PAC REPORT | The National Audit Department disagreed with Finance Minister Lim Guan Eng and the Customs Department that there was RM19.47 billion in delayed GST refunds as of June 5 last year.

According to the Public Accounts Committee report tabled today, both Lim and the department were "kurang tepat" (inaccurate).

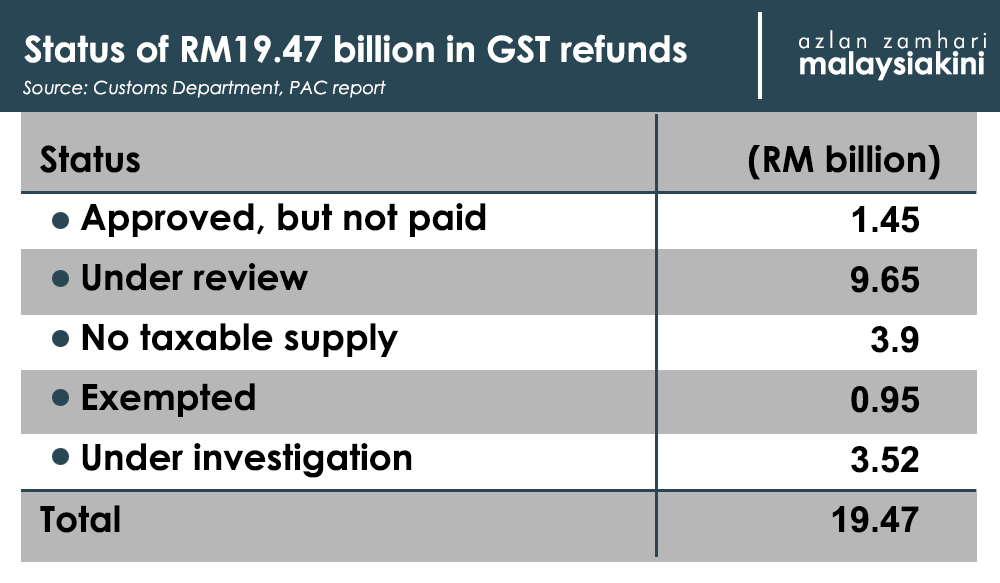

During a briefing to the PAC in March, the Customs Department explained that of the RM19.47 billion, only RM1.41 billion was verified as legitimate claims that were delayed as of June 5 last year.

The Audit Department also told the PAC that it disagreed with the Customs Department's assessment that 93 percent of the RM19.4 billion in claims should be paid.

"The Audit Department's opinion was that this statement was inaccurate because it isn't SOP to accept all claims processed through the RMS (revenue management system) as legitimate claims," read the report.

As of April 10 this year, a total of RM5.73 billion in GST refund payments have been made out of the RM19.47 billion whereas the balance is still being processed.

The report also cited the Customs Department as stating that the GST Trust Fund had only RM152 million as of May 31, 2018 and could not pay the refunds.

The PAC investigation was prompted by Lim's claim in Parliament that RM19.47 billion meant for GST refunds were the subject of "rompak" (robbed).

Although concluding that "no money was missing," the PAC said this GST Trust Fund was insufficient because the money was used for other purposes.

The committee also concluded that the previous administration violated Section 54 of the GST Act 2014 for paying GST monies into the consolidated revenue account.

However, former premier Najib Abdul Razak, who was also finance minister, and former Treasury secretary-general Mohd Irwan Serigar Abdullah told the PAC that things were done according to the law. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.