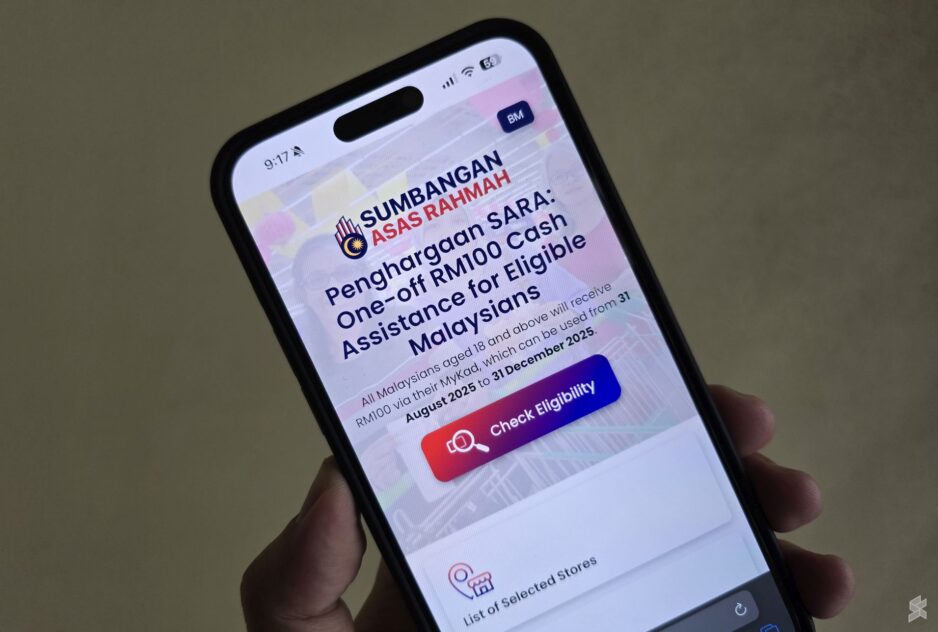

PRIME Minister Datuk Seri Anwar Ibrahim’s New Year message included an announcement regarding the RM100 cash for every Malaysian aged 18 and above under Sumbangan Asas Rahmah (SARA).

The aid will reach roughly 22 million adults, functioning as a short-term cushion for households facing cost-of-living pressures ahead of festive seasons.

In an economic environment characterised by inflationary stress and stagnant salaries, the transfer might alleviate the burden of everyday necessities.

However, a more profound policy question comes to mind: Is this simply a transaction, or can it evolve to build lasting financial capability for its citizens?

A fixed RM100 payment may have limited impact on long-term resilience, as short-term assistance alone does not necessarily strengthen individuals’ earning capacity or economic security.

The universality of the payment, albeit politically attractive, reduces targeting efficiency as high-income beneficiaries obtain the same amount as low-income individuals, potentially diluting the support available to those who require it the most.

Over time, this extensive distribution may place fiscal pressure on public resources while delivering only modest social impact.

Cash transfers need not be abandoned, but they can be reimagined. The government could use such programmes to signal a parallel commitment to capability building.

A portion of future aid could be linked to optional redemption for short-term courses, vocational certifications, or entrepreneurship toolkits, enabling recipients to convert temporary assistance into skills and employability.

In addition to disbursement notifications, beneficiaries could receive links to budgeting tools, micro-investment opportunities, or details regarding upskilling programs provided by Malaysia Digital Economy Corporation (MDEC), Human Resource Development Corporation (HRD Corp), or community colleges.

These linkages would transform aid from a simple disbursement into a catalyst for engagement in the formal sector.

More importantly, the government could measure not only distribution efficiency but also how recipients use the funds, whether short-term consumption translates into improved welfare, and whether complementary support mechanisms reach those who need them most.

Transparency in outcomes would support future budget planning and help refine targeting in a constructive manner.

The fundamental issue is the absence of a mechanism that links immediate relief to longer-term advancement. In a nation where wealth disparities persist and youth unemployment remains persistently high, fiscal instruments must be crafted to empower rather than simply placate.

On that note, the Budget 2026 rightly places people at the centre of economic recovery, signalling that the government is listening to public concerns. But it also highlights a missed opportunity to pivot from relief towards resilience.

The difference between a transfer and a transformation lies in what follows the payment: whether it becomes a brief respite or becomes the foundation of a stronger, more skilled society.

Malaysia has proven adept at distributing money efficiently. The next challenge is to distribute opportunity with the same zeal. Only then can the promise of shared prosperity move beyond the wallet, and into the fabric of everyday capability.

Galvin Lee Kuan Sian serves as Lecturer & Programme Coordinator for the Diploma in Business programme at the School of Diploma & Professional Studies, Taylor’s College.

The views expressed are solely of the author and do not necessarily reflect those of MMKtT.

- Focus Malaysia.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.