The Federal Court in Putrajaya ruled that banks cannot rely on exclusion clauses in loan agreements to absolve any liability against them, describing the patent as unfairness and injustice as there is an absolute restriction to customers’ right to damages.

Federal Court Judge Balia Yusof Wahi in his 37-page of judgment dated Dec 17, said the court had agreed with the views of the Court of Appeal that the kind of damages spelt out in Clause 12 of the Loan Agreement encompasses all forms of damages under a suit for breach of contract negligence.

He said Clause 12 may typically be found in most banking agreements, and in reality, the bargaining powers of the parties to that agreement were different and never equal.

“The parties seldom deal on equal terms. In today’s commercial world, the reality is that if a customer wishes to buy a product or obtain services, he has to accept the terms and condition of a standard contract prepared by the other party.

“The plaintiffs (respondents), as borrowers in the instant case, are no different. They have unequal bargaining powers with the defendant (appellant),” he said.

The judge made the ruling after dismissing the appeal by CIMB Bank Berhad who was the appellant against the Court of Appeal ruling that the bank was liable for breach of contract an in tort for refusal to make a housing loan progress payment to a developer.

The judgment was in regard to a suit brought by British couple Anthony Lawrence Bourke and Alison Deborah Essex Bourke against CIMB Bank for breach of contract and fiduciary duty over the termination of the Sale and Purchase Agreement (SPA) of a property in Kuala Lumpur.

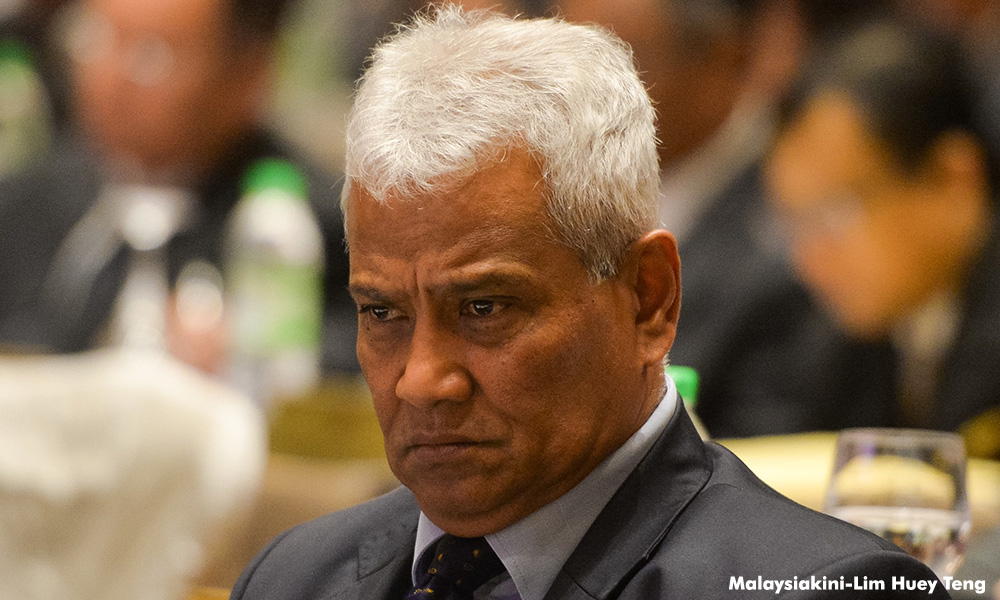

Justice Balia (photo) said there was the patent unfairness and injustice to the couple had this Clause 12 been allowed to deny their claim or rights against the bank.

“It is unconscionable on the part of the bank to seek refuge behind the clause and abuse of the freedom of contract.

“If the plaintiffs (the couple) were precluded from claiming the remedies they sought in their statement of claim, what they can claim from the defendant? Are they totally restricted from enforcing their rights in respect of the contract?,” asked the judge.

He said the court was of the view that on the plain meaning of the words used in Clause 12, whatever the plaintiffs were claiming, had been negated.

“The House of Lords had also observed in Suisse Atlantique Societe (supra) that freedom of contract must surely imply some choice or room for bargaining. The plaintiffs in this appeal had none. This court too must be vigilant and will not shrink from properly applying the principle in deserving cases. Public policy is not static,” he said.

Justice Balia further said that Clause 12 in the appeal, on the other hand, speaks of an absolute restriction to plaintiffs’ right to damages.

Besides Justice Balia, the other two judges were Chief Judge of Malaya Zaharah Ibrahim and Federal Court judge Azahar Mohamed.

In January 2018, the appeal was heard before a five-member bench led by Zulkefli Ahmad Makinudin (photo), and adjourned the ruling to another date.

Zulkefli, who was Court of Appeal president, resigned in July, while Zainun Ali who was also on the bench, retired in October.

The Bourkes, who now live in the United Kingdom, bought a property in Kuala Lumpur which was under construction and was granted a term loan facility of RM715,487 by CIMB Bank in April 2008.

Under the loan agreement, the bank was obligated to make direct payment on a progressive basis to the developer on behalf of the couple, whenever such sums become due for payment.

However, CIMB Bank failed to make payment on one of the invoices and the sum remained unpaid, resulting in the SPA being terminated by the developer in April 2015.

Later, in 2015, the couple filed a suit against the bank at the High Court, seeking for damages suffered resulting from the termination of the SPA, but their claim was dismissed by the High Court which ruled that Clause 12 absolved any liability against the bank.

Dissatisfied with the decision, the plaintiffs appealed to the Court of Appeal and succeeded as the Court of Appeal concluded that the bank had breached its main obligation under the Loan Agreement when it failed to fulfil the terms to pay the invoice issued directly to it under the Loan Agreement.

CIMB Bank later filed an application for leave to appeal against the Court of Appeal ruling at the Federal Court. The leave was granted and in January, the court heard questions of law in the appeal.

Counsel Wong Hok Mun and Sharifah Alliana Idid represented CIMB Bank, while Ong Yu Jian and James Lee acted for the couple.

-- Bernama

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.