The criminal trial of former prime minister Najib Abdul Razak involving the alleged abuse of power and money laundering of 1MDB funds enters its 27th day today at the High Court in Kuala Lumpur.

Malaysiakini brings you live reports of the proceedings.

KEY HIGHLIGHTS

- 1MDB board approved US$1.5b loan to PetroSaudi (Cayman) in 2010

- PetroSaudi directors stonewalled attempts to check on 1MDB funds

- Tarek shares US$85m Good Star payment with another PetroSaudi director

- US$85m paid to PetroSaudi director Tarek Obaid as commission

- Good Star sent Tarek Obaid US$85m days after it received 1MDB monies

Thank you for following Malaysiakini's live report

1.05pm - Thank you for following our live report today.

Court adjourns early as judge has a matter to attend

1pm - Najib Abdul Razak's RM2.28 billion 1MDB trial adjourns earlier today as High Court judge Collin Lawrence Sequerah has a matter to attend to this afternoon.

Before Sequerah allows proceedings to adjourn today, the former prime minister's lead defence counsel Muhammad Shafee Abdullah informs the court that tomorrow he has a Federal Court appeal to attend.

The judge then also allows Shafee's application for proceedings tomorrow to begin at 2.30pm instead of 9.30am.

1MDB board approved US$1.5b loan to PetroSaudi (Cayman) in 2010

12.30pm - In March 2010, 1MDB's board of directors agreed to a US$1.5 billion loan to PetroSaudi Holdings (Cayman) Ltd (PSI Cayman), which used to be the sovereign wealth fund's partner in a joint venture, the court hears.

This was despite PSI Cayman not being able to pay US$1.2 billion to 1MDB as reimbursement when they parted ways several months earlier.

Former 1MDB CEO Shahrol Azral Ibrahim Halmi testifies that the company's board of directors had approved to lend PSI Cayman the US$1.5 billion through a directors' circular resolution dated March 22, 2010.

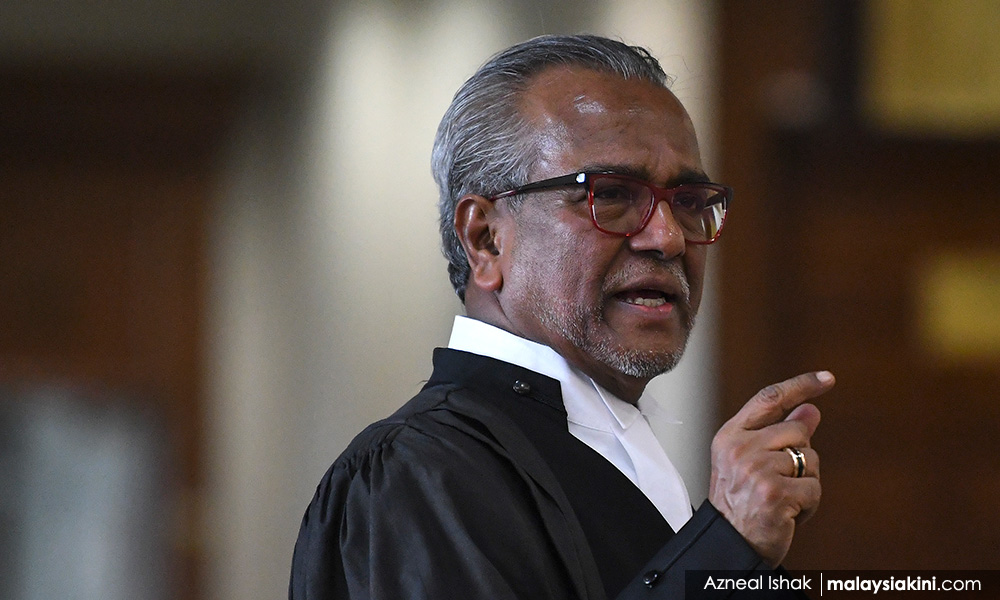

Asked by lead defence counsel Muhammad Shafee Abdullah (above) if this made sense to him then, the witness says that he did not question much at the point in time as he saw the joint-venture matters as being part of government-to-government deals.

"Now, with everything that has happened, it doesn't make sense," says Shahrol.

PetroSaudi directors stonewalled attempts to check on 1MDB funds

12.08pm - PetroSaudi International's directors Tarek Obaid and Patrick Mahoney stonewalled former 1MDB CEO Shahrol Azral Ibrahim Halmi's attempt to check if the entire US$1 billion of funds went into the 1MDB-Petrosaudi's joint venture, the High Court hears.

The ninth witness says this during cross-examination by lead defence counsel Muhammad Shafee Abdullah.

Shafee: Were you able to inspect if the money went into either PSI (PetroSaudi International) or the (1MDB-PetroSaudi) joint-venture company?

Shahrol: No. We tried to get to the account for the 1MDB joint-venture company but we were unable to do so. We were getting stonewalled by Patrick Mahoney and (Tarek) Obaid.

Shafee: When was this stonewalling?

Shahrol: Between end-2009 and early 2010, before the Murabaha deal.

Shafee: You were a (1MDB) director. Were you physically prevented?

Shahrol: We submitted email requests but a lot of excuses were given, and the information not provided. I tried to go through Jho (Low) which resulted in the proposal of the Murabaha notes.

'Tarek shared US$85m Good Star payment with another PetroSaudi director'

12pm - The court hears that PetroSaudi co-founder Tarek Obaid had shared a portion of the US$85 million he received from Jho Low's Good Star Ltd with an associate.

Based on banking documents tendered in court, Tarek had transferred US$33 million to a bank account belonging to PetroSaudi director Patrick Mahoney on Oct 20, 2009.

This was about two weeks after Tarek received US$85 million from Good Star, which earlier received US$700 million from 1MDB.

Former 1MDB CEO Shahrol Azral Ibrahim Halmi agrees with lead defence counsel Muhammad Shafee Abdullah that this showed that Tarek was splitting the money he received from Good Star with Mahoney.

Shafee: So he (Tarek) received US$85 million, then he shared with Patrick US$33 million.

Shahrol: Yes.

Shafee: Christmas came a bit early that year.

The witness testifies that he, however, did not know anything about the payment that Tarek and Mahoney received.

US$85m paid to PetroSaudi director as commission

11.47pm - PetroSaudi International director Tarek Obaid (below) was paid US$85 million out of the US$700 million allegedly diverted from the 1MDB-PetroSaudi joint venture as commission for the said deal, former 1MDB CEO Shahrol Azral Ibrahim Halmi testifies.

He says this when shown a JP Morgan bank statement by Najib Abdul Razak's lead defence counsel Muhammad Shafee Abdullah during cross-examination today.

Shafee (Reading out from the bank statement): Tarek Obaid was paid US$85 million out of US$700 million as commission received by a client for a joint-venture deal.

Shahrol: Yes. The JV is the 1MDB-Petrosaudi deal.

Shafee: Our money of US$700 million went there, US$85 million to Tarek Obaid to swipe as purported commission?

Shahrol: Yes.

Shafee: Is this a bona fide commission or outright stealing?

Shahrol: There's not enough information to tell.

Shahrol agrees with the defence counsel that the US$85 million constitutes more than 10 percent of the US$700 million and that it is quite high for a commission for the deal.

The witness also agrees with Shafee that he was not informed by Tarek at the time about this payment, which may have been a conflict of interest on Tarek's behalf.

Good Star sent Tarek US$85m days after it received 1MDB monies

11.39am - The hearing starts with lead defence counsel Muhammad Shafee Abdullah showing to the court a bank account statement that belonged to Good Star Ltd, a company that belonged to Jho Low.

According to Shafee's cross-examination of former 1MDB CEO Shahrol Azral Halmi, the RBS Coutts bank statement showed Good Star had zero balance on June 12, 2009, before it was credited with US$700 million on Sept 30, 2009.

It had been established earlier in the trial that Sept 30, 2009, was the date when 1MDB made a US$700 million payment to an RBS Coutts account, which was supposedly meant for PetroSaudi.

Shahrol is then shown a bank statement that belonged to Tarek Obaid's JP Morgan account, which showed that the PetroSaudi International co-founder received US$85 million from Good Star.

This transfer from Good Star to Tarek occurred on Oct 5, 2009, which was five days after Good Star received the 1MDB monies.

Proceedings begin as Najib enters the dock

11.26am - Najib Abdul Razak enters the dock as proceedings begin.

11.12am - Najib Abdul Razak's lead defence counsel Muhammad Shafee Abdullah enters the High Court after having attended an earlier Federal Court matter at the Palace of Justice in Putrajaya.

10.55am - Accused Najib Abdul Razak enters the High Court and takes a seat at the front row of the public gallery to await proceedings to begin.

Also in court is the former prime minister's defence team, except his lead lawyer Muhammad Shafee Abdullah, who has an earlier scheduled Federal Court matter to attend to this morning.

Also present is lead DPP Gopal Sri Ram and other DPPs.

The 27th day of Najib Abdul Razak's RM2.28 billion 1MDB trial will start at 11am today rather than the usual 9.30am.

This is because the former prime minister's lead defence counsel Muhammad Shafee Abdullah has to attend to a separate matter before the Federal Court in Putrajaya earlier this morning.

Yesterday, Kuala Lumpur High Court judge Collin Lawrence Sequerah allowed Shafee's application for today's trial to start at 11am so that the veteran legal practitioner could attend to the apex court matter first.

When the 1MDB trial resumes today, Shafee is expected to continue cross-examination of former 1MDB CEO Shahrol Azral Ibrahim Halmi.

During yesterday's trial, Shafee described fugitive businessperson Low Taek Jho, who is a central figure at the heart of the 1MDB scandal, as a fox tasked with safeguarding the chicken.

Among testimonies heard by the court yesterday was that Shahrol admitted that he would have resigned as then 1MDB CEO if he had realised about the lies told to him by Low and the sovereign wealth fund's then business development executive director, Casey Tang. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.