Chanelling GST revenue directly into the federal government’s consolidated revenue account was wrong, according to Attorney-General Tommy Thomas.

In his correspondence to the Public Accounts Committee (PAC) last October, Thomas said this contravened Section 7 of the Financial Procedure Act 1957 and Section 54 of the GST Act 2014.

He said this was a breach of fundamental trust law principles and trust accounting requirements. He also opined that doing so was a radical departure from Parliament’s intentions.

“The GST regime is based on the fundamental precept that taxpayers will receive a refund for the amount of GST they pay in the course of producing taxable supplies.

“Parliament’s intention is that taxpayers receive this refund. The statutory entitlement to a refund and the creation of the GST Trust Fund are evidence of that intention.

“By failing to ensure that taxpayers received their refunds, the former government failed to give effect to Parliament’s intention,” he added.

Legal risks

To remedy this, Thomas advised the government to pay the beneficiary taxpayers, including interest, because the government profited from the improper use of GST monies.

The attorney-general’s letter, however, does not address the subject of criminal liability, but stressed that it must be “further considered.”

“Apparently, they are the subject matter of criminal investigations by the police,” said Thomas.

Thomas also warned that the government must proactively reach a settlement with beneficiary taxpayers to avoid legal problems.

“Importantly, where a trustee mixes trust money with his own, the beneficiary has a charge on the whole mass of monies. i.e. the entire consolidated revenue account,” he said.

Thomas’ reply was appended to the PAC’s report on the delayed RM19.4 billion in GST refunds released today.

The PAC concluded that while “no money was missing”, the GST Trust Fund was insufficiently funded because it was used for other purposes.

The committee also concluded that the previous administration violated Section 54 of the GST Act for paying GST monies into the consolidated revenue account.

Audit dept terms Guan Eng, customs’ RM19.4b claim as inaccurate

PAC REPORT | The National Audit Department disagreed with Finance Minister Lim Guan Eng and the Customs Department that there was RM19.47 billion in delayed GST refunds as of June 5 last year.

According to the Public Accounts Committee (PAC) report tabled today, both Lim and the department were “kurang tepat” (inaccurate).

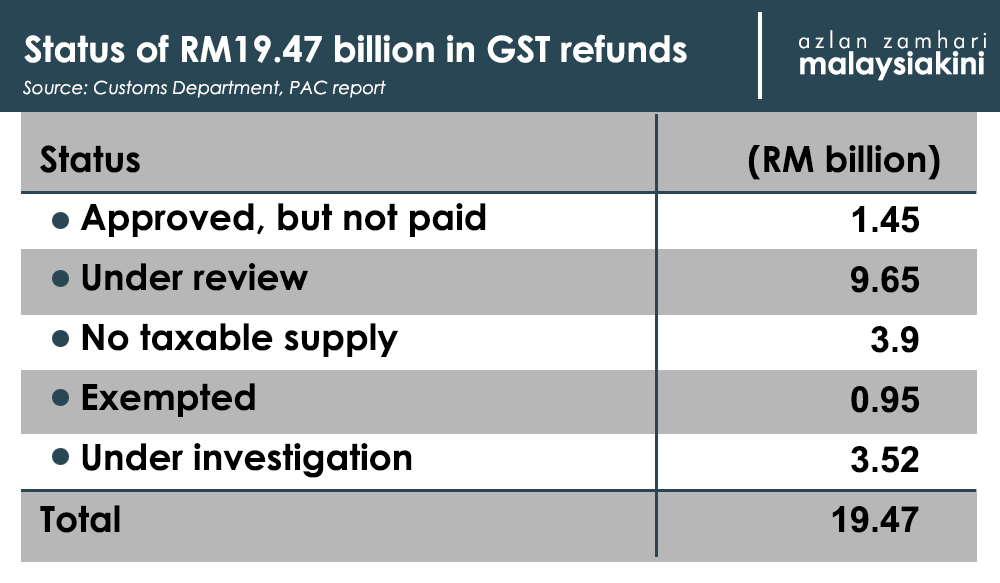

During a briefing to the PAC in March, the customs department explained that of the RM19.47 billion, only RM1.41 billion was verified as legitimate claims that were delayed as of June 5 last year.

The audit department also told the PAC that it disagreed with the customs department’s assessment that 93 percent of the RM19.4 billion in claims should be paid.

“The audit department’s opinion was that this statement was inaccurate because it isn’t SOP to accept all claims processed through the RMS (revenue management system) as legitimate claims,” read the report.

As of April 10 this year, a total of RM5.73 billion in GST refund payments have been made out of the RM19.47 billion whereas the balance is still being processed.

The report also cited the Customs Department as stating that the GST Trust Fund had only RM152 million as of May 31, 2018 and could not pay the refunds.

The PAC investigation was prompted by Lim’s claim in Parliament that RM19.47 billion meant for GST refunds was the subject of “rompak” (robbed).

Although concluding that “no money was missing”, the PAC said this GST Trust Fund was insufficient because the money was used for other purposes.

The committee also concluded that the previous administration violated Section 54 of the Goods and Services Act 2014 for paying GST monies into the consolidated revenue account.

However, former premier Najib Abdul Razak, who was also finance minister, and former Treasury secretary-general Mohd Irwan Serigar Abdullah told the PAC that things were done according to the law.

– M’kini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.