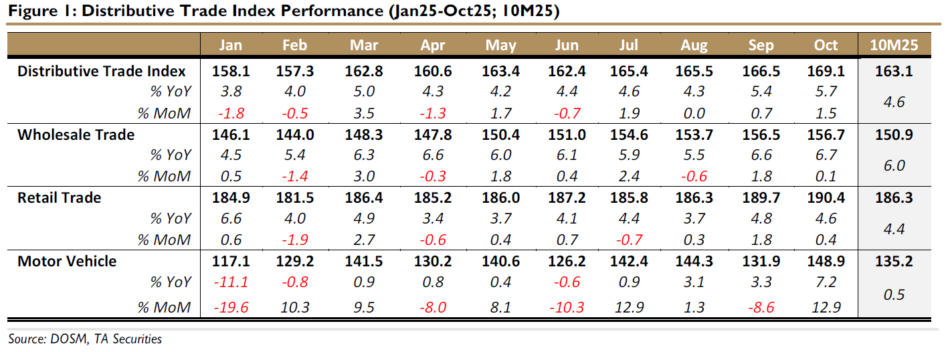

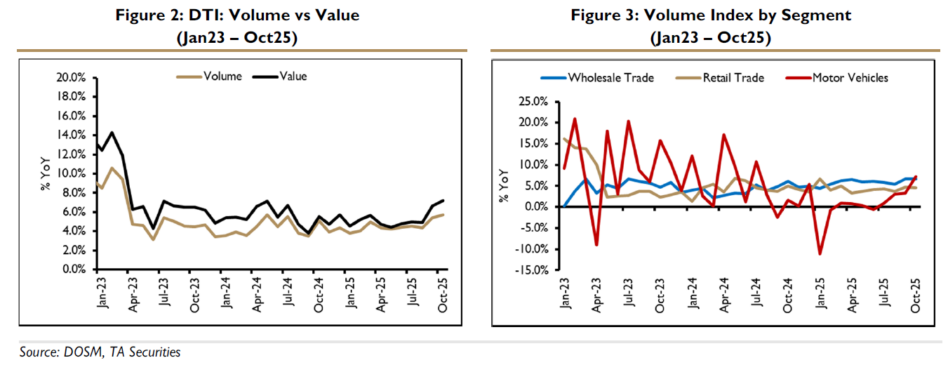

MALAYSIA’S distributive trade growth strengthened in October 2025, with the Volume Index of Distributive Trade (DTI) expanding by 5.7% year-on-year (YoY) to 169.1 points, accelerating from 5.4% YoY in September.

In value terms, Distributive Trade Sales (DTS) rose by a robust 7.2% YoY to RM169.1 bil, improving from a 6.6% YoY increase in the previous month.

The stronger performance in both volume and value terms points to firmer domestic demand and sustained consumer spending momentum during the month.

Despite a challenging and uncertain global backdrop, Malaysia’s consumer spending remained resilient, underpinned by a robust labour market, stable household income conditions, and targeted government assistance programmes.

“Retail and services activity received an additional boost from the festive season, particularly Deepavali, while lower pump prices following the introduction of the BUDI95 mechanism helped alleviate fuel related cost pressures,” said TA Securities.

This, in turn, freed up household disposable income, supporting discretionary spending and overall domestic demand.

As a result, distributive trade activity strengthened on a month-on-month basis, with trade volume rising by 1.5% month-on-month (MoM) and trade value increasing by 0.2% MoM, signalling a continued healthy consumption trajectory despite external headwinds.

“We maintain our view that private consumption will remain the primary growth driver in the final quarter, supported by a confluence of policy support and favourable cyclical conditions,” said TA.

A robust labour market, lower fuel prices, and a stable interest rate environment are expected to enhance household purchasing power, further reinforced by the government’s one-off RM100 SARA cash transfer.

Meanwhile, subdued inflationary pressures continue to support real incomes and sustain discretionary spending.

Collectively, these factors point to continued demand for both essential and discretionary goods, reinforcing Malaysia’s consumption-led growth.

Importantly, resilient domestic demand should act as a buffer against external headwinds, including softer export growth amid heightened US tariffs and persistent global trade uncertainties.

“We therefore maintain our 2025 GDP growth forecast at 4.7% YoY, anchored by resilient private consumption (5.6% YoY) and a steady expansion in the services sector (5.1% YoY), which are expected to remain the key pillars of growth through year-end,” said TA. — Focus Malaysia

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.