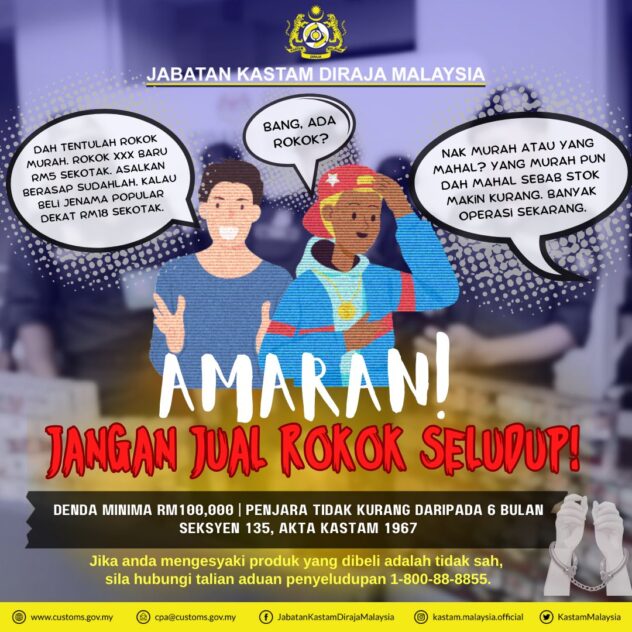

MALAYSIA’S long-running battle against illicit cigarettes is often framed as an enforcement challenge.

Each major seizure reinforces the perception that the problem is being actively contained. New border controls and tougher crackdowns signal resolve.

If this is true, why do illicit cigarettes continue to occupy a significant share of the domestic market?

By most estimates, the illicit cigarette trade now costs Malaysia up to RM5 bil annually in lost revenue. This persistence raises an uncomfortable but necessary question: if enforcement has been consistently strengthened, why does the shadow market remain so resilient?

This is not a criticism of enforcement agencies. Malaysia’s customs and security authorities have demonstrated sustained operational commitment with regular seizures and increasingly targeted interdiction strategies.

‘Policy blind spots’

But enforcement outcomes should ultimately be assessed not by the value of contraband seized but by whether demand for illegal products is meaningfully reduced over time. If demand remains intact, supply will inevitably find new routes.

Here lies the policy blind spot.

Illicit markets persist when economic incentives favour non-compliance. In the case of cigarettes, a wide and enduring price gap between legal and illegal products continues to shape consumer behaviour.

When the legal product becomes significantly less affordable relative illicit alternatives, price-sensitive consumers are pushed toward the illegal market.

As long as illegal cigarettes remain readily available at a fraction of the price, enforcement alone cannot fundamentally alter consumption patterns.

International experience reinforces this reality. In Australia, former deputy chief medical officer Dr Nick Coatsworth has warned that the scale of illicit cigarette consumption reflects a policy failure that enforcement alone cannot contain.

This is especially so when organised crime has stepped in to meet demand created by market distortions.

Addressing demand size dynamics

Independent estimates indicate that illicit tobacco consumption accounted for 28.6 % of total tobacco use in Australia in 2023, a significant increase from earlier years and suggestive of a market that organised criminal networks have moved into as legal prices rise.

Across Europe, authorities have reported a similar pattern of adaption. In 2024 alone, an estimated nearly 39 billion illicit cigarettes were consumed across Europe, a double-digit increase from the previous year, representing a double-digit increase from the previous year.

The lesson is consistent. When regulation focuses primarily on supply suppression without addressing demand-side dynamics, illicit trade does not disappear.

Instead, it becomes more resilient. Risks are priced in, enforcement losses are absorbed and the market survives because consumer demand remains unchanged.

This highlights a broader policy challenge. Enforcement is essential but it cannot operate in isolation. When the economic logic of illicit consumption remains unaddressed, enforcement risks becoming reactive rather than corrective – capable of disruption, but not resolution.

None of this suggests that enforcement should be weakened. Strong borders, inter-agency coordination and technology-enabled surveillance remain critical.

But enforcement must be complemented by a broader policy conversation that considers regulatory calibration, consumer behaviour and market realities. This includes re-assessing whether current tax and pricing structures unintentionally incentivise illegal substitution.

Illicit cigarettes should therefore be recognised not merely as a law enforcement issue but as a structural policy challenge at the intersection of regulation, taxation and consumer behaviour.

Until this is acknowledged, the shadow market will continue to adapt by quietly imposing costs on public revenue and market integrity.

Good policy does not rely solely on punishment. It reduces the incentive to bypass the system in the first place. That is the conversation Malaysia now needs to have.

Foo Lee Khean is a Malaysian capital markets practitioner and policy commentator with extensive experience in corporate finance, market structures and regulatory frameworks.

The views expressed are solely of the author and do not necessarily reflect those of MMKtT.

- Focus Malaysia.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.