Former Goldman Sachs Group Inc banker Tim Leissner is in talks with US prosecutors to potentially plead guilty to criminal charges of stealing billions of dollars from the 1MDB fund, The Wall Street Journal (WSJ) reported yesterday.

Leissner was seeking an agreement with prosecutors that would involve his cooperation with the US government's criminal-fraud probe into 1MDB and Goldman, the US business daily quoted sources as saying.

He had been Goldman’s former chairperson for Southeast Asia and lead banker for three 1MDB bond sales.

The bank had helped raise US$6.5 billion (RM26.16 billion at current rate) in bonds for 1MDB in 2012 and 2013 while raking in US$593 million (RM2.387 billion) in commissions.

Leissner may plead guilty to the charge of violating the US' Foreign Corrupt Practices Act, which bans the use of bribes to foreign officials to get or keep business, according to the sources familiar with the case.

Prosecutors will determine if the information provided by Leissner will help the probe before agreeing to a plea, a legal expert said.

The US Department of Justice (DOJ) had alleged in its civil lawsuit that US$4.5 billion (RM18.11 billion) was taken from the 1MDB fund, the brainchild of former Prime Minister Najib Abdul Razak.

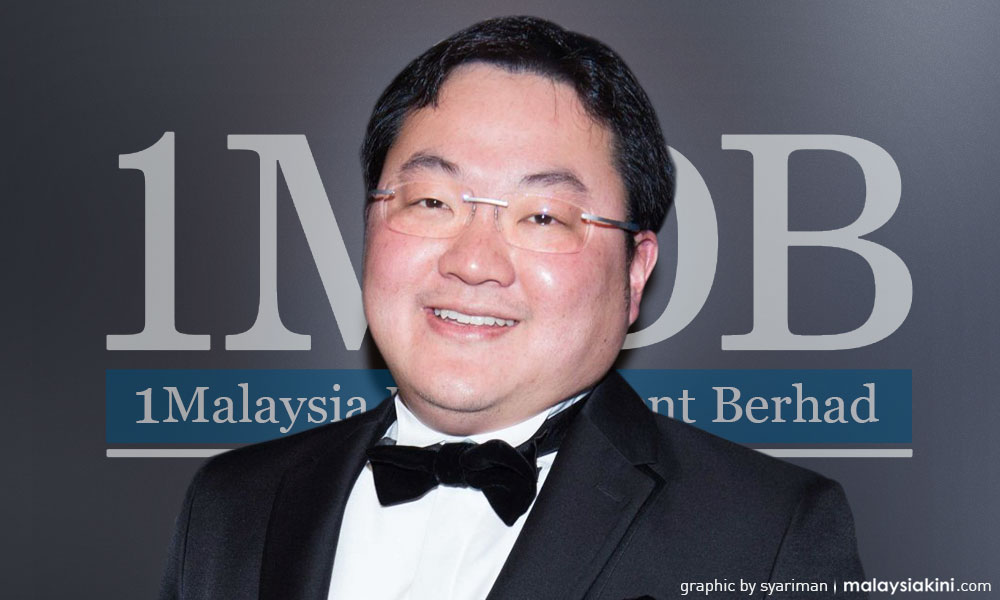

It is believed that Leissner had forged a close relationship with Penang-born businessperson Jho Low (photo), whom the investigator alleged is the mastermind of the purported fraud.

It was previously reported in 2016 that US investigators had been probing if Goldman Sachs had misled bondholders when it sold securities issued by 1MDB.

US court documents state the account was used to siphon about US$1.4 billion (RM5.64 billion) from two 2012 bond sales.

Besides the US, Singapore authorities are also reportedly zooming into the bond deal between Low and Leissner.

Leissner left Goldman in 2016, after he was suspended for allegedly violating the firm's policies and was slapped with a 10-year trading ban in Singapore for improprieties related to the 1MDB transactions.

“Since we suspended Leissner, we have discovered that certain activities he undertook were deliberately hidden from the firm,” a Goldman spokesman said. “We will continue to cooperate with the relevant authorities.”

A spokesperson for the US Attorney’s Office in Brooklyn and a spokesperson for the DOJ declined to comment.

It was reported that the US Federal Reserve, Securities and Exchange Commission and New York state’s Department of Financial Services were also examining some of the bank’s actions.

Goldman said it did nothing wrong and had no way of knowing there might be fraud surrounding 1MDB.

No one flagged the 1MDB transactions to regulators.

"We have found no evidence showing any involvement by Jho Low in the 1MDB bond transactions,” the firm said. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.