Section 17A of the MACC Act 2009, which came into force on June 1, is the perfect weapon to curtail corruption at a time when companies struggling to keep afloat may consider bribery to earn a quick profit.

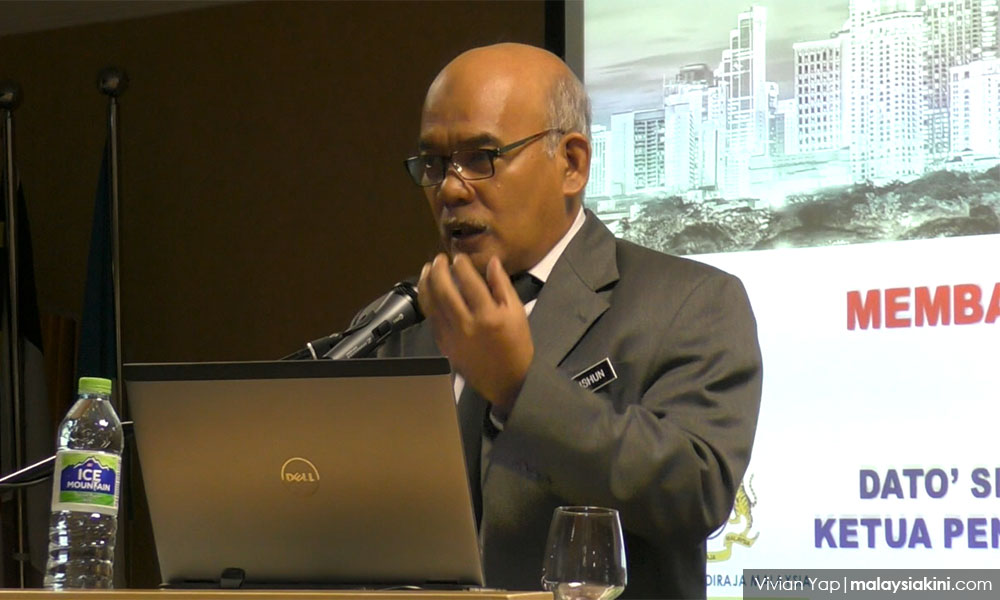

Malaysian Anti-Corruption Commission (MACC) Deputy Chief Commissioner (Prevention) Shamshun Baharin Mohd Jamil (above) said while there have been positive developments in the nation’s economic recovery post the movement control order (MCO), the agency is concerned that businesses affected by the Covid-19 crisis might lean towards corrupt practices to earn profits.

Speaking at a press conference in Putrajaya recently to explain what Section 17A is all about, Shamshun Baharin said the new provision is timely in view of the reopening of various economic sectors during the recovery MCO (RMCO) period.

“It (Section 17A) is a reminder to commercial organisations not to get involved in corruption in their zeal to make a profit, post-MCO.

“It’s common knowledge that the risk of engaging in corrupt practices is high in the commercial sector, particular when it comes to bidding for tenders for projects and contracts worth millions of ringgit,” he said.

Section 17A of the MACC Act, which was passed by Parliament on April 5, 2018, introduces corporate liability to commercial organisations in Malaysia, with the aim of fostering the growth and development of a corruption-free business environment.

Under the new section, commercial organisations and associated persons can be subjected to legal proceedings should the “person associated with the commercial organisation commit corruption offences or promise gratification to any person with an intent to obtain or retain business or an advantage in the conduct of business for the commercial organisation”.

Prior to the introduction of Section 17A, the MACC Act only focused on the prosecution of a natural person involved in corruption. In law, a natural person is defined as an actual person as opposed to an organisation.

However, under Section 17A, companies involved in corruption activities will be subjected to legal action.

Any commercial organisation found guilty under Section 17A faces a fine not less than 10 times the value of the bribe or RM1 million, whichever is higher, or a jail term of up to 20 years, or both.

British varsity studies on bribery

The MACC’s concerns with regard to the possible rise in corrupt activities in the post-MCO era are not entirely without basis as studies carried out by the University of the West of England in 2013 revealed that bribery involving commercial organisations was widespread during economic crises mainly because the companies wanted their businesses to recover as soon as possible.

Closer to home, the KPMG Malaysia’s Fraud, Bribery and Corruption Survey carried out in 2013 showed that 80 percent of the respondents felt that the incidence of bribery and corruption in the corporate sector has increased since 2010.

Ninety percent of the respondents believed that corporate fraud was a major issue in Malaysia’s business sector.

The outcome of this survey is not based on perception alone but is supported by statistics as well. According to MACC, it recorded 1,517 cases involving information or complaints of corruption against commercial organisations between 2014 and 2018. During the same period, investigation papers were opened for 900 cases while there were 782 cases of arrest.

'Natural person' may have been used

Shamshun Baharin said it was necessary to introduce Section 17A because, in the past, top management such as the chief executive officer and general manager escaped legal action as the focus of the MACC Act was on prosecuting the natural person directly involved in a corrupt act.

In other words, it allowed the top management to get away scot-free, although they may have been directly or indirectly involved in securing a contract or tender for their company.

In this context, the “natural person” may have been used by the company to win a contract or tender.

“Based on investigations by MACC in the context of commercial organisations, individuals were found to have paid bribes to get a project or procure certain benefits for their company.

“However, in many situations, those (corrupt) acts received the blessings of the company’s top management,” he said.

This, Shamshun Baharin added, was the reason why Section 17A was drafted, namely to take legal action against companies involved in corrupt activities.

Accordingly, when an offence is committed by a commercial organisation, its director, controller, officer, partner or any member of its management will be deemed to have committed the offence, unless it can be proven that the offence was committed without the person’s consent and that due diligence to prevent the commission of the offence was exercised.

According to Shamshun Baharin, the enforcement of Section 17A also fulfills the international requirements under Article 26 of the United Nations Convention Against Corruption, which refers to the liability of legal persons.

Various legal sources studied

Explaining the definition of commercial organisation as outlined under Section 17A, Shamshun Baharin said it is defined as:

- A company incorporated under the Companies Act 2016 and carried out a business in Malaysia or elsewhere;

- A company wherever incorporated and carries on a business or part of a business in Malaysia;

- A partnership registered under the Partnership Act 1961 and carries on a business in Malaysia or elsewhere, or (ii) a partnership registered under the Limited Liability Partnerships Act 2012 and carries on a business in Malaysia or elsewhere; and

- A partnership wherever formed and carries on a business or part of a business in Malaysia.

During the drafting of Section 17A, MACC referred to various legal sources within and outside the country, particularly Section 7 of the UK Bribery Act 2010 and the US Foreign Corrupt Practices Act 1977.

Shamshun Baharin said with the spirit of Section 17A of the MACC Act being preventive, it is aimed at preventing companies from carrying out or being involved in corrupt practices.

“This way, we can create commercial organisations that embrace a clean and honest culture and ensure their staff do not resort to bribery to enrich themselves,” he said.

He believes that the reduction of graft cases and leakages in the commercial sector will boost economic growth as it will draw more foreign investors to the country.

No postponement of Section 17A

On requests from certain parties to postpone the implementation of Section 17A, Shamshun Baharin said the government was committed to the June 1 enforcement date in its efforts to fight corruption, as well as improve integrity and ensure good governance among commercial organisations.

In the event a company faces legal action under Section 17A, it can defend itself by proving that it has “adequate procedures” in place to prevent corruption in its business operations or activities.

These “adequate procedures”, Shamshun Baharin said, would be the company’s corruption prevention policy, as well as the use of instruments and processes to promote good governance and integrity.

Companies wishing to get advice on formulating adequate procedures to prevent corruption in their organisations can refer to three government-recognised entities, namely MACC, Integrity Malaysia and the National Centre for Governance, Integrity and Anti-Corruption (GIACC).

“GIACC has set five guiding principles, T.R.U.S.T, as adequate procedures to prevent corruption in companies. MACC is also ready to help any company to prepare guiding principles for adequate procedures,” he said.

Besides creating their own corruption prevention policy, companies can also seek certification such as MS ISO 37001 Anti-Bribery Management System from existing certification bodies in Malaysia or sign the MACC’s corporate integrity pledge to prevent corrupt practices in their organisations, Shamshun Baharin added.

- Bernama

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.