A Finance Ministry proposal to acquire four highways in the Klang Valley was "on hold pending a full review", according to an unnamed minister cited by Straits Times.

The Singapore newspaper's report cited the minister stating that Finance Minister Lim Guan Eng had announced the plan and formally offered it to Gamuda Bhd's shareholders without receiving any green light from the cabinet.

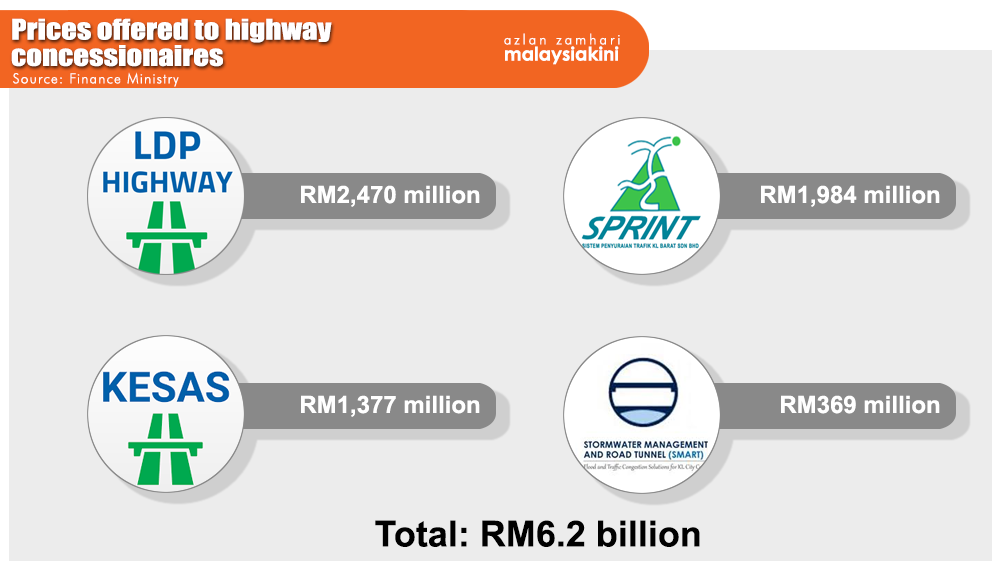

In February, the Prime Minister's Office (PMO) said the government was in talks with Gamuda to takeover Lebuhraya Damansara Puchong (LDP), Sistem Penyuraian Trafik KL Barat (Sprint), Lebuhraya Shah Alam (Kesas) and Smart Tunnel.

"I am pleased to announce that as a first step, the government has commenced talks with Gamuda Bhd to negotiate the acquisition of highway concession in which the company has a majority stake.

"Further details on the proposed exercise will be announced by the Finance Minister at the appropriate time," said Prime Minister Dr Mahathir Mohamad at the time.

A day before the PMO statement, Home Minister Muhyiddin Yassin had hinted at the announcement, saying it was discussed in cabinet.

However, according to a Finance Ministry statement on June 26, the offer made to the four highway operators still required final approval from the cabinet.

According to Straits Times, detractors to the Gamuda plan believe the buyout proposal to be overpriced, while the congestion charge idea was insufficient to cover the takeover costs.

Lim (above) had said users of the four highways will save around RM180 million a year, while the government could save RM5.3 billion in compensation required to freeze the toll rates under the current system.

It said the Works Ministry was looking into a separate proposal by a little-known private investment holding company Karongsa Capital to consolidate the country's 19 highway concessions under a special highway trust entity.

Proponents of this plan claim that tolls can be reduced by up to 45 percent at no cost to the government.

It was previously reported that Works Minister Baru Bian and Lim were also on opposite ends on the separate matter of Maju Holdings Sdn Bhd's revived bid to buyout Plus Highway.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.