The Malaysian Trades Union Congress (MTUC) foresees problems in the plan by the National Higher Education Fund Corporation (PTPTN) to implement scheduled salary deductions from its borrowers, as PTPTN has to obtain consent from both borrowers and their employers.

Malay Mail reported MTUC president Abdul Halim Mansor as saying that provisions under the Employment Act 1955 stipulate that any form of deduction must have prior approval of the workers themselves.

“There must also be a (written) agreement which the worker signed with the loaner (PTPTN) to authorise them or a bank acting for the loaner to make the deductions,” he told the daily.

Abdul Halim said that the agreement must come with the consent of the employer, adding that the Act ensures that any deductions for whatever purpose cannot exceed more than 50 percent of the worker's basic salary.

He said PTPTN's announcement on the plan was premature, as it had been made before engaging all the parties involved.

"I am unsure what PTPTN would be able to do if it comes across any worker or employer who simply disagrees to the deductions,” he told Malay Mail.

Deduction schedule needed

PTPTN, Abdul Halim said, must respect this, for it cannot emulate the Inland Revenue Board's (IRB) monthly tax deduction system, given that IRB has its own legislation to implement the system.

He said employers would face several issues in term of paperwork and administration, as well as dealing with the deductions since salary payments are computerised.

PTPTN must, therefore, provide a deduction schedule which clearly states the date of its commencement and cessation for each worker’s deduction, he added.

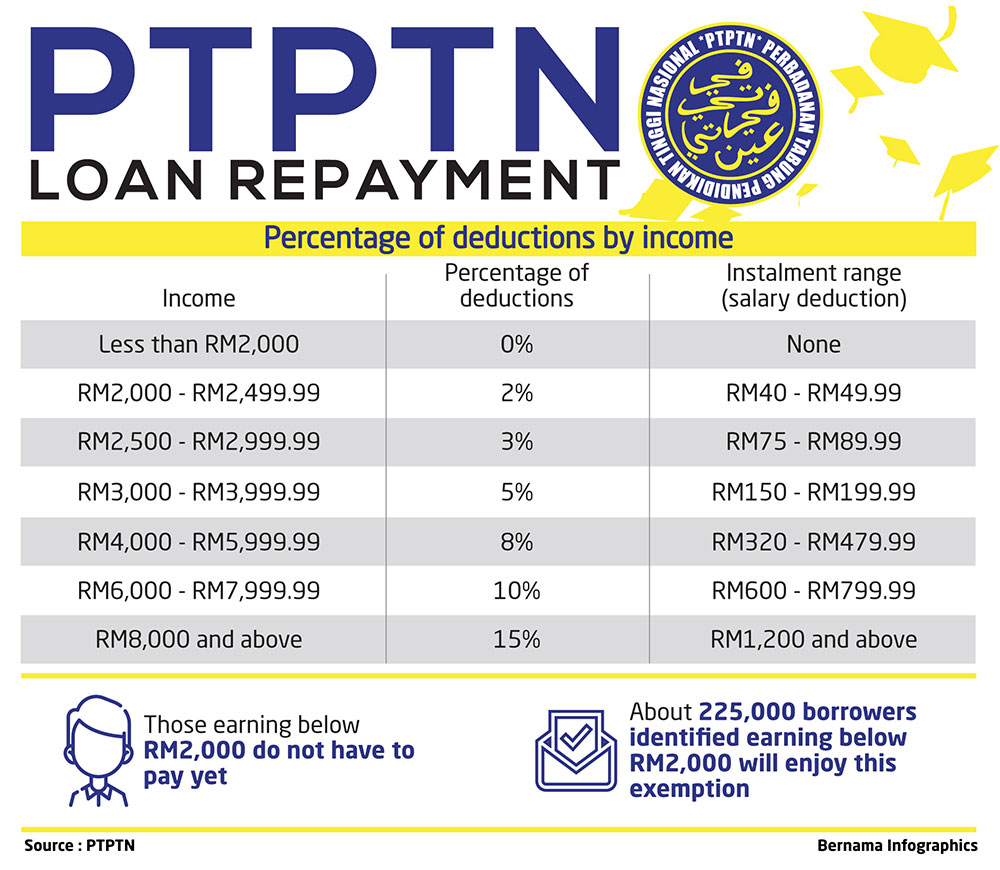

At the tabling of Budget 2019, Finance Minister Lim Guan Eng had announced the plan to deduct between two and 15 percent from the monthly income of PTPTN borrowers who were earning more than RM1,000 a month.

Borrowers who belong to the B40 income group could be exempted if a graduate obtained a first-class bachelor’s degree.

However, Education Minister Maszlee Malik clarified last week that the salary threshold for the monthly income deduction would be RM2,000.

The initiative is scheduled to begin in January 2019.

Maszlee added that the exemption from repayment had also been extended to members of the M40 income category. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.