Surprising that in 2010 there was a news report that claimed that Bumiputra Equity Ownership has achieved its target of 30%. Read this news report below:

Revisiting the Bumiputera corporate equity issue

- Category: Lim Teck Ghee's Contribution

- Written by Dr. Lim Teck Ghee

The study's findings of a 45 percent Bumiputera share were based on a different method of measurement compared with the official one. Using market value as opposed to the par value valuation official method, and allocating the equity of GLCs according to racial share, the study noted that it was time to do away with the policy which had been implemented since the 1970s.

The study's findings raised a hue and cry not only because it challenged the official data on the share equity attained by the Malay community but more importantly because it challenged the official orthodoxy.

Strong reactions from various Umno leaders at that time indicated their fury -- and perhaps fear -- that the Asli study negated a long-held belief on how the Bumiputera corporate equity strategy was necessary for Bumiputera economic advancement and synonymous with the interests of the Malays.

Lost in the firestorm were the study's recommendations that encompassed a wide spectrum of issues. Those recommendations are reproduced below.

I hope they will be read more carefully by the present crop of policymakers and politicians that are trying to find their way out of what has correctly been referred to as the "bastardization of the NEP" - an assessment made by one of the nation's foremost bankers, Nazir Razak.

Corporate equity findings (from Centre for Public Policy Studies' Report)

* GLCs are leading shareholders of corporate equity. The GLCs' pattern of operation reflects little entrepreneurial and manufacturing capacity.

* Regulatory agencies ensure that 30% of the equity of quoted firms are owned by Bumiputera. These agencies do not, however, ensure that individual Bumputera allocated large volumes of publicly-listed equity, especially during IPOs, retain their ownership of this equity.

* Publicly-listed shares distributed to Bumiputera minority shareholders during IPOs should be done in a more equitable and transparent manner. Currently, an elite benefits from such IPOs, and these shares are quickly divested for huge profits.

* The continuous divestment by Bumiputera shareholders (partly as a means of asset diversification) has been mainly responsible for the so-called "under achievement" by Bumiputera in relation to the NEP corporate equity targets based on the official definition.

* Even if this divestment is not taken into account, Bumiputera share of corporate equity presently is well in excess of the target of 30 percent, if more objective methodologies of measurement are used.

* There is little intra-ethnic business cooperation among leading Chinese businessmen. There is growing evidence of inter-ethnic partnerships forged on a basis where the partners contribute equally to the development of an enterprise.

* Government regulation and policies, principally in the form of NEP measures, are stymieing entrepreneurial development and hindering domestic and foreign investment.

Corporate equity recommendations

* Enterprises owned by the GLCs must be managed by competent professionals with expertise in the business of the company under their charge. Senior management positions should not be determined on the basis of ethnic background but on merit and professional achievement.

* The government should cease allocating equity to individual Bumiputera during IPOs. The allocation of shares to Bumiputera before IPOs tend to promote Ali-Baba relationships that only serve to undermine investor confidence and foster ill-will.

* Bumiputera trust agencies, such as the ASN and ASB, should be the primary beneficiaries of IPOs allocated to this community. At the same time, there should be equal determination by the government to increase the share participation of the Indian and East Malaysian Bumiputera communities through similar community-based trust agencies.

* Government initiatives to promote enterprise development on the basis of affirmative action will undermine entrepreneurial endeavours, which have emerged primarily among SMEs, without state support.

* The government should focus its attention on promoting key economic sectors and SMEs as a means to develop Malaysia's economic potential. The government should particularly tap into the potential of the new middle class to create thriving enterprises and find means to support such endeavours.

* Racially oriented affirmative action and the promotion of Malay-owned businesses have created serious intra-ethnic Malay cleavages while also hindering the creation of a competitive economic environment. The government should not continue with the continued promotion of such policies.

* In calculating the respective ethnic shares of the corporate equity, there is need to apportion the share of GLCs as well as nominee companies according to the ethnic composition of the country. This will provide a fairer and more objective computation of the respective ethnic shares as compared with the current methodology.

* Government policies to enhance Malay Bumiputera and other ethnic minority participation in commerce and industry are better achieved through capacity building efforts such as investment in human resource development and skills training rather than through forced equity restructuring.

* Regulatory agencies ensure that 30% of the equity of quoted firms are owned by Bumiputera. These agencies do not, however, ensure that individual Bumputera allocated large volumes of publicly-listed equity, especially during IPOs, retain their ownership of this equity.

* Publicly-listed shares distributed to Bumiputera minority shareholders during IPOs should be done in a more equitable and transparent manner. Currently, an elite benefits from such IPOs, and these shares are quickly divested for huge profits.

* The continuous divestment by Bumiputera shareholders (partly as a means of asset diversification) has been mainly responsible for the so-called "under achievement" by Bumiputera in relation to the NEP corporate equity targets based on the official definition.

* Even if this divestment is not taken into account, Bumiputera share of corporate equity presently is well in excess of the target of 30 percent, if more objective methodologies of measurement are used.

* There is little intra-ethnic business cooperation among leading Chinese businessmen. There is growing evidence of inter-ethnic partnerships forged on a basis where the partners contribute equally to the development of an enterprise.

* Government regulation and policies, principally in the form of NEP measures, are stymieing entrepreneurial development and hindering domestic and foreign investment.

Corporate equity recommendations

* Enterprises owned by the GLCs must be managed by competent professionals with expertise in the business of the company under their charge. Senior management positions should not be determined on the basis of ethnic background but on merit and professional achievement.

* The government should cease allocating equity to individual Bumiputera during IPOs. The allocation of shares to Bumiputera before IPOs tend to promote Ali-Baba relationships that only serve to undermine investor confidence and foster ill-will.

* Bumiputera trust agencies, such as the ASN and ASB, should be the primary beneficiaries of IPOs allocated to this community. At the same time, there should be equal determination by the government to increase the share participation of the Indian and East Malaysian Bumiputera communities through similar community-based trust agencies.

* Government initiatives to promote enterprise development on the basis of affirmative action will undermine entrepreneurial endeavours, which have emerged primarily among SMEs, without state support.

* The government should focus its attention on promoting key economic sectors and SMEs as a means to develop Malaysia's economic potential. The government should particularly tap into the potential of the new middle class to create thriving enterprises and find means to support such endeavours.

* Racially oriented affirmative action and the promotion of Malay-owned businesses have created serious intra-ethnic Malay cleavages while also hindering the creation of a competitive economic environment. The government should not continue with the continued promotion of such policies.

* In calculating the respective ethnic shares of the corporate equity, there is need to apportion the share of GLCs as well as nominee companies according to the ethnic composition of the country. This will provide a fairer and more objective computation of the respective ethnic shares as compared with the current methodology.

* Government policies to enhance Malay Bumiputera and other ethnic minority participation in commerce and industry are better achieved through capacity building efforts such as investment in human resource development and skills training rather than through forced equity restructuring.

Continuing wayang on Malay corporate equity

It is understandable why Perkasa and similar parasitic groups are raging away at the corporate equity issue. The ultra nationalist movement badly needs issues that can burnish its credentials as the protector of Malay interests and derail the structural reforms the country needs to flourish.

What is incomprehensible is why Umno continues to harp on the attainment of the racial corporate equity share target as a key goal to be pursued for the Malays and country as a whole.

It is absolutely the wrong target to focus on because it has been conclusively shown to benefit only a small minority of well-connected and already wealthy business and political leaders - numbering perhaps no more than a few tens of thousands of individuals and their families at most.

One would have thought that the $52 billion out of $54 billion of equity value sold off by Bumiputera preferred investors between 1985 and 2005 would be sufficient proof that these individuals do not need more perks and special treatment.

More important, the Bumiputra corporate equity target is the wrong one as it will only distract from the more important challenges that the nation and especially the Malays and other Bumiputra communities need to face up to.

Note: This article first appeared in Chinese in the weekly paper, 'Red Tomato'.

Today, Economic Affairs Minister had informed that the Bumiputra Equity Ownership stands at 16.2% as of 2015 from 23% in 2011.

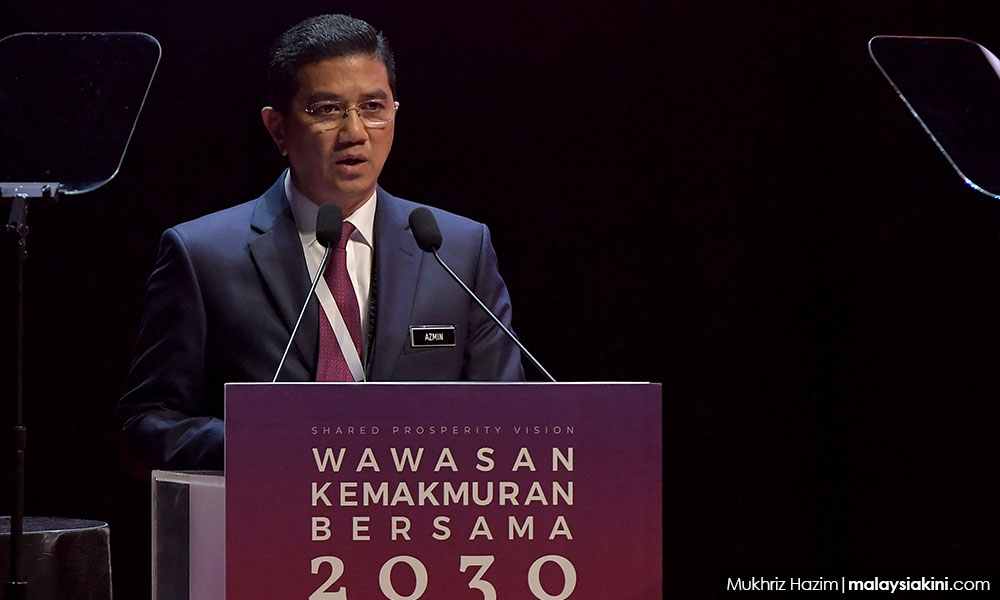

Azmin: SPV2030 will continue efforts to reach 30% bumiputera equity ownership

The Shared Prosperity Vision 2030 will continue with efforts to achieve the 30 percent bumiputera equity ownership target but needed participation from the country’s corporate sector for it to become a reality, says Economic Affairs Minister Mohamed Azmin Ali.

According to him, participation from bumiputera and non-bumiputera corporations are important in increasing the percentage of equity ownership of both ethnic groups.

“Bumiputera equity ownership has not only failed to reach its target but dropped to 16.2 percent (in 2015) from 23 percent in 2011. Non-bumiputera equity ownership has also declined to 30.7 percent in 2015 compared to 34.8 percent in 2011 while foreign equity ownership has increased to 45.3 percent.

“This is due to the imprudent policy by the previous government which hurried the liberalisation process and made an impact on Malaysians,” he told the media after attending the launching of SPV2030 by Prime Minister Dr Mahathir Mohamad in Kuala Lumpur today.

According to him, the current government might have to revisit some of the initiative taken by the previous government in regards to liberalisation.

“[...] Maybe we are not ready for that (liberalisation on some of the policies), maybe the timing was not correct, we don’t know, so we have to study what was done and what happened in the past,” he said.

Mohamed Azmin also said the Pakatan Harapan government would continue to seek greater foreign direct investment into the country, in new sectors including aerospace, digital economy and big data.

“Malaysians, in particular, must be ready to embrace this technology. Certainly, the objective is to ensure that the local participation, from either bumiputera or non-bumiputera, would be enhanced under SPV2030,” he explained.

The government, according to him, was also looking at the need to 'recalibrate' new policies so that the country's prosperity could be shared among the people.

This, he said, would be important to ensure the stability and harmony of Malaysians of various races, religions and ethnic groups.

The minister also said even though SPV2030 would only be officially implemented in 2021 until 2030, but the spirit of the SPV would be incorporated in the next budget to be tabled on Oct 11.

“So, during the transitional period we will be able to see the progress of this SPV, and when we hit 2021 we will be full steam ahead to achieve the full target for the next 10 years”, he said.

Asked on the government’s target of achieving RM3.4 trillion gross domestic product by 2030, Mohamed Azmin said that as long as the country’s economy expands between 4.5 percent to 5.0 percent every year, then Malaysia is on the right track.

- Bernama

Malaysians are now wondering whether the figures informed are accurate or not.

IF the current situation prevails and with so much of emphasis and assistance already given to Bumiputras and if they have not reached the desired target of 30% by now, it seems that even after another 100 years (year 2119), Bumiputra Equity Ownership will not achieve the targeted 30%.

Most of the oil monies received from Petronas were channel to Bumiputras so that they could achieve this 30% equity ownership.

Very soon, there will be NO MORE oil monies since our oil reserves have become depleted.

Will this 30% target for the Bumiputra Equity Ownership be ever achieved? - Mohd. Kamal Abdullah

Even if it's achieved, it is not necessary to forgo the policy. It needs to stay forever as protection.

ReplyDelete