A Singapore government-owned company may have had a stake of over 70 percent in U Mobile when it announced on Dec 4 its divestment of a “majority” stake (over 50 percent) in the company which obtained the second 5G licence from Malaysian authorities.

Two other things are very clear from the divestment of a stake in U Mobile by a Singapore government company. The first is the paucity of information on the deal, of which the main one is that no price details are given.

The second is the puzzling seeming absence of conditions on U Mobile’s major shareholders by the Malaysian Communications and Multimedia Commission (MCMC) in awarding the second 5G spectrum to U Mobile in November.

Why award a 5G spectrum to a company whose shareholdings are in a state of flux?

The announcement (see below) referred to the divestment of an unspecified “majority” stake in U Mobile which will no longer be a “subsidiary” of the relevant Singapore company. It was not thought that U Mobile may be majority Singapore-owned.

There is much to unpack and several key questions arise. But first, let’s look at the announcement in greater detail.

ST Telemedia, which is a wholly owned subsidiary of Singapore government-owned Temasek Holdings, said that its wholly owned subsidiary Straits Mobile Investments Pte Ltd signed a conditional agreement with Mawar Setia Sdn Bhd for the sale of a majority stake in subsidiary U Mobile Sdn Bhd).

After the sale of the stake, U Mobile ceased to be a subsidiary, clearly implying it was a subsidiary before that.

Shareholding structure

According to reports, Mawar Setia is 70 percent owned by tycoon Vincent Tan and 30 percent owned by Tunku Aminah Sultan Ibrahim - the Johor ruler’s daughter.

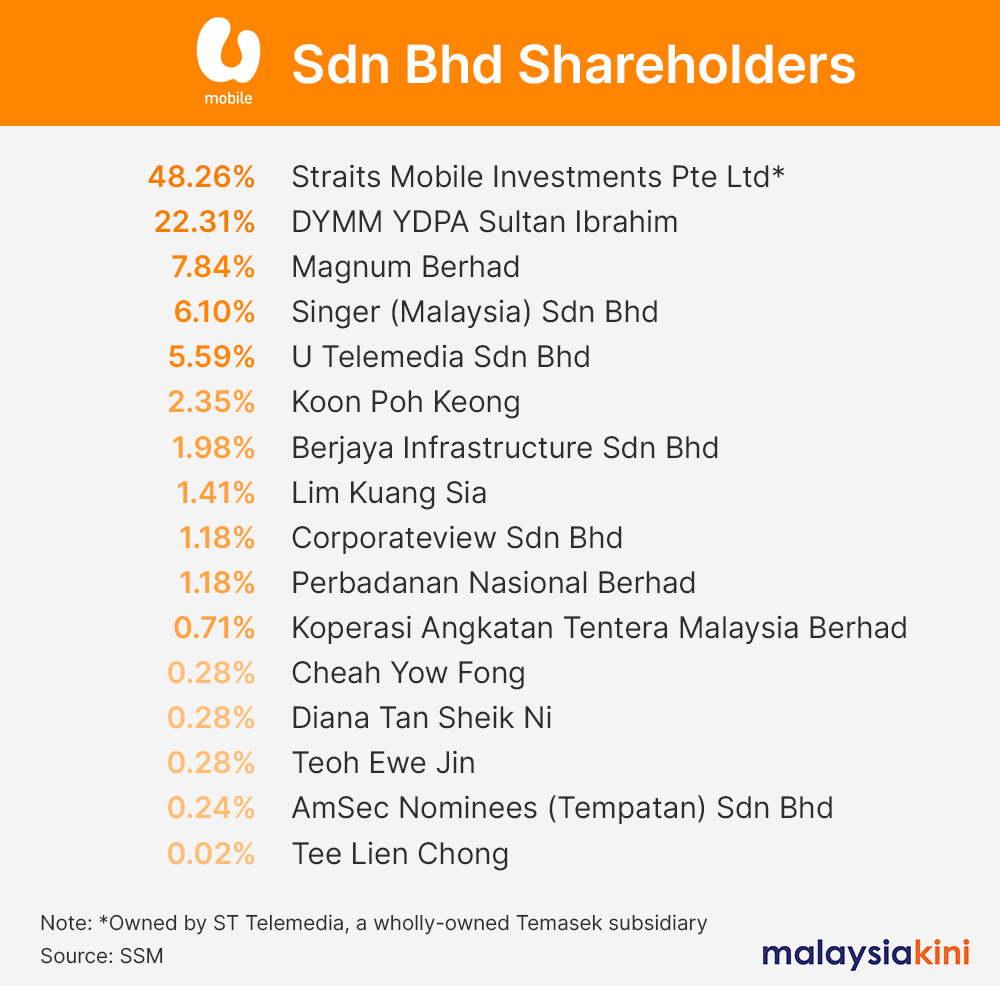

The announcement is unusual because it does not tally with the last known shareholding structure of U Mobile (see chart below).

According to this data from the Companies Commission of Malaysia, Straits Mobile did not have a majority stake (over 50 percent) in U Mobile, it had 48.26 percent. This directly contradicts the ST Telemedia statement that it sold a majority stake in U Mobile which was a subsidiary previously.

That would imply that Straits Mobile owned at least over 70 percent previously, otherwise, it could not have a 20 percent stake after the divestment of more than a 50 percent stake.

According to sources, what was not taken into account in news reports was that Straits Mobile had made convertible loans and similar instruments to U Mobile. There was a convertible arrangement which allowed them to be exchanged for shares in U Mobile.

Apparently, conversion gave Straits Mobile over a 70 percent stake in U Mobile, making the divestment of a majority stake possible. That explains the general confusion about ST Telemedia’s statement.

Because of the additional shares issued due to the conversion, the entire shareholding structure changes. Other shareholders, including the king who owns 22.3 percent, would have their stakes diluted proportionately. The revelation raises a plethora of other issues.

In effect, the major shareholder of U Mobile becomes Mawar Setia, with over a 50 percent stake and not 28.26 percent as stated in most of the news. Thus, Tan will be in the driver’s seat with a 70 percent plus stake in Mawar Setia, the effective controlling shareholder of U Mobile.

Key issues

Here are four key issues arising:

1. Did MCMC give the new 5G spectrum to a company over 70 percent owned by Singapore? Why did it do such a thing when there were much better choices such as CelcomDigi and Maxis as I explained here?

2. What is the price of the divestment? This is important as the sale comes after the 5G spectrum award was announced. It thus allows Singapore to cash out after a spectrum value of as high as billions of ringgit has been taken into account in the valuation, giving much larger gains.

3. Was approval given for Straits Mobile to raise its stake? For Straits Mobile to have a stake of over 50 percent and indeed over 70 percent in U Mobile, regulatory approval is needed for it to exceed the 49 percent stake limit for foreigners in telecommunications. Was it given? If so, why?

4. Why was the second 5G contact given to U Mobile? There are other easier deals. The government could revert to a single operator as originally planned which would have avoided all these problems. Or it could have awarded it to a more capable less controversial operator - Celcom-Digi or Maxis.

This deal is not good and is shrouded in too much secrecy. It calls for greater transparency so that the ramifications are better understood, discussed and debated before a final decision.

The deal is still subject to regulatory approvals, and it is to be hoped that the authorities - the MCMC and the government - will take into account everything and decide on the basis of the national good in terms of 5G rollout at a reasonable cost by those best positioned and able to do it. - Mkini

P GUNASEGARAM says we should get suspicious if deals get needlessly complicated.

The views expressed here are those of the author/contributor and do not necessarily represent the views of MMKtT.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.