MALAYSIA’s power sector is set to sustain a broad-based upcycle into the first half of 2026 (1H2026), underpinned by accelerating renewable deployment, rising baseload capacity requirements and a structural step-up in electricity demand led primarily by hyperscale data centres.

Against this backdrop, grid modernisation has become an inevitable structural requirement to preserve system reliability and enable grid connectivity.

This upcycle is anchored by Tenaga Nasional’s (TNB) Regulated Period 4 (RP4), which provides multi-year capex visibility and underpins a significant acceleration in execution as the cycle enters its second year.

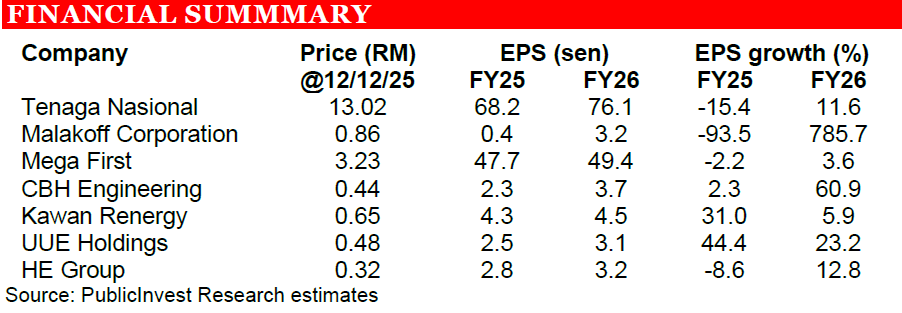

“We maintain our Overweight view on the sector, with TNB as our top pick, supported by strong earnings visibility under the RP4 framework and regulatory-backed returns from its expanding capex programme,” said Public Investment Bank (PIB).

PIB also favors UUE as a beneficiary of the anticipated ramp-up in grid investment and underground utility works during the peak RP4 execution phase in 2026.

On the sector downside risk, the implementation of carbon tax introduces uncertainty for the sector, particularly around cost recovery and tariffs.

However, the current low fuel cost environment may allow gradual pass-through with limited near-term impact on consumers.

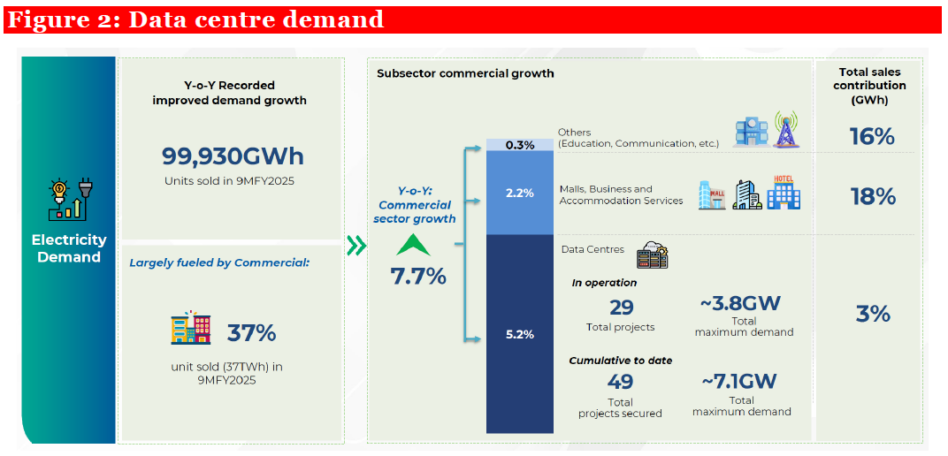

Data centre demand is scaling rapidly, emerging as a key structural driver of electricity growth, with TNB securing 49 projects totalling 7.1GW and actual load ramping up to 850MW by October 2025.

This momentum is supported by TNB’s enhanced Green Lane framework, which shortens connection timelines for higher-spec facilities.

In parallel, accelerating demand is intensifying grid pressure, driving a step-up in RP4 infrastructure spending, with capex tracking RM15 bil in FY2025 and RM42.8 bil over the RP4 period, reinforcing a multi-year grid investment upcycle.

Rapid growth in both electricity supply and demand is placing increasing pressure on Malaysia’s transmission and distribution networks, reinforcing the urgency of grid modernisation under RP4.

As a result, grid and distribution upgrades have emerged as the primary investment lever within the current power infrastructure upcycle.

Historically, capital expenditure across grid, distribution and retail investment averaged ~RM7.1 bil per annum during RP2 (2018–2020), the RP2 Extension (2021) and RP3 (2022–2024).

However, investment momentum has accelerated meaningfully under RP4, with 9M2025 capex reaching RM8.4 bil (9M2024: RM6.0bn), placing TNB on track to deliver ~RM15bn in FY2025 and RM42.8 bil over the three-year RP4 period.

As RP4 enters its second year, execution is expected to ramp up further as projects transition from planning into full deployment, reinforcing a multi-year investment upcycle across the power infrastructure value chain. — Focus Malaysia

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.