Prime Minister Anwar Ibrahim has been staunchly in support of MACC chief Azam Baki amid a second scandal over shareholdings - and even passed the buck on whether the top graftbuster should be suspended.

This was not the case four years ago.

On Jan 12, 2022, Anwar, DAP’s Lim Guan Eng, Amanah’s Mohamad Sabu, and Upko’s Wilfred Mangius Tangau issued a joint statement calling for Azam and two others to be suspended over a shareholding scandal to make way for an independent investigation.

The other two they wanted to put on ice were then-Anti-Corruption Advisory Board chairperson Abu Zahar Ujang and then-MACC Consultative and Anti-Corruption Panel chair Borhan Dolah.

This was because Abu Zahar had come to Azam’s defence in the scandal, while Borhan had reportedly refused to take any action.

In late 2021, the MACC chief came under scrutiny over his ownership of 1,930,000 shares in Gets Global Berhad (previously KBES Berhad) on April 30, 2015, worth around RM772,000 at the time.

His shareholding in Gets Global Berhad went down to 1,029,500 as of March 31, 2016, worth around RM340,000 at the time. He also held 2,156,000 warrants in Excel Force MSC Berhad in March 2016.

In January 2022, Azam said he informed the MACC Corruption Prevention Advisory Board that the shares were bought by his brother, who borrowed his name, and that he believed he did not do anything wrong.

The declaration triggered a Securities Commission probe that eventually found no evidence of proxy trading as Azam had “control” over his own trading account.

Anwar and the three other Harapan leaders said in their statement that it was clear the MACC or the MACC advisory body cannot investigate the chief commissioner himself, and investigations by independent bodies unrelated to the MACC are urgently required.

They also called for a special Parliament session to be held to debate the matter.

Millions in shares

Fast forward to today, and Azam is in the spotlight again after Bloomberg and Malaysiakini separately reported that the top graftbuster had significant shares in two companies that appeared to be in excess of what the civil service allowed.

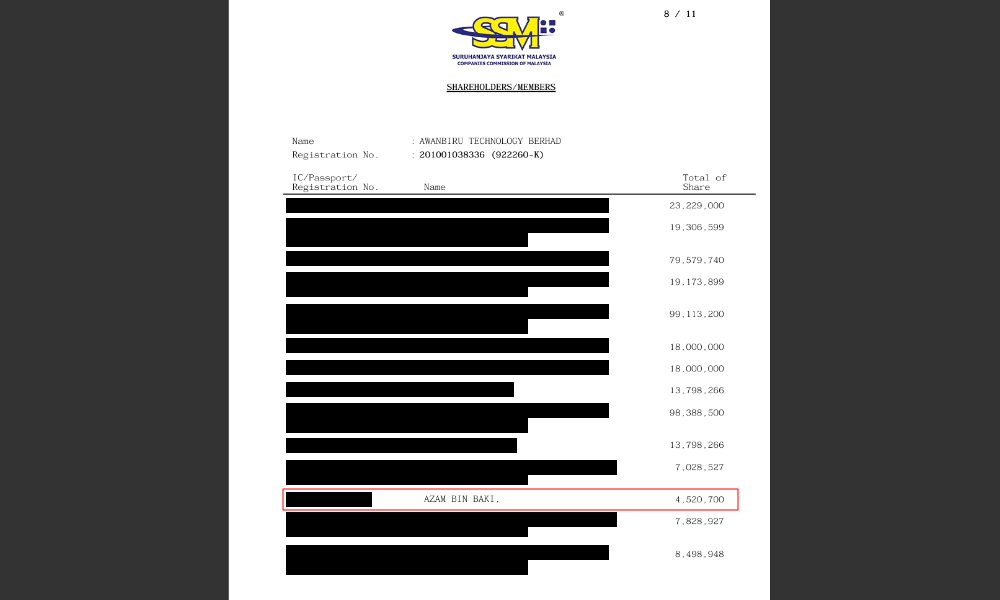

Companies Commission of Malaysia (CCM) records revealed that Azam had at some point held 17.7 million shares in Velocity Capital Partner Berhad and around 4.52 million shares in Awanbiru Technology Berhad.

The Velocity Capital Partner shares were believed to have been bought for around RM1.5 million, while the Awanbiru Technology shares were estimated to have been valued between RM1.24 million and RM1.38 billion at some point.

While share trading by civil servants is not illegal, the 2024 Public Officers’ Conduct and Disciplinary Management Circular stipulates that civil servants are not allowed to purchase shares exceeding five percent of paid-up capital or RM100,000 at current value.

In addition to this, a Bloomberg report accused the MACC of collusion with businesspersons - an act which the business portal claimed Azam was aware of and had even supported.

AG heading special committee

Anwar’s cabinet has responded by setting up a three-member special committee - headed by Attorney-General Dusuki Mokhtar to investigate the shareholdings issue.

Dusuki told several media yesterday that the investigation has already begun, and is currently in the information gathering phase.

Lawmakers from PKR, DAP, and PAS have panned the committee as lacking independence, while also pointing out potential conflict of interest when the attorney-general is also the investigator.

The government has also been urged to expand the scope of the probe to include the collusion allegations.

At 4pm today, a rally will be held at Sogo, Kuala Lumpur, to pressure the government on the Azam scandal. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.