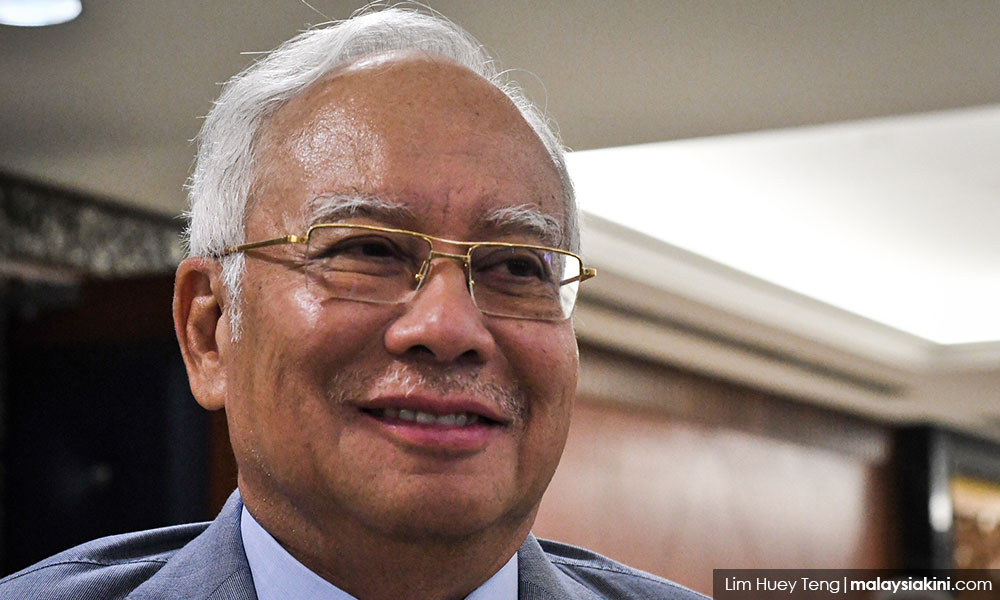

Former prime minister Najib Abdul Razak is concerned with Putrajaya's plan to sell government land as well as the assets of Khazanah Nasional and Pemodalan Nasional Bhd (PNB) based on the claim of managing the RM1 trillion debt inherited from his administration.

He also noted how this “excuse” has been used to announce the imposition of new taxes in Pakatan Harapan's inaugural budget for the nation.

Najib reiterated his stand that the national debt is not at RM1 trillion as repeatedly claimed by Harapan leaders, and blamed the government's financial conundrum on its populist measures.

“The reports from the three international credit rating agencies and the World Bank did not place the national debt at RM1 trillion. Bank Negara itself did not state this as the official debt figure.

“The root of the problem are populist measures such as the three-month tax holiday, switching from GST to SST, which led to widespread tax evasion and the return of bulk subsidies that clearly have leakages, which have led to the government losing revenue up to RM40 billion.

“Due to these measures, the rakyat are urged to sacrifice and brace for hardship. What I am concerned about is that the selling of national assets and land is not to reduce the debt but to cushion the RM40 billion loss in revenue.

“Let us see if the coming budget is a surplus or deficit budget. If it is a deficit budget, then the selling of assets and land is to cushion the loss in revenue and not to reduce debt,” he added.

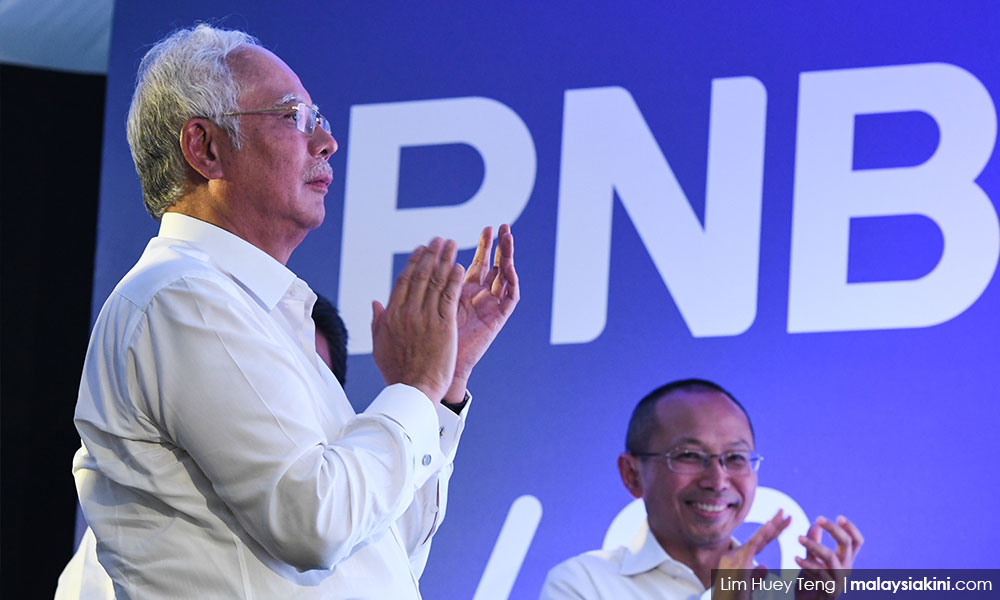

Najib said when he was prime minister, Khazanah's assets rose from RM33.7 billion at the end of 2008 to RM115.7 billion at the end of 2017 whereas PNB's went from RM120 billion to RM279.2 billion.

“When PNB is mentioned, which are holders of ASN, ASB, and so forth, many contributors might be upset with the government for wanting to liquidate PNB's assets. But many are not aware that PNB also manages its own fund called 'propriety funds'.

“PNB's funds, which is a national asset, increased from around RM12 bilion at the end of 2008 to RM43.9 billion at the end of 2017,” he added.

Has proper research been done?

Najib, who was also the former finance minister, said selling national assets, especially those in the form of shares is the easiest measure to be undertaken.

“Announce today, and sell tomorrow. But is this a wise measure, and has proper research been done? We have to balance between the cost and benefit before making a decision,” he added.

Najib explained that the government's debt is mostly in the form of bonds or sukuk and the interest on these bonds is around 3.6 percent per annum.

He said the average growth of assets in Khazanah is around 9.6 percent whereas PNB's is around 9.2 percent, which is far higher than the cost of the interest incurred by the debt.

“I will give an example. In 2008, Khazanah's assets were RM33.7 billion. If we sold the assets that year, we would have reduced the national debt by RM33.7 billion.

“This also means we would have reduced the interest with regard to the debt by RM1.2 billion a year if the rate was at 3.6 percent – which is saving RM10.1 billion for nine years until 2017.

“Due to us not selling Khazanah's assets at the time, the assets rose from RM33.7 billion to RM115.7 billion at the end of 2017 – which is a profit of RM82 billion.

“Which is the wiser choice? RM82 billion in profit or saving RM10.1 billion?” Najib asked. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.