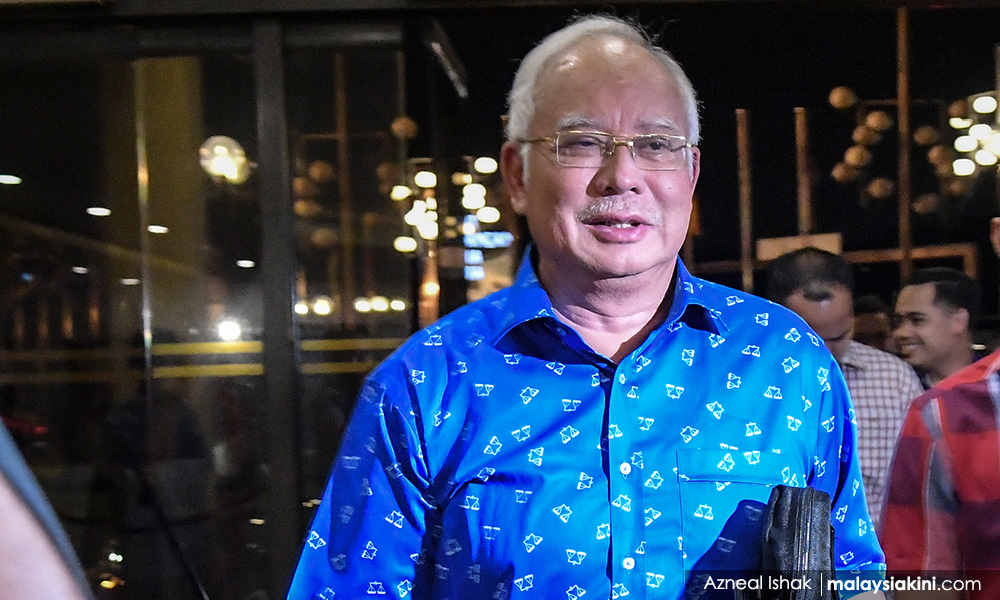

Former prime minister Najib Abdul Razak has lamented that national sovereign wealth fund Khazanah Nasional Bhd is disposing of its entire stake in Saudi Arabian water and power companies to Syed Mokhtar Al-Bukhary's Malakoff Corp Bhd.

In a post on his Facebook page today, Najib said although the Saudi companies were profitable every year, they had nonetheless been sold off by the Pakatan Harapan government.

"Previously, we (the BN government) worked hard to build the nation's assets, but we were accused of selling the country.

"Harapan continues to sell the country's assets every day since they won GE14, but this is what the people want," he wrote.

The US$70 million deal will see Malakoff purchase Khazanah's entire stake in Desaru Investments (Cayman Islands) Ltd (DIL).

In turn, Malakoff doubles its stake in Malaysian Shoaiba Consortium Sdn Bhd - which invests in several Saudi Arabian power and water companies - from 40 percent to 80 percent.

Before the divestment, Khazanah held a 40 percent interest in Malaysian Shoaiba Consortium through DIL. Malakoff, via Malakoff Gulf, also owned 40 percent in the consortium, while Tenaga Nasional Bhd held the remaining 20 percent.

In a press release yesterday, Malakoff had said the acquisition would contribute “immediate earnings accretion” to the company, as well as an increase in cashflows.

Najib said Malakoff had also stated that the purchase would increase the company's profit for 2018 by RM68.3 million.

The RM68.3 million estimation is in line with a paper prepared by Public Investment Bank Berhad, which estimated that the acquisition would increase Malakoff's earnings by RM36 million a year.

In addition, the paper noted that Malakoff is eligible for a one-off gain amounting to RM32.6 million.

This, it said, was due to the revaluation of existing investment following the change in status of Malaysian Shoaiba Consortium from an associate to a subsidiary.

FGV China Oils

In a separate post, Najib also wrote about FGV Holdings Bhd (FGV) selling its entire stake in FGV China Oils Ltd to China's Grand Industrial Holdings Ltd for RMB165 million (RM100 million).

FGV China Oils is involved in processing and promoting Malaysian palm oil for the Chinese market.

"Perhaps the market in China is not big enough. Therefore the Harapan government sold the company to Chinese company for RM100 million."

Najib went on to state that FGV never suffered any losses since its listing in 2012.

"However after GE14, FGV suffered from losses every quarter. Never mind, there are still plenty of assets built by BN for Harapan to sell," he said.

In a filing with Bursa Malaysia, FGV said FGV China Oils has been making losses since it was acquired in 2015, mainly due to market disparity arising from competition coming from regional suppliers.

It said the disposal is in line with the group's plans to rationalise and divest its non-performing businesses.

In 2012, FGV - then known as Felda Global Ventures Holdings Bhd - recorded a profit of RM800 million before hitting a high of RM982.2 million in 2013.

Subsequently, its profit fell until it hit a low of RM110.2 million in 2016 before rising to RM208 million in 2017.

Following GE14, FGV reported its first net loss of RM1.08 billion as it was largely hit by impairments and lower average crude palm oil prices.

For the first quarter ending in March 2019, losses continued with a net loss of RM3.37 million compared with a net profit of RM1.12 million during the same quarter in the previous year.

This was due to a sharp drop in palm oil and sugar prices. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.