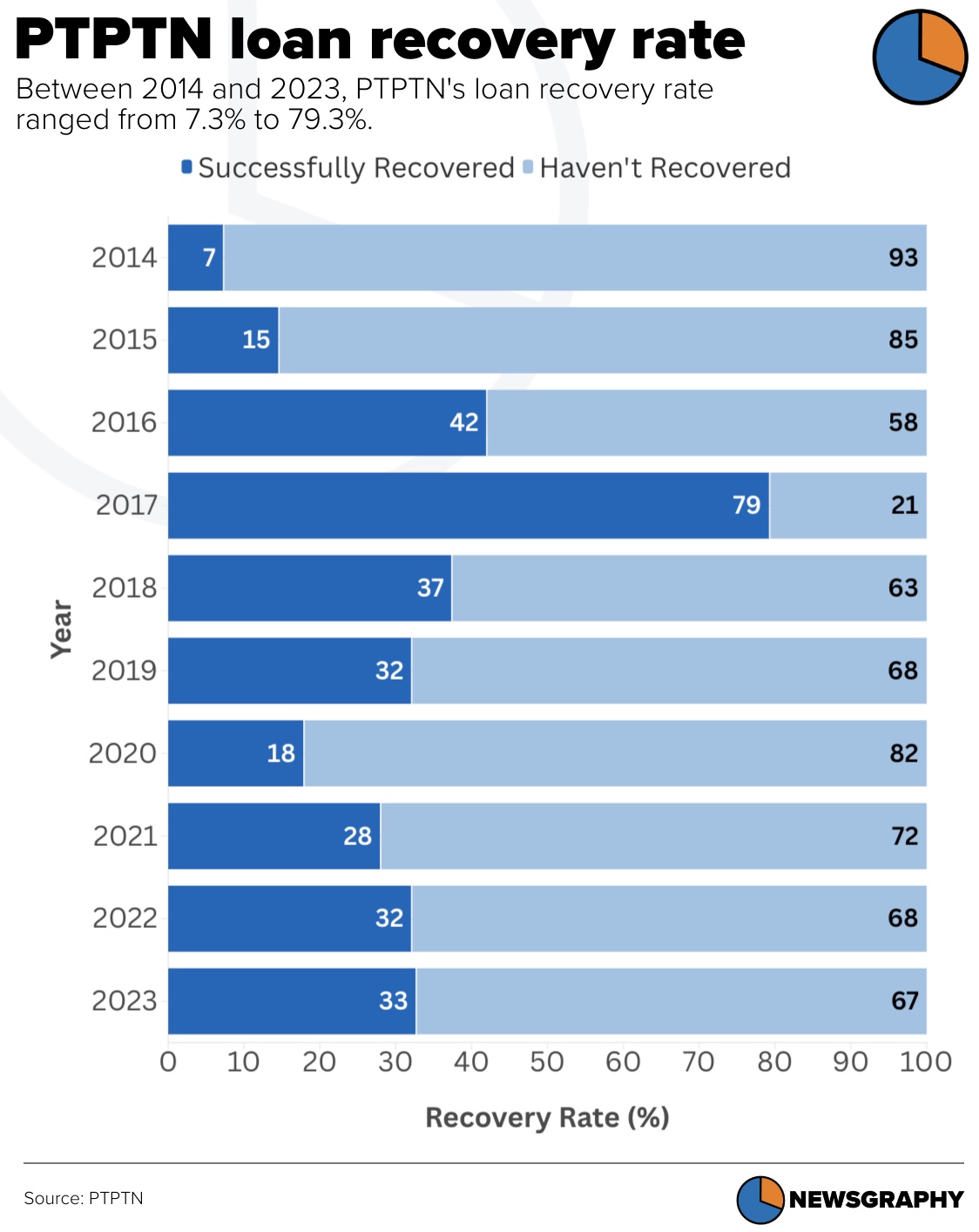

The report states that between 2014 and 2023, PTPTN successfully recovered RM26.4 billion in loans, primarily through salary deductions, direct debits, Employees Provident Fund (EPF) withdrawals, and counter or online payments.

Between 2014 and 2023, PTPTN’s loan recovery rate ranged from 7.3 percent to 79.3 percent, reaching its peak in 2017 at 79.3 percent.

The Auditor-General’s Report noted that this success was attributed to the government’s strict enforcement actions that year, such as blacklisting borrowers in the Central Credit Reference Information System (CCRIS) and mandatory salary deductions for civil servants.

However, after the government suspended mandatory repayment enforcement actions in 2018, the loan recovery rate showed a declining trend over the next three years, only beginning to recover in 2021.

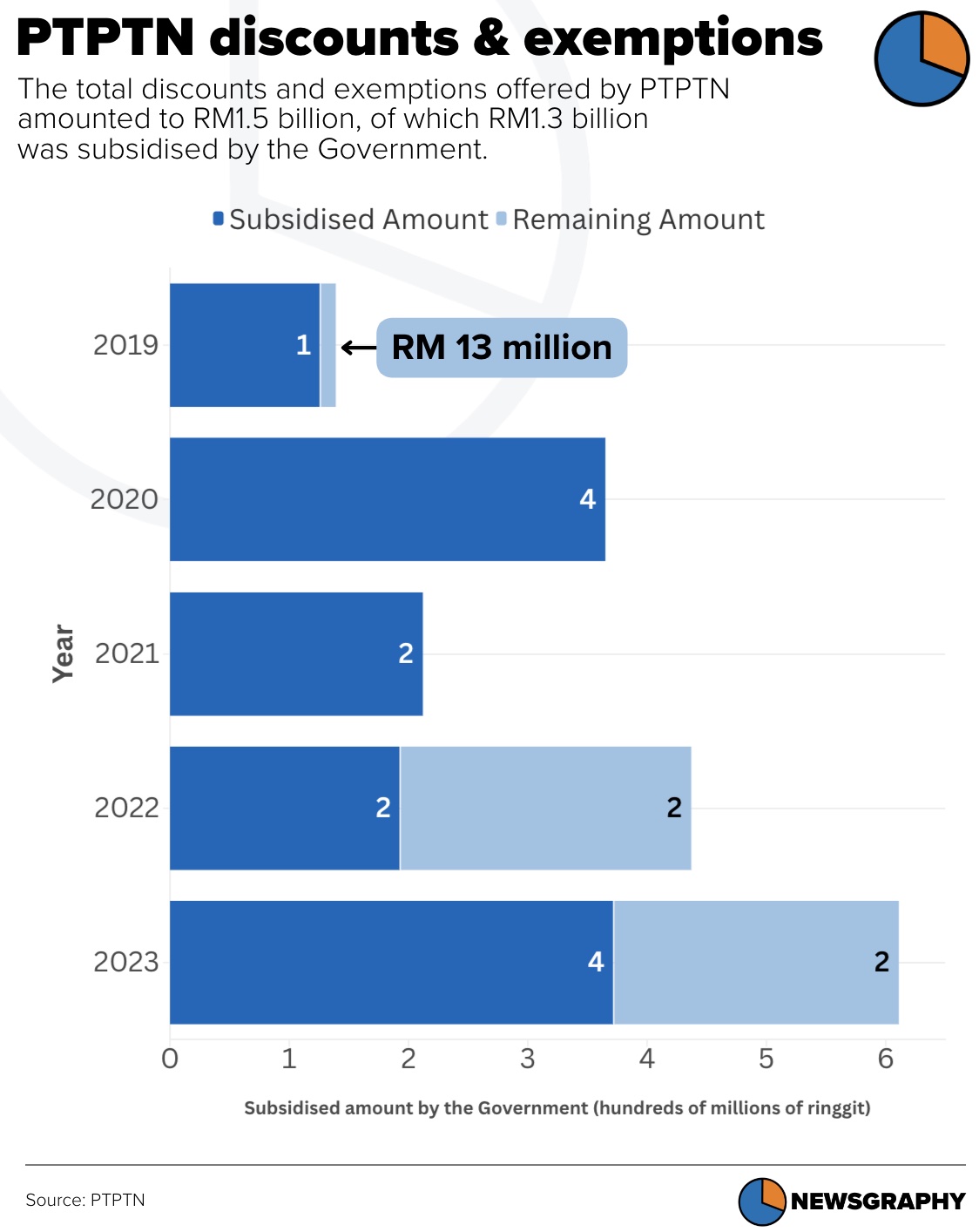

To encourage repayment, PTPTN has introduced discount offers ranging from five percent to 20 percent. Additionally, they provide 100 percent loan exemptions for those who achieve first-class bachelor’s degrees or equivalent qualifications, rewarding borrowers with outstanding academic performance.

However, these discounts and exemptions are subsidised by the government to PTPTN.

- Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.