Malaysians must be united for New Malaysia to succeed

6.35pm - Lim ends his speech, which lasted more than two hours, by repeating the virtues of the Shared Prosperity Vision 2030. He urges Malaysians to unite in oder for New Malaysia to succeed.

The Dewan Rakyat sitting resumes on Monday.

6.30pm - Fire and Rescue Department staff will receive a RM200 monthly allowance for 2020 whereas the allowance for the People's Volunteer Corps (Rela) will increase by RM2 an hour.

A total of 70,000 military personnel with the Pingat Jasa Malaysia award will be given a RM500 one-off payment.

6.25pm - The rest of the civil service - grade 56 and below - will receive a RM500 spacial handout as well. As for retirees, they will receive half that amount.

6:22pm - Allocation for the Football Development Programme has tripled. It will receive RM45 million next year compared to 15 million this year.

The government will spend RM179 million for the Tokyo Olympics 2020 and Hanoi SEA Games 2021 preparations.

RM10 million will be allocated to develop women sports.

6:20pm - The threshold for foreigners to purchase local properties has been reduced from RM1 million to RM600,000.

Lim says this is to reduce the RM8.3 billion in overhang for condominiums.

Rent-to-Own scheme for first-time housebuyers

6.15pm - Following last year's Home Ownership Campaign, a new Rent-To-Own (RTO) scheme will be introduced next year.

The scheme will allow first-time homeowners to rent properties priced under RM500,000 for five years before they are given the option to purchase the unit at the price stated in the rental agreement.

Stamp duty will be waived.

Financial institutions will allocate RM10 billion for this scheme and the government will guarantee 30 percent (RM3 billion) of the funds.

6:12pm - Starting 2021, Malaysian adults and businesses will need to register for a Tax Identification Number (Nombor Pengenalan Cukai). Engagement sessions will begin in 2020.

Effectively, this move will force everyone to file their annual income returns.

Higher taxes for those earning RM2m or more a year

6.10pm - The super-rich will have to pay more tax. The new tax bracket - RM2 million and more per annum - will b e 30 percent.

This is expected to affect only 2,000 people.

On Jan 1, the new digital tax will take effect. This tax covers services such as media streaming and digital advertising.

The number of special draws for lottery operators have been reduced from 11 to eight times a year.

1MDB's RM2.7b debt bill for 2020

6:08pm - Lim blames the previous administration for saddling the country with RM150 billion in debts due to the 1MDB scandal.

This elicits boos from the opposition bench.

The government will allocate RM2.7 billion in 2020 to settle 1MDB and SRC International debts. Lim thanks Malaysians for donating RM203 million to Tabung Harapan and says the funds will be used to repay loans.

The government has since recovered about RM1.45 billion in 1MDB-related funds and assets. Lim says Harapan will continue to recover more money and initiatiate legal action against US-based bank Goldman Sachs.

RM85m to be spent on resolving causeway gridlock

6.05pm - The government will spend RM85 million to upgrade the Customs, Immigration and Quarantine (CIQ) services as well as resolve traffic congestion along the Johor-Singapore Causeway.

Lim also announces that 50 additional immigration counters will be opened for motorcyclists.

In the long term, the government will continue the Rapid Transit System (RTS) project but no further details were announced.

100 litres of subsidised RON95 fuel for all

5.50pm - It is not those on Bantuan Sara Hidup welfare payments who are qualified for fuel subsidies. Everyone can obtain a fuel card that will allow them to buy 100 litres of RON95 subsidised fuel. For now, the government plans to subsidise RM0.30 per litre.

Expect lesser toll rates on PLUS-managed roads

5.45pm - Expect to pay less on tolled roads managed by PLUS. The government says it will be 18 percent cheaper on average but no additional details were revealed. The implementation date has yet to be announced.

Cabinet has also decided to acquire four highways in the Klang Valley which will charge cheaper toll rates during off-peak times and none at all from midnight until dawn.

5:35pm - MySalam insurance scheme is extended to cover 45 critical health conditions including terminal illnesses and polio. This is on top of the existing 36 conditions currently covered.

The age limit for the scheme has also been extended to 65 beginning next year, up from 55.

Gov't subsidising pneumococcal vaccines for kids

5.40pm - The government is finally subsidising pneumococcal vaccines for children. The vaccine currently cost about RM325 a dose at private clinics and two doses are needed.

Pakatan Harapan had promised to the subsidies in their election manifesto.

Al-Quran, Fardu Ain teachers to gain extra RM100 allowance

5.35pm - Monthly allowances for Kelas Al-Quran dan Fardhu Ain teachers (Kafa) will be increased by RM100. This will benefit 33,200 teachers.

The government will provide a one-off payment of RM500 for iman, bilal, mosque caretakers and guru takmir.

Special grant for Sabah, Swak doubled, first review since 1969

5.30pm - Windfall for Sabah and Sarawak. The federal government will double the special grant payments to the two territories, which has not been reviewed since 1969.

The revised special grant will be RM53.4 million for Sabah and RM32 million for Sarawak beginning next year. The government plans to double the figure again in five years.

Also, there will be more funds for Orang Asli development.

On top of the RM57 million allocation for Jakoa, the government will inject an additional RM83 million for economic, educational and infrastructure development.

RM300 monthly aid for single, special needs adults

5:25pm - Handouts for middle-aged singles and adults with special needs. Unlike this year, RM300 per month of Bantuan Sara Hidup will be allocated to single adults above the age of 40 and special needs adults who earn less than RM2,000 a month.

They will also receive free MySalam Takaful scheme.

Allocation for Education Ministry up from RM60.2b to RM64.1b

5:20pm - As with previous years, the Education Ministry receives the biggest chunk of the budget - RM64.1 billion. This is up from RM60.2 billion last year.

Minimum wage raised to RM1,200 in major cities

5.25pm - The minimum monthly wage will be raised to RM1,200 in major cities beginning 2020. The present nationwide minimum wage is RM1,100.

The government will study amendments to the Employment Act 1955 to increase maternity leave from 60 days to 90 days, and to better protect workers from both sexual harassment and discrimination.

5.15pm - RM23 million is allocated for national schools to remove barriers in order to make the premises accessible for disabled children.

Malaysians@Work scheme seeks to reduce unemployment

5.10pm – The government will introduce a new incentive called #MalaysiaKerja (Malaysians@Work) for companies to hire locals.

It is applicable to graduates who secure a job after 12 months of being unemployed, women who rejoin the workforce and locals who replace foreigners.

In a nutshell, it is a two-year scheme where qualified individuals are paid RM500 a month for two years on top of their salaries. Participating employers will be given an incentive of RM300 a month.

There is a different scheme for apprenticeships which fall under the TVET category, which involves an allowance of RM100 a month over the same duration.

Putrajaya believes this will reduce unemployment and increase the skilled workforce.

Incentives for bumiputera entrepreneurs

4:50pm - SME Bank will introduce two new funds - RM200 million for female entrepreneurs and RM300 million for firms with potential, with priority given to locally-made halal products.

Interest rates will be at a government-subsidised rate of two percent.

The government will guarantee up to 80 percent of export-oriented and digital bumiputera businesses, up 10 percent from last year.

Female bumiputera entrepreneurs will receive up to RM500 million in government guarantees.

These guarantees will be distributed by the Skim Jaminan Pinjaman Perniagaan (SJPP).

A further RM445 million in grants will be allocated for bumiputera entrepreneurs through PUNB, SMECorp, Tekun Nasional, Pelaburan Hartanah Bhd and Unit Peneraju Agenda Bumiputera which is parked under the Economic Affairs Ministry.

Lim heckled again, this time over cable car project in Penang

5.00pm - To encourage more tourists, the government will offer tax incentives to new investments in theme parks and organisers of international cultural and sports activities.

Companies which support arts and cultural activities will be given tax incentives as well.

The government will allocate RM100 million for a new cable car project in Bukit Bendera, Penang, to replace the existing funicular train. This triggered opposition lawmakers to heckle him, who was the former Penang chief minister.

4.55pm - The special monthly allowance for fishermen will increase to RM250 from the present RM200.

RM180m allocated for Felda settlers

4.52pm - The government allocates RM810 million to improve Felda settlers' income, write off some of their debts, improve water supply, construct houses and upgrade existing infrastructure.

Gov't aid for palm oil industry

4.50pm - To help small oil palm planters, The government will allocate RM550 million for loans for smallholders, who will be given 12 years to repay it at an interest rate of two percent.

The government will also allocate RM27 million to help the Malaysian Palm Oil Board to establish new markets for palm oil abroad and address the ongoing anti-palm oil campaign.

One-off RM30 credit for e-wallet users

4.45pm - To encourage adoption of e-wallets, the government will give adults with an annual income of less than RM100,000 a one-off RM30 credit in their e-wallet. The money can be redeemed between Jan 1, 2020 and Feb 29, 2020.

4:40pm - Various grants for digital initiatives. RM50 million for 5G ecosystem development, RM20 million for the Malaysian Digital Economy Corporation (MDEC), RM25 million for pilot projects for apps that utilise 5G and optic fibre.

Fifty percent in matching grants (up to RM5 million) for efforts to support digitalisation of SMEs plus matching grants (up to RM2 million) for 2,000 manufacturing and services firms that embark on automation efforts.

RM10 million allocated for e-commerce training

4.35pm - Private companies which adopt digital social responsibility to help train their workforce will be given tax breaks. The government will allocate RM10 million to train people in e-commerce.

Government is allocating RM20 million for e-sports. The finance minister hopes Malaysian athletes will do well in the upcoming SEA Games.

4.30pm - Those in the rural areas of Sarawak and Sabah will not be left out of the National Fiberisation and Connectivity Plan. Some RM250 million will be spent on the two states alone, which will include providing rural areas with satellite internet connection.

4.28pm - The government expects to spend RM8 billion to improve port infrastructure and turn Port Klang and Pulau Carey into regional maritime centres and logistic hubs.

The government is studying ways to develop Carey island and will allocate RM50 million to repair roads in Port Klang.

Gov't has no plans to reintroduce GST

4.25pm – Lim says the government has no plans to reintroduce the Goods and Services Tax (GST)

4.22pm - The government is creating various schemes to attract Fortune 500 companies in the following industries - technology, manufacturing, creative and new economy.

The government will also offer 10-year tax breaks and other incentives for qualified electrical and engineering companies.

Lim heckled after blaming BN for abuses

4.20pm - Putrajaya will set up a special channel in InvestKL for investors from China to ensure that Chinese investments match that of the US.

4.11pm - Some three minutes into his speech, Lim is interrupted by loud heckling from opposition MPs. The opposition MPs were upset because Lim accused the previous government of abuses.

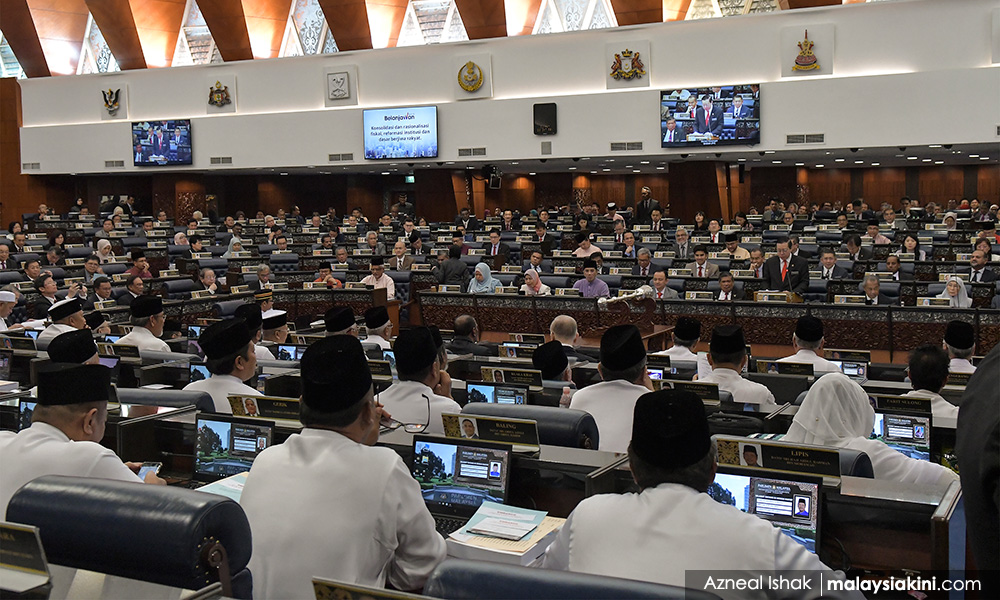

Finance Minister Lim Guan Eng is tabling the Pakatan Harapan government's second budget in the Dewan Rakyat since the coalition came to power.

The total Budget 2020 size is RM297.020 billion, which is a 5.57 percent reduction compared to the RM314.55 billion allocation in Budget 2019.

Although this might appear as a contractionary budget, the government, however, is not spending less on normal operations and development expenditure.

The reduction is due to the absence of the Goods and Services Tax (GST) and income tax refund, which amounted to RM37 billion in the previous budget.

Discounting the RM37 billion in the last budget, Budget 2020 is larger by 6.99 percent (See Malaysiakini's visualised explanation here).

However, covering the shortfall from the abolition of the GST remains a challenge which the government continues to deal with in Budget 2020.

At a glance:

- Total budget for 2020: RM297.020 billion (excludes RM2 billion contingency fund), down 5.57%.

- Operational expenditure: RM241.020 billion, down 7.25%

- Development expenditure: RM56 billion, up 2.32%

- Projected deficit for 2020: 3.2% (revised from 3.0%)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.