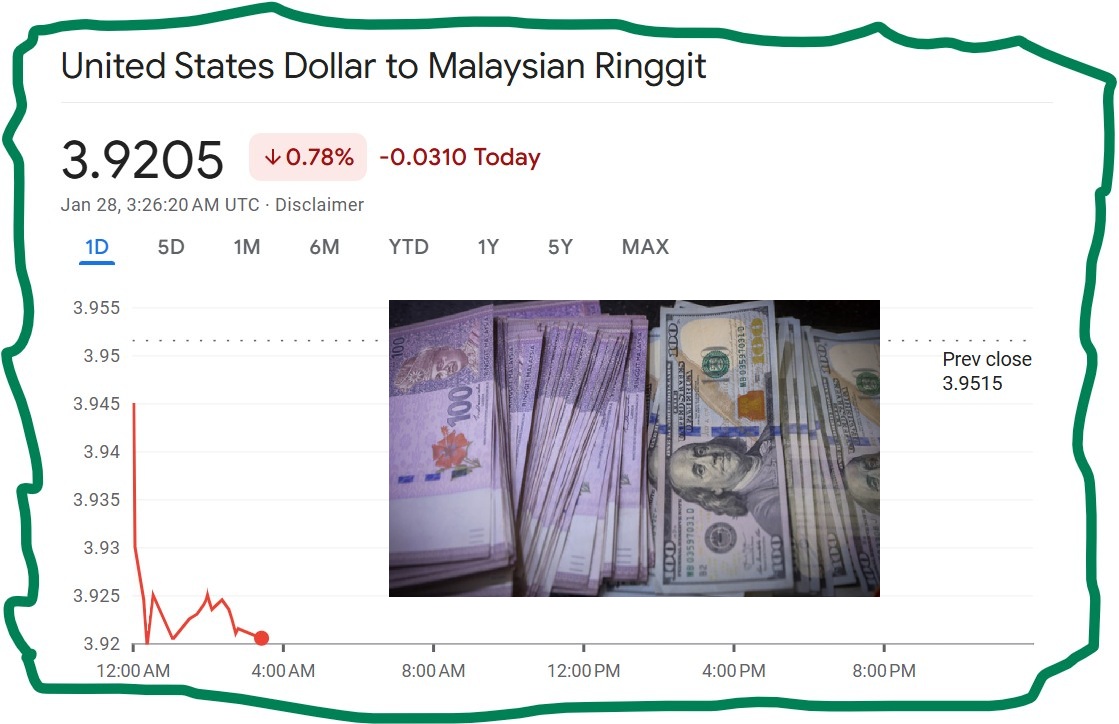

THAT the ringgit continues to firm considerably against the greenback – RM3.92/US$ at the time of writing – has sparked a double joy in Malaysia’s financial market with the FBM KLCI having extended its rally to close at a fresh multi-year high of 1,771.25 yesterday (Jan 27).

While Madani government lawmakers are quick to claim credit over the ringgit roaring to its highest level since 2018 (one of the strongest performing currencies vs the US dollar regionally), the right mindset should be that the ringgit is strengthening in tandem with a stable Malaysian economy and not just because the USD is weak.

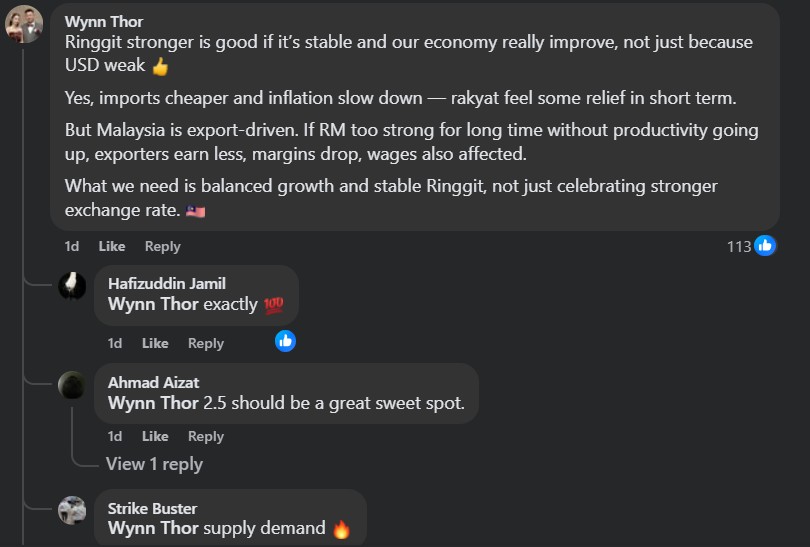

Such is how businessman Thor Wei Wynn responded to a Facebook post by Deputy Investment, Trade and Industry Minister Sim Tze Tzin who contended that the has ringgit firmed on the back of “a stronger economy, good government policies, fiscal discipline, strong foreign investments and strong tourist arrivals”.

“A strong ringgit is good if it’s stable and our economy really improve, not just because USD is weak

“Yes, imports become cheaper and inflation slows down, hence the rakyat feel some relief in the short term. But Malaysia is an export-driven economy. If the ringgit is too strong for long period without productivity moving up in tandem, exporters earn less, margins drop and wages also affected.

“What we need is balanced growth and stable ringgit – not just celebrating stronger exchange rate.

Positive effect not immediate

In reality, the strengthening of the ringgit against the greenback creates a “see-saw” effect on the domestic economy. While it is a major win for consumers and importers, it presents significant hurdles for Malaysia’s massive export sector.

Economists generally believe that the obvious winners are consumers and importers which helps stabilise the cost of living although the actual effect is not immediate and may three to six months to start trickling down to consumers in the form of lower prices for imported goods while the overall impact on the cost of living is often gradual rather than immediate.

On the bright side, however, a stronger ringgit lowers the cost of imported dairy, meat and grains given Malaysia is a net importer of many food items and raw materials, hence translating to cheaper essentials and helping to keep household grocery bills in check.

In a way, a strong ringgit also elevates purchasing power in the sense that high-end consumer goods – notably electronics, smartphones and vehicles – become more affordable.

Imagine a US$1,000 laptop will be significantly cheaper at RM3,92/US$ compared to RM4.70/US$ (when the ringgit was at its lowest point in 25 years against the USD in October 2023).

Moreover, local manufacturers who rely on imported machinery or raw materials – ie components for the electronic and electrical (E&E) sector – can expect a reduction in their production costs, thus improve their profit margins.

Likewise, Malaysians travelling abroad or parents paying for children’s overseas education see immediate savings as their ringgit is now able “to buy” more foreign currency.

Flip side

While a strong currency signals economic health, it makes Malaysian goods more expensive for foreign buyers, thus can be a bane to exporters and multinational corporations (MNCs).

This can weigh down on the country’s export competitiveness with key sectors like rubber gloves, timber and furniture subject to price pressure. Simply, if the ringgit is too strong, Malaysian products become less competitive compared to those from neighbouring countries with weaker currencies.

Large exporters who earn in USD (like Top Glove Corp Bhd or the numerous tech firms) will see their earnings “shrink” when converted back into ringgit for local reporting and payroll.

On a similar note, MNCs which channel in USD to pay local salaries and utilities will find their “cost of doing business” increases in dollar terms.

All in all, the average Malaysian will find the ringgit below RM4/US$ to be largely positive as it provides a buffer against global inflation and increases personal wealth.

However, the government and Bank Negara Malaysia (BNM) must balance the so-called “macro-economic Goldilocks effect” to ensure export-heavy industries are not priced out of the global market.

Additionally, the central bank must conduct oversight to ensure that the ringgit is strengthening due to positive economic fundamentals as opposed to some kind of manoeuvring, ie repatriation home of more GLC (government-lined companies) investments from overseas (trade-off from overseas investment for future income stream).

Another valid question to be posed is whether the stronger ringgit resolves the spiralling cost of living issues affecting particularly the B40 and M40 groups from the stand-point of price mechanism control on basic food items. – Focus Malaysia

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.