Former Lembaga Tabung Haji chairperson Abdul Azeez Abdul Rahim has disputed Minister in the Prime Minister's Department Mujahid Yusof Rawa's statement that the pilgrimage fund has a deficit of RM4.1 billion.

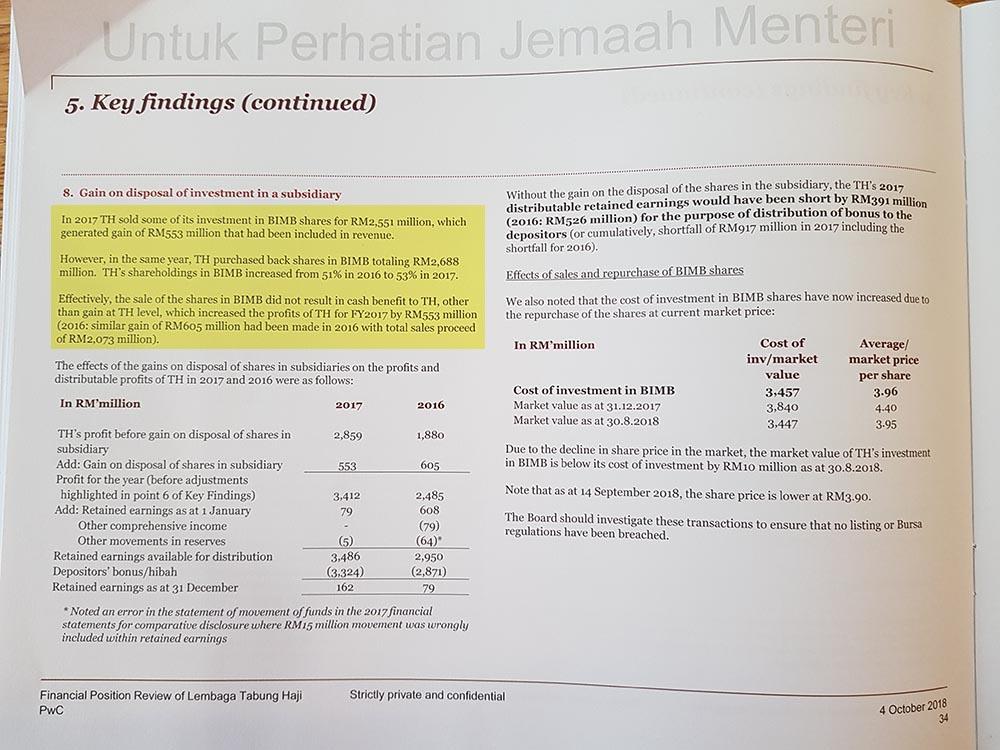

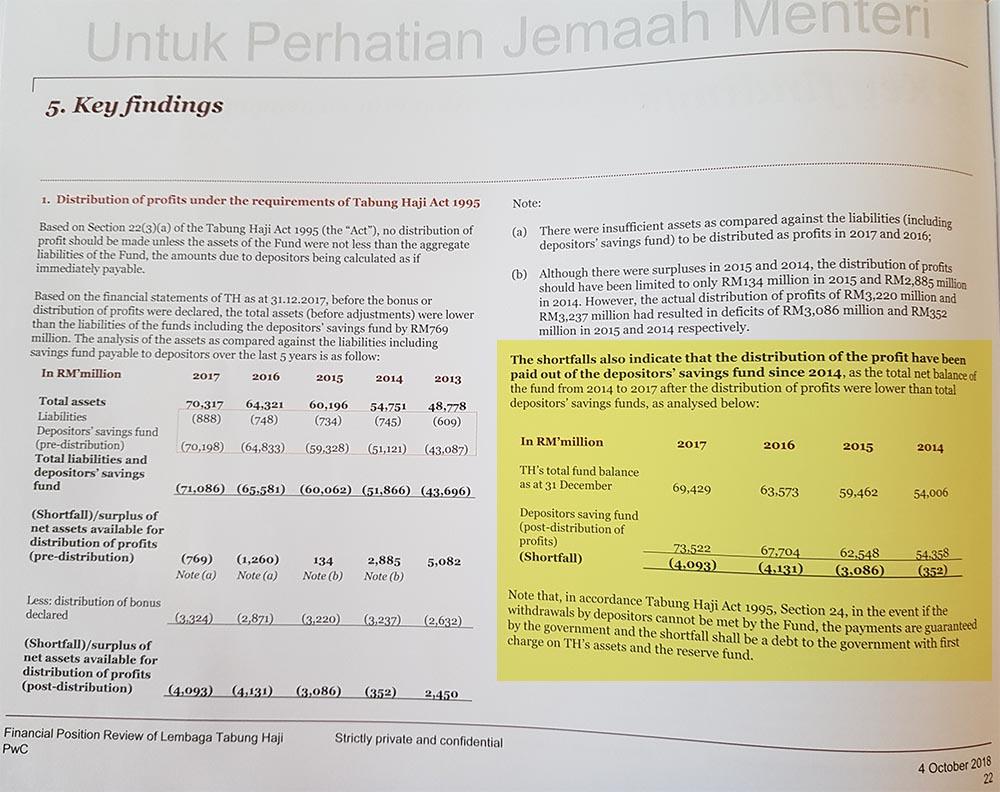

Based on an independent audit by PriceWaterhouseCoopers (PWC), Mujahid had said Tabung Haji has an asset of 70.3 billion as opposed to liabilities of RM74.1 billion, representing a deficit of RM4.1 billion as of end 2017.

However, Azeez, citing reports by independent auditor Ernst & Young (E&Y), appointed during BN's time, said Tabung Haji's assets should be at RM74.7 billion while its liabilities is at RM74.4 billion as at end 2017, representing a surplus of RM373 million.

So how did Mujahid (photo) and Azeez's asset figures have a discrepancy of more than RM4 billion? This was actually explained in PWC's financial position review which was tabled in the Dewan Rakyat yesterday.

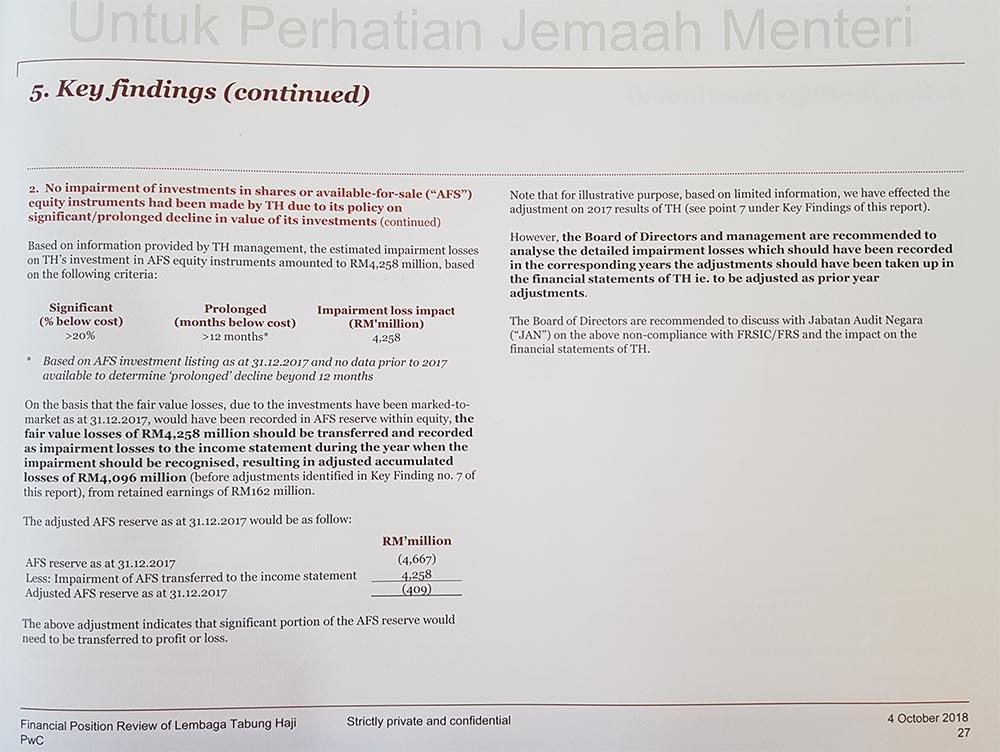

PWC said in the financial position review that it had accounted for an RM4.258 billion in impairment losses in equities, which Tabung Haji had previously hidden through creative accounting.

Manipulated thresholds

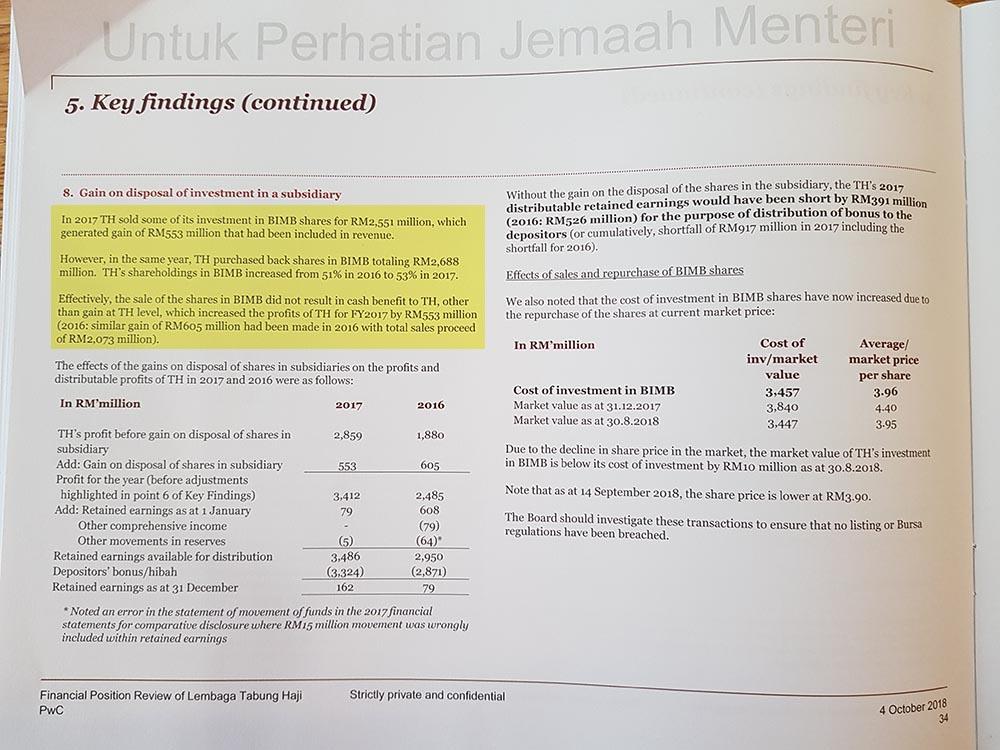

According to financial reporting standards, a company must declare its impairment loss if the value of shares it bought falls by more than 20 percent of the original cost persistently for a period of nine to 12 months.

According to financial reporting standards, a company must declare its impairment loss if the value of shares it bought falls by more than 20 percent of the original cost persistently for a period of nine to 12 months.

However, PWC said Tabung Haji's threshold was set at 70 percent over a period of 24 months. It adjusted this twice in 2017, to 85 percent then to 90 percent.

PWC said if the threshold was at 70 percent, Tabung Haji would have needed to declare an impairment loss of RM1.313 billion, at 85 percent, it would need to declare a loss of RM171 million and at 90 percent, it would only need to declare a loss of RM1 million.

PWC said the hiding of losses was aimed at showing enough profit so that Tabung Haji could issue dividends in 2017. The Tabung Haji Act 1995 does not allow the distribution of dividends if the pilgrimage fund is in deficit.

"Based on our discussion with the chief financial officer (of Tabung Haji), it was confirmed that changes to the threshold have been made to enable Tabung Haji to have sufficient profits for distribution of bonus to the depositors for 2017.

Non-compliance with financial reporting standards

"The chief financial officer also represented that the changes had been approved by the Board and had been made known to the Auditor-General's Department," PWC said in its financial position review of Tabung Haji.

"The chief financial officer also represented that the changes had been approved by the Board and had been made known to the Auditor-General's Department," PWC said in its financial position review of Tabung Haji.

PWC said the threshold previously used by Tabung Haji was in non-compliance with financial reporting standards.

It added that in its audit of Tabung Haji for 2017 was based on the financial reporting standards where impairment losses must be declared if the value had fallen by more than 20 percent and sustained for 12 months.

Based on these standards, PWC said the total impairment loss in equities was RM4.258 billion.

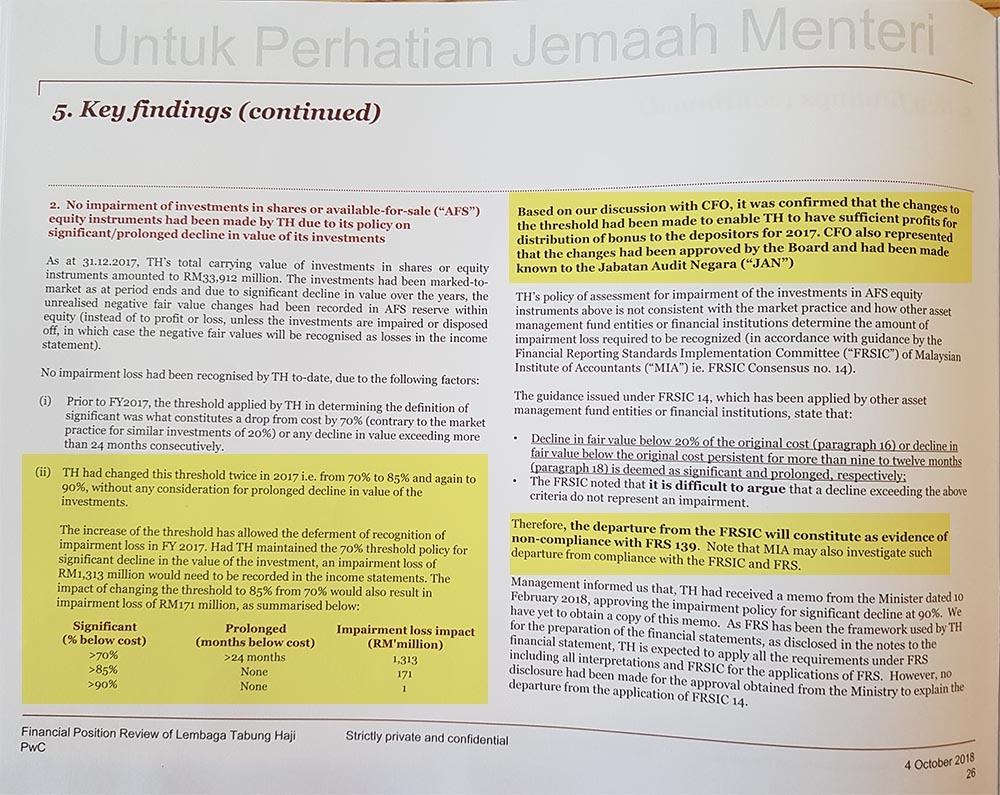

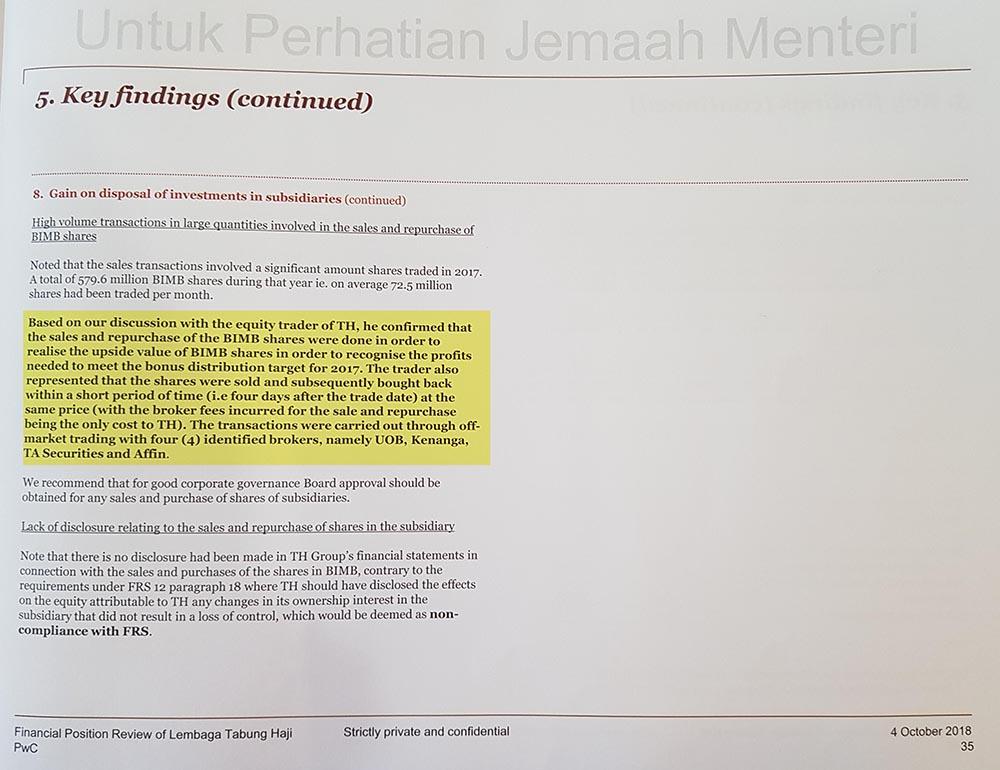

Apart from hiding losses, PWC had also found that Tabung Haji sold shares to report a profit and later rebuying them and incurring additional brokerage cost as well as having subsidiaries to declare high dividends that were never fully paid.

Without the creative accounting, Mujahid said Tabung Haji would have been in deficit since 2014. Nevertheless it continued to issue dividends in contravention of the Tabung Haji Act 1995.

Azeez, in a press conference at Parliament today, said he was shocked by Mujahid's claim.

"I would like to stress that the Tabung Haji management (during my time) did not violate the Act and had not done any wrongdoing.

"Muhajid failed to account Ernst&Young's valuation of realised assets involving its subsidiaries, associate companies, joint ventures and real estate.

"What he considered was merely the financial statement," he said.

Below are excerpts of PWC's financial position review of Tabung Haji which was tabled in the Dewan Rakyat yesterday:

On paying dividends using deposits:

On hiding losses:

On selling and rebuying shares to show profit:

- Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.