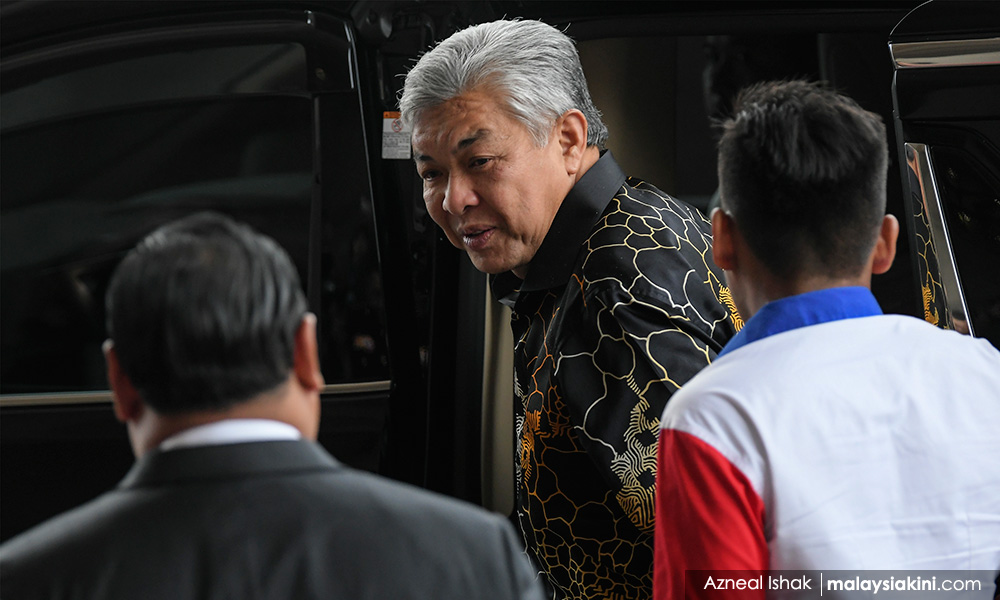

ZAHID TRIAL | Ahmad Zahid Hamidi once voiced his willingness to advance US$2.058 million from "a foundation's funds" to facilitate a corporate takeover by his daughter, a witness told the Kuala Lumpur High Court today.

Former Exim bank chairperson Mat Noor Nawi said the payment was meant to pay off Ri-Yaz Asset Sdn Bhd's debts before Nurulhidayah Ahmad Zahid could acquire a 60 percent stake in the company.

Mat Noor was testifying in the trial against Zahid for corruption, criminal breach of trust and money laundering of millions of ringgit from Yayasan Akalbudi, and other allegations.

According to the witness, it all started with a phone call he had with Nurulhidayah on May 19, 2016.

"As best I can remember, Nurulhidayah had passed the phone to Zahid. Zahid said Nurulhidayah wanted to take over 60 percent shares in Ri-Yaz Asset from (its chairperson) Abdul Rashid Abdul Manaf," he said.

Mat Noor said a meeting was later held sometime in June 2016 between himself, Zahid, Nurulhidayah, then Exim bank CEO Norzilah Mohammed, and Ri-yaz Asset director Mohammad Shaheen Shah Mohd Sidek.

The half-hour meeting, held at the Deputy Prime Minister's Office in Putrajaya, was to secure Exim Bank's approval for the deal.

During the meeting, Mat Noor said he informed Zahid that Ri-Yaz Asset owed US$2.058 million, which was the first tranche of repayment for a US$24.8 million loan the company took to finance the purchase of a hotel in Indonesia.

"Zahid said he was willing to pay the loan debt of Ri-Yaz Asset worth US$2.058 million using a foundation's funds. But he did not tell me the name of the foundation.

"Zahid then told us that if he advanced the foundation's funds, Nurulhidayah (below) and Shaheen would have to pay back the foundation," he said.

According to Mat Noor, Nurulhidayah's share acquisition proposal was approved by Exim Bank's credit committee on Dec 14, 2016, with the requirement that Ri-Yaz Asset chairperson Rashid remained the loan's guarantor, and held at least a 10 percent stake in the company.

However, he said Nurulhidayah did not proceed with her acquisition plans, and that shares were instead bought by an Indonesian company he had no knowledge of.

While the share acquisition deal did not materialise, law firm Lewis & Co which is a trustee of Yayasan Akalbudi did receive two cheques from Ri-Yaz Asset.

CIMB Bank branch manager Yap Mary had testified earlier that the company paid the foundation via cheques RM254,879 on July 15, 2016, and RM8.348 million on May 2, 2017.

The second sum, RM8.348, is the ringgit equivalent at that time for the US$2.058 million owed by Ri-Yaz Asset to Exim bank. This was attested to by Mat Noor.

During cross-examination, Mat Noor said on record, the payments to service Ri-Yaz Asset's loan had come from the company.

He also said that Zahid's intent to make an advance was not considered an investment, and that using foundation funds for investment had never been discussed.

Mat Noor said for Yayasan Akalbudi to make an investment it must be in line with the fund's statutory objective which is: "To receive and administer funds for the eradication of poverty and the enhancement of the welfare of the poor and to conduct studies and research relevant to the poverty eradication programme and to this end."

Zahid is facing 47 charges, comprising 12 charges of criminal breach of trust and 27 charges of money laundering.

For the money laundering charges, Zahid is accused of receiving RM65 million through Lewis & Co, with a majority of the amount used to place a fixed deposit in the law firm's name. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.