Daim Zainuddin is in China for two reasons.

First, he is seeking to tie some financial institutions he owns together with China’s CITIC Bank and Export-Import Bank (EXIM).

Second, he is seeking a quid pro quo that will ultimately see Dr Mahathir Mohamad’s son acquire the beneficial ownership of an oil and gas concern that the Chinese government is expected to commit to.

The deal is expected to rake in some RM20 billion for Daim and gang from out of thin air.

THE THIRD FORCE

Daim Zainuddin is in China.

The Council of Eminent Persons (CEP) de facto chief, tasked with advising Dr Mahathir Mohamad on economic matters, is really there to negotiate the establishment of a banking nexus involving some financial institutions he owns together with China’s CITIC Bank and Export-Import Bank (EXIM). On the 15th of July 2018, The Third Forcetook the wraps of a conspiracy involving Daim and Tan Sri Vincent Tan to part finance the construction of the East Coast Rail Link (ECRL) project (READ FULL STORY HERE). Vincent, who currently is the beneficial owner of a local entity that jointly bid for the project, is seeking Daim’s assistance to provide that entity assistance in the form of soft loans.

The said entity, Syarikat T7 Global Sdn Bhd, happens to be an oil and gas service provider that both Mahathir and his sons have a great deal of interest in. On the 1st of June 2018, The Third Force made known the extent of control Mahathir’s sons once had over ExxonMobil’s upstream and downstream business within the region (READ FULL STORY HERE). Mokhzani Mahathir lost a chunk of that control in 2017 when he undertook to dispose of his 190.3 million stake in SapuraKenchana Petroleum Bhd (SK), an oilfield services company he established six years earlier together with childhood friend,Tan Sri Shahril Shamsuddin.

Mahathir wants that control back.

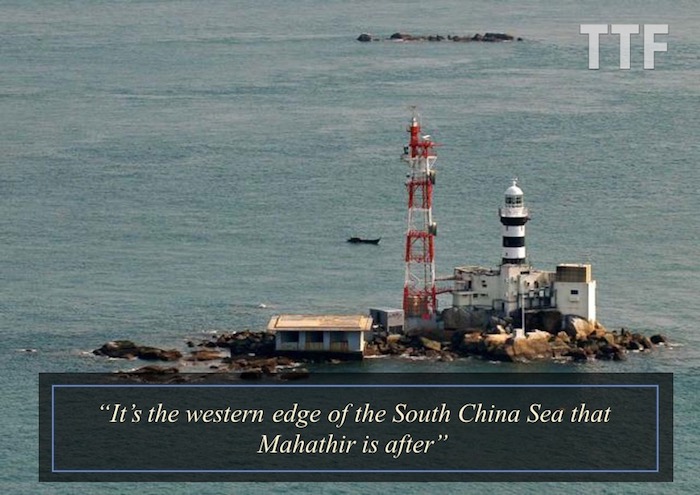

That explains why he’s interested in building a new island where the once disputed Middle Rocks cluster (known also as the Pedra Branca island) stands. After meeting Singaporean premier Lee Hsien Long on the 19th of May 2018, he quickly announced the scrapping of the Kuala Lumpur-Singapore High-Speed Rail (HSR) Link between Kuala Lumpur and the southern republic before making known his plan to expand Malaysian territory southward. The expansion involves the introduction of non-submerged land mass around the Middle Rocks cluster, which happens to sit within the eastern opening of the Singapore Straits and the western edge of the South China Sea.

The area is rich with oil and is of interest to both Singapore and the People’s Republic of China. Mahathir is aware that the Chinese government has long had disputes with the Singaporean government and is desperate to work with Malaysia in exploiting the region. The building of an island where Middle Rocks stands seemed a perfect opportunity for him to redraw territorial borders and force Singapore into renegotiating Maritime Security arrangements. The renegotiation would immediately grant Malaysia exclusive rights to the edge of the South China Sea and allow China to participate in deep sea drilling.

But the only Malaysian oil and gas entity that currently has access to deep sea technology is Petronas, a company neither Mokhzani nor Mirzan Mahathir have control over. Mokhzani lost access to that technology when he got Khasera to dispose of its holdings in SK and beneficial ownerships in some oil and gas concerns worldwide. Mirzan is working to regain that access by interesting San Miguel Corporation into purchasing a chunk of Petronas’ interests. Just so that you know, San Miguel is a food and beverages (F&B) conglomerate that owns 63 percent of Petron Corporation.

Mahathir is backing Mirzan all the way in his pursuit for deep water technology. To prevent the possibility of there being competition for his sons in the near or distant future, the Prime Minister is undertaking to consolidate all oil and gas related entities in Malaysia that are service based under the roofs of his cronies. That helps explain Vincent’s recent purchase of T7 shares and the initial scrapping of the HSR project. By calling off the project, Mahathir effected a 37.6 percent decline in the price of Gamuda Berhad’s shares which Daim’s and Vincent’s people have since purchased.

Gamuda had previously partaken in a 50:50 joint venture (JV) to provide solutions mainly to the Government of Malaysia (GoM). The company it partnered with, MMC Corporation Berhad, is an investment holding entity that is 51.8 percent owned by Tan Sr Syed Mokhtar Al-Bukhary. Syed was the onetime owner of an oil and gas concern that he recently sold to one of his own companies, Melati Pertiwi Sdn Bhd.

Thus, not only is Bukhari in the business of oil and gas, he is a joint shareholder with Gamuda in a company that constructs airports, highways, bridges and railway links. That is another reason why Daim is seeking to renegotiate terms associated with the construction of the ECRL. Apart from looking at ways to establish a banking nexus with EXIM and CITIC, the Council of Eminent Persons (CEP) de facto chief is seeking to offer MMC-Gamuda a lucrative slice of the ECRL project in a quid pro quo that involves the transfer of Melati Pertiwi shares to his people. The Chinese government is expected to commit itself to Melati Pertiwi in deep sea drilling at the edge of the South China Sea.

The deal would ultimately allow Syed Mokhtar to partake with Vincent in a cost-appreciated version of the railway project and Mahathir to sink his teeth into Syed’s oil and gas interest. And if you’re thinking that Tan Sri Zeti Akhtar Aziz has nothing to do with all this, you’re dead wrong…

To be continued…

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.