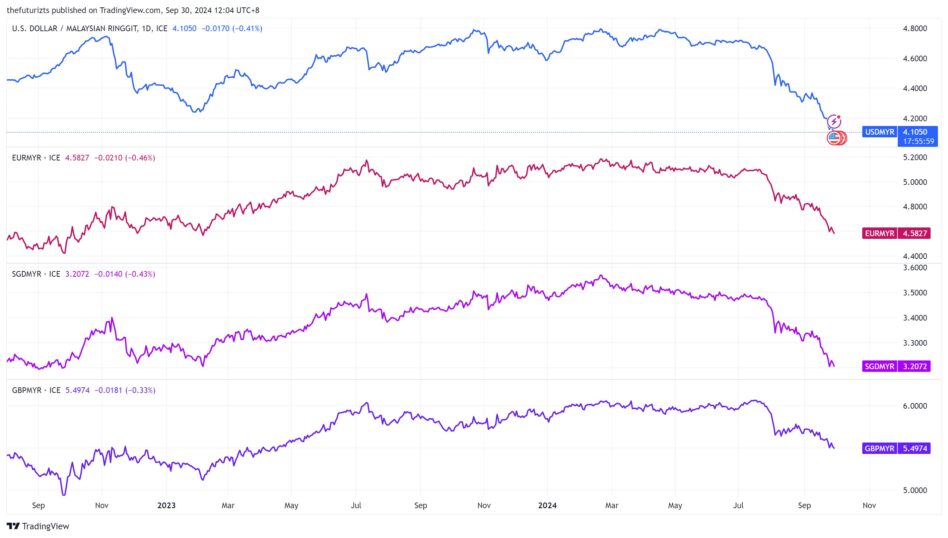

A FINFLUENCER who prides himself for helping Malaysians to achieve financial literary has done a brilliant job in allaying the concerns of Malaysians as to why prices of goods and services remain high when the ringgit had ringgit rallied against the greenback to 4.1040/US$1 on Sept 25 – its highest level since December 2021.

This came about after the ringgit having briefly slipped past RM4.80/US$1 on Feb 20 which has been deemed its weakest level since January 1998 which then was the height of the Asian Financial Crisis (AFC).

Notably, the ringgit’s skyrocketing performance has made the local currency as the best-performing currency in the Asia-Pacific region this year as it pushes to replicate its strongest performance since 2017.

To a common query by consumers that the ringgit has touched RM4.1040 “but I don’t see my bills getting cheaper!” The Futurizts (@TheFuturizts) contended that the actual situation depends on what type of goods and services one is referring to.

“Goods that are produced locally but have SOME foreign supply chain such as soybeans, corn and feed for meats will be impacted by the weakening US dollar because the materials are imported,” suggested The Futurizts.

“However, it will take time (roughly six to eight weeks) for price readjustments to take effect.”

As for foreign-made goods or imported items, these goods will see price changes quite rapidly, according to The Futurizts.

“For example, the listing price of iPhone 16 Pro Max is RM500 cheaper compared to the older model,” noted the finfluencer. “That said, companies tend to re-adjust prices monthly or quarterly, so we may see price reductions in the coming months.”

Nevertheless, due to the “price stickiness” effect, the prices of items are likely to remain constant or adjust slowly despite the ringgit’s strength.

“This is because they often move in just one direction. Prices rise much faster than they fall,” observed The Futurizts.

According to Investopedia, price stickiness is the resistance of a market price to change quickly despite shifts in the broad economy suggesting a different price is optimal.

“Sticky” is a general economics term that can apply to any financial variable that is resistant to change. When applied to prices, it means that the sellers or buyers of certain goods are reluctant to change the price despite changes in input cost or demand patterns.

More broadly, The Futurizts reckoned that some firms will try to keep prices constant as a business strategy.

“Take restaurants as an example. These businesses are unlikely to lower prices now because they would have to create and update their entire menu,” suggested the finfluencer.

“Also, there could also be a lag in pricing effect in that businesses often set prices based on their costs when they purchase raw materials. If they bought materials before the currency appreciation, those higher costs can still affect current pricing.”

Whatever said and done, a ‘faster impact’ from the stronger ringgit could be that “travelling and overseas education becomes cheaper”.

“It may be the perfect time to travel to that Western country you’ve always talked about or finish your studies abroad,” added The Futurizts. – Focus Malaysia

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.