Quoting Bloomberg, which in turn relied on the analysis of a financial company, Shroeders, the Malaysian authorities argued that "ringgit Malaysia (RM)" was the strongest among a basket of Asian currencies, including that of Japan and China.

Does the Ministry of Finance, which is also the portfolio of Prime Minister Najib Abdul Razak, even know what it means?

China's currency, i.e. the renminbi, is based on official intervention, especially towards the end of December 2016 and January 2017, since China does not want a cheap currency to give US President Donald Trump the impression that Beijing was lowering its currency value intentionally to corner the global market. Thus, China's renminbi isn't a reflection of the market forces and has never been such a case.

The same applies to Japan, which is why its economy had once produced 'Mr Yen', or Eisuke Sasakibara, whose goal at the Ministry of Finance in the 1990s involved keeping the yen low but stable, so that Japanese exports could become sought-after commodities, especially in the West.

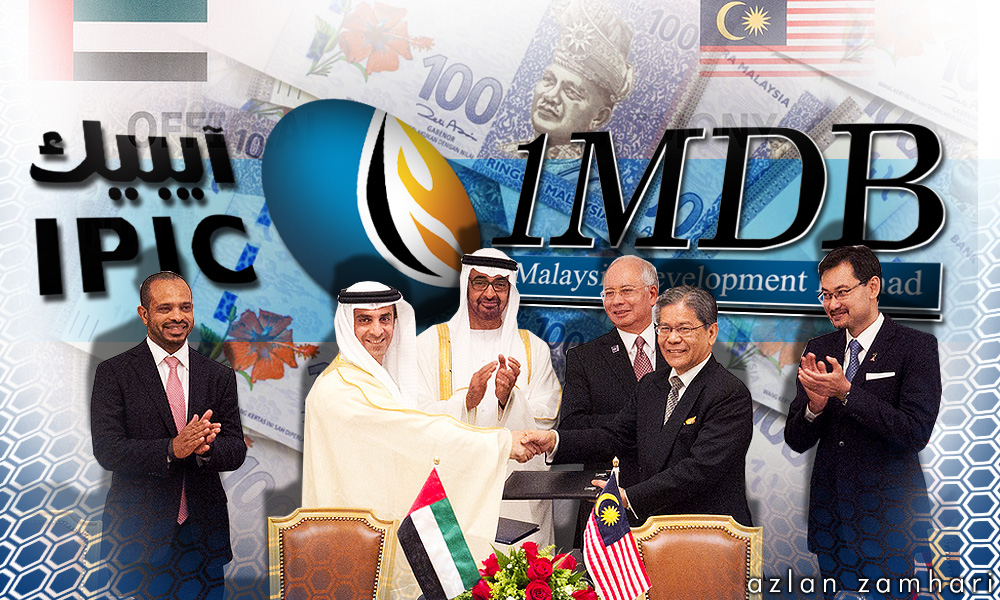

After allegedly blowing US$11 billion away through 1MDB, Malaysia was forced to rationalise the entity, which, among others, involved selling its energy assets and land banks to foreign companies.

When one sells something to repay the interest and the debt is accrued, the international market will applaud.

After all, what once belonged to Malaysia now slips into the hands of others. And, as the period of debt repayment is elongated, as marked by Malaysia's guarantee to repay the International Petroleum Investment Corporation (IPIC) through an arbitration in London, the market will even cheer on.

After all, what once belonged to Malaysia now slips into the hands of others. And, as the period of debt repayment is elongated, as marked by Malaysia's guarantee to repay the International Petroleum Investment Corporation (IPIC) through an arbitration in London, the market will even cheer on.

Good job, good job, Malaysia is repaying its debt obligations, in this case close to more than US$600 million a year until 2023 and beyond. But is Malaysia free from debt yet? No.

Malaysia merely committed all the resources that should be spent on building schools, hospitals and paying the payroll of the government in the years to come to debt servicing instead.

Since the international financial sector regards this as a "yield," or "return", it has not equated the ruinous debt of 1MDB to the worsening fiscal position of the Malaysian government.

'The smallest rebound from rock bottom is deemed strong'

Obviously the Malaysian authorities have not understood the context of international currencies and financial scrutiny.

When a currency is the worst currency in the region, as the ringgit was and still is, any smallest rebound is deemed to be strong. But one cannot expect any of the rating agencies to bump Malaysia's ratings.

They merely describe the strength of the currency, but they know concurrently that Malaysia will be weak for years to come.

That is what happening to the ringgit - having scrapped the bottom for the last few years against all international currencies, especially the greenback, it has nowhere to go but up.

But the uptrend is not real nor lasting, since Malaysia's economy has not undergone any structural or fundamental change.

That is what happens when the national currency dropped more than 53 percent against the US dollar over the last two years. The ringgit can inch up, but it can never catch up quickly.

It also means that financial speculators have reached the threshold to short the currency. That if they keep attacking the currency, as they will, Malaysia will borrow from all available financial authorities, both local and international, to buffer itself against the ringgit attack.

Plans for structural reform missing

The issue is structural reform, sustainable development, where wealth can be passed from this to the next generation without incurring more debt, and systemic competitiveness, where Malaysia becomes a dynamic economy that can attract, but also retain foreign direct investments (FDIs).

So far the Malaysian prime minister cum finance minister has not articulated any of the above, except to mouth platitudes on the marketing strategy Blue Ocean Strategy. But with the exception of AirAsia, Petronas and Genting, have we produced any other company that can break into the Fortune 500?

This reminds one of the song "Money for Nothing (And Chicks For Free) by the band Dire Straits.

In the Dire Straits’ case, Mark Knopfler was a world class guitarist. In the case of Malaysia, the world class disappearing act of Jho Low has made Malaysia look rather screamingly tenuous. Thus, the value of the ringgit will not rise in any sustainable manner.

Malaysia is still not out of the woods yet, which is why the comparison with the currencies of China and Japan is false and misleading. These two countries, too, have yet to find a new strategy to engage globalisation face-on.

They have decided to buy into the American corporate sector for a free ride on its growth. But how much can our ringgit be lifted to make any inroads into Wall Street and Main Street? The answer is zilch. This is why the Bloomberg report is one dimensional.

RAIS HUSSIN is a supreme council member of Parti Pribumi Bersatu Malaysia (Bersatu). He also heads the policy and strategy bureau of Bersatu.- Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.