Following the sea change in government with the new Pakatan Harapan coalition in place, many observers are paying intense and critical attention to fathoming the true nature and size of Malaysia’s public debt obligations. Greater transparency is demanded.

The previous BN administration, under former prime minister Najib Abdul Razak, had been less than transparent about the true size of the government’s liabilities.

How was this accomplished? There was a three-fold approach. First, the annual federal government budgets (as presented to Parliament) recorded for most years a modest deficit; such deficits were financed by borrowings in ringgit-denominated loans.

While direct borrowings from foreign sources were minimal, foreign hedge funds and other investors held sizable holdings of ringgit-based paper. These holders were attracted in part by the relatively higher returns Malaysia offered at a time when global interest rates were at record low levels. Using this approach, total federal government debt was kept to a level averaging just above 50 percent of GDP.

Second, much of the financing of development projects came from loans that never appeared in the federal government budget; these were off-budget loans and were raised by publicly owned/controlled corporations and entities.

These loans appear, for the most part, to have been guaranteed by the federal government. While these were government liabilities, they were not fully reported. As a result, Parliament and the public were left in the dark; off-budget borrowing hid the size of the debt from regulators; and the virtual outsourcing of development projects provided an opportunity to ignore procurement rules, such as the need for competitive bidding.

Third, Bank Negara reporting of debt data was partial and lacked clarity or any semblance of full disclosure. And large loans linked with the Kuala Lumpur-Singapore High-Speed Rail Link and the East Coast Railway Line projects were not highlighted in the government’s Economic Report or the Budget presentation.

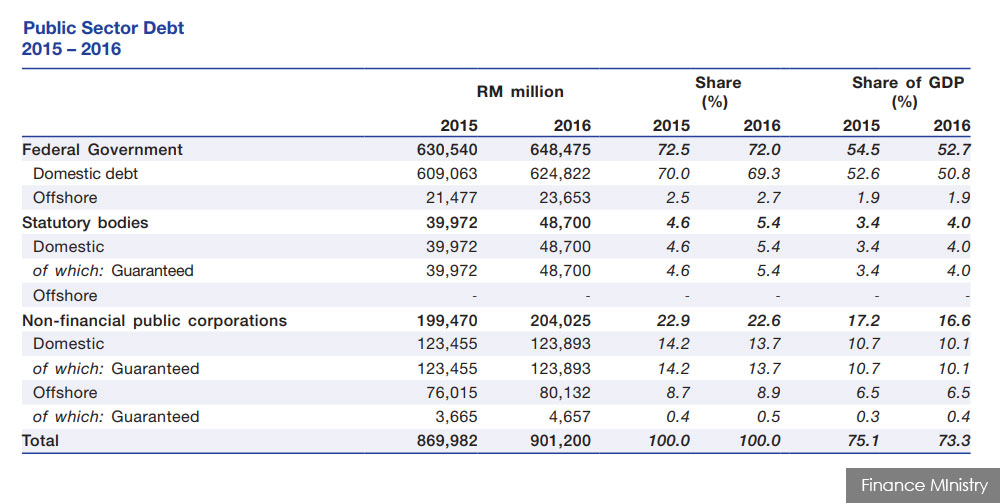

In the Economic Report, the reported consolidated public sector debt at the end of 2016 amounted to RM 901 billion. However, this figure was not highlighted; ministerial statements emphasised the lower figure of federal government debt of RM648 billion.

One may well ask: why did these BN administration practices never come to light? But in fact, they did.

The 2017 International Monetary Fund report following the annual Article IV Consultations was laced with numerous observations concerning fiscal transparency, risk management, as well as the high level of contingent liabilities and loan guarantees by the federal government.

In a departure from the IMF’s usual nuanced language, several of these critical observations were blunt. While government officials attempted to placate IMF staff by stating that corrective actions were either being taken or under consideration, there is no evidence that this was indeed the case.

Even though the IMF report was publicly available, mainstream media were selective, as they highlighted growth prospects and upward revisions to GDP forecasts (which in any case were largely linked to a recovery in international oil prices). None of the critical or purportedly negative observations were publicised.

The IMF also ran simulations under different scenarios and offered policy options for debt management. There is no evidence as of this date that the measures proposed by the IMF were acted upon by the then-BN administration.

Debt management

The speed with which the new finance minister of the Harapan administration acted by issuing a press statement together with the statement by the newly installed prime minister were commendable actions.

Their statements about the debt level were indicative of the seriousness with which the new government saw a need for greater transparency in addressing the challenges facing the country.

These statements were in part designed to reassure the markets that the new government was committed to promoting stability and pursuing responsible policies. These actions had the intended calming effect on the markets.

Equally important, the public at large welcomed the greater transparency and sharing of information. These actions also led to a surge in the expression of patriotism through contributions to the Tabung Harapan Fund, which has attracted over RM 100 million in public donations.

That said, it is important to note a few less than positive aspects. The finance minister’s press statement has been criticised as alarmist for citing the estimated size of the 'government’s debt' at RM1 trillion.

Surprisingly, the calculations deviated from internationally accepted statistical standards. Most significantly, in citing the RM1 trillion figure, no attempt was made to distinguish between foreign and domestic debt. Each type of debt requires differing debt management initiatives in order to steady the economic ship of the nation.

With this announcement, the impression was left that Malaysia was on the verge of a serious debt crisis, akin to what Latin American countries such as Mexico and Argentina had faced in the past.

Segments of the public concluded that Malaysia would join European Union countries such as Portugal, Italy, Greece, and Spain in seeking debt relief and assistance. However, Malaysia’s circumstances were far different, as the debt is substantially domestic, whilst in the case of the other countries, it was mainly foreign debt.

The ministerial statement concerning the size of debt was accompanied by a series of statements concerning the adoption of austerity measures, cancellation or suspension of several mega projects, an intent to renegotiate bilateral loans arranged by the previous government, and so forth.

Regrettably, these actions were not fashioned as part of a coherent and integrated plan to tackle the overall issue.

The current public impression is that the Harapan administration will pay off the debt even as it restores certain subsidies, eliminates the GST and embarks upon new programmes. The reality is that repayment of debt is unlikely; at best some reduction in liabilities may occur.

The inconsistencies inherent in this populist mix are likely to come back to haunt the coalition. It is thus imperative that steps be taken now to develop a coherent debt management programme.

Recommended programme

As a first step, there is an urgent need to improve the scope of government finance statistics. Greater transparency pertaining to the activities of all publicly owned corporations is essential. Meaningful consolidation of public finances is demanded as it will provide the basis for evidence-based decisions.

Some key considerations in the design of a debt management programme include a separation of total public debt into foreign and domestic debt to provide focus and targeted policies.

Additionally, it needs to be kept in mind that Malaysia’s foreign debt is made up of two parts. In the first part, foreigners hold a sizable part of Malaysian debt instruments denominated in ringgit. These need careful surveillance, as volatile movements can impact on external stability and the exchange rate.

A second part of the stock of foreign debt is made up of the significant loans associated with the mega projects contemplated by the previous government. Two approaches are already being taken by the Harapan administration. Proposals are being developed to either cancel projects or renegotiate the terms of these loans.

The renegotiations will demand actions embracing size, servicing terms, etc., and in certain instances, debt-equity swaps should be an option for consideration. Prudent management of the external debt by the Ministry of Finance would be greatly aided by the use of tools outlined in the IMF’s external debt sustainability analysis.

The management of domestic debt will require a host of actions including:

Easing pressure on the budget: A combination of austerity measures, removal of overlapping functions and increase in efficiency to contribute to easing pressures on the federal government’s budget.

Broadening the revenue base: While new taxes may ultimately be needed to service the government and to enable it to deliver on its electoral promises, there would appear to be scope for reviewing the various ‘incentives’ that the BN administration extended to its crony corporate supporters. These so-called incentives are no more than a form of ‘corporate welfare’ and have grown in successive budgets over recent years. It is time that the government ensures that corporate entities pay a fair share of taxation.

Reducing off-budget borrowing: This borrowing by the government via GLCs and other entities, as observed earlier in this note, has been the largest contributor to the growth of public sector debt. To prevent a reccurrence, as a measure under the proposed debt management programme, the accounting system of the federal government should move from a cash basis to an accrual system. This will provide a more realistic portrait of the public sector’s financial circumstances.

Reforming GLCs: The key reform that will need early implementation concerns the GLCs. These are in reality state-owned enterprises (SOEs). They dominate activities across the entire economic spectrum; they are monopolies that hinder the entry of competing firms; these parastatals are open to abuse as demonstrated by the 1MDB saga and other scandals.

Their impact in so far as debt is concerned is clearly enormous: they are able to borrow on preferential terms with the aid of government guarantees; there is minimal accountability and ample opportunities for abuse. It should be recalled that the Najib administration had promised restructuring and selective privatisation of these entities. These promises were not delivered upon.

It is important now to push through the long-promised reforms. Insofar as the existing debt of these entities is concerned, some or all of it should be restructured through debt-equity swaps.

Alternatively, these debts should be written down as part of a restructuring effort preceding privatisation. It should be noted that reforms of this nature will contribute to enhancing Malaysia’s competitiveness and help the country loosen one constraint that is contributing to its entrapment as a middle-income country.

While Malaysia does not face a debt crisis of the type experienced by the Latin American and European countries, it does need to adopt sound debt management practices to contain the public sector’s borrowings. Reforms that lead to a downsizing of the public sector will create a more friendly environment for the private sector to play its role as an engine of growth.

R CHANDER is first Malaysian to hold the office of chief statistician in the 1960s and 1970s. He then went on to serve as the senior adviser to the World Bank’s chief economist/senior vice president from 1977 to 1996. Upon retirement from the bank he has functioned as an international advisor to multiple international agencies and governments. -Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.