Former finance minister Lim Guan Eng has called on the government to gradually increase Malaysia’s personal income tax relief, arguing that the current level no longer reflects the rising living costs that have occurred after years of inflation.

Lim said the personal income tax relief has remained at RM9,000 for the past 15 years without any adjustment for inflation.

Based on inflation rates over that period, he noted that the relief should now stand at around RM12,300.

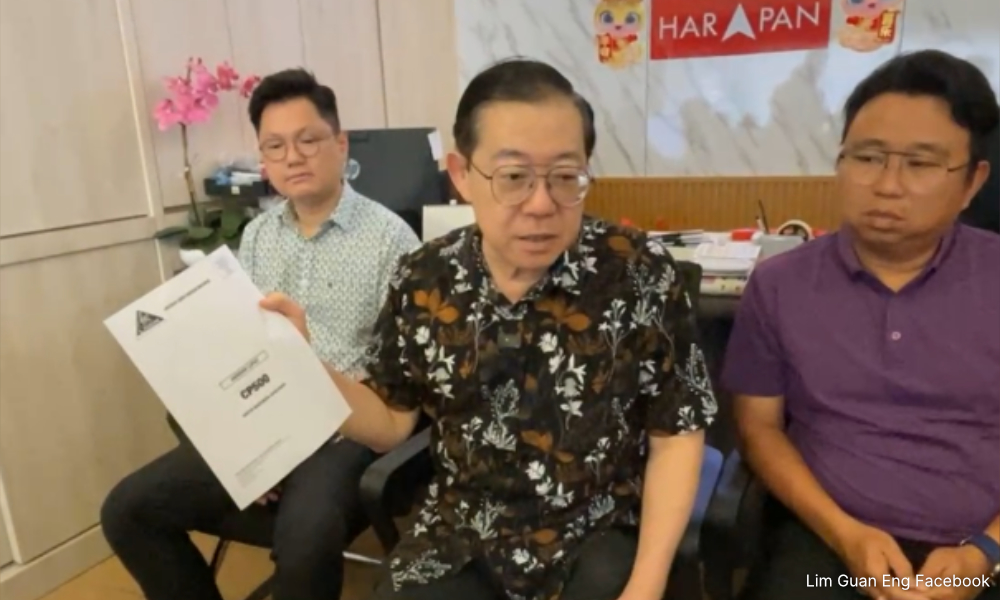

“With inflation continuing to rise, many people believe it is time for personal income tax relief to be reviewed, and I agree,” Lim posted on Facebook after handing over an allocation to a temple committee in Butterworth today.

However, the DAP adviser cautioned that increasing the relief by RM3,000 in one move would place an excessive burden on the country’s tax revenue.

As an alternative, Lim proposed a phased approach. Under his suggestion, the government would increase the tax relief by RM1,000 each year starting from 2026. This would bring the relief to RM12,000 by 2028.

“This approach would meet the needs of the people while at the same time reducing pressure on government finances. It is a reasonable demand,” he said.

Lim added that such an adjustment could also help restore public confidence in Pakatan Harapan and the unity government.

He referred to remarks by DAP secretary-general Anthony Loke, who had said that economic issues were a key factor behind declining voter confidence, citing the Sabah state election as an example.

Lim also revealed that he had recently written to Prime Minister Anwar Ibrahim with 10 proposals aimed at restoring public trust through economic reforms. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.