Lim Guan Eng, who has been named as the federal finance minister, is taking a cautious approach to answering questions about his new portfolio.

Asked on the stock market which will open tomorrow after a four-day break – including two public holidays following Pakatan Harapan’s upset victory at the polls – he said, “I am only the finance minister-designate, not a stockbroker.”

Lim then added he was not able to answer questions pertaining to his new portfolio until he was officially sworn in, the date for which has yet to be fixed.

Yesterday, Prime Minister Dr Mahathir Mohamad announcedPakatan Harapan’s top three cabinet portfolios, including Lim as finance minister, Amanah’s Mohamad Sabu as defence minister and Bersatu’s Muhyiddin Yassin as home minister.

Lim said there would be no comments from him until he meets with the relevant department heads from the Securities Commission, Bank Negara and other relevant financial bodies including the Employees Provident Fund.

He said presently, officers from the Securities Commission were in Penang to brief him.

“So let me meet with all my senior officers from the relevant bodies whether they are from the Securities Commission or Bank Negara.

“Thanks for all the good wishes extended to me, we will work very hard to make the economy alive again,” Lim said.

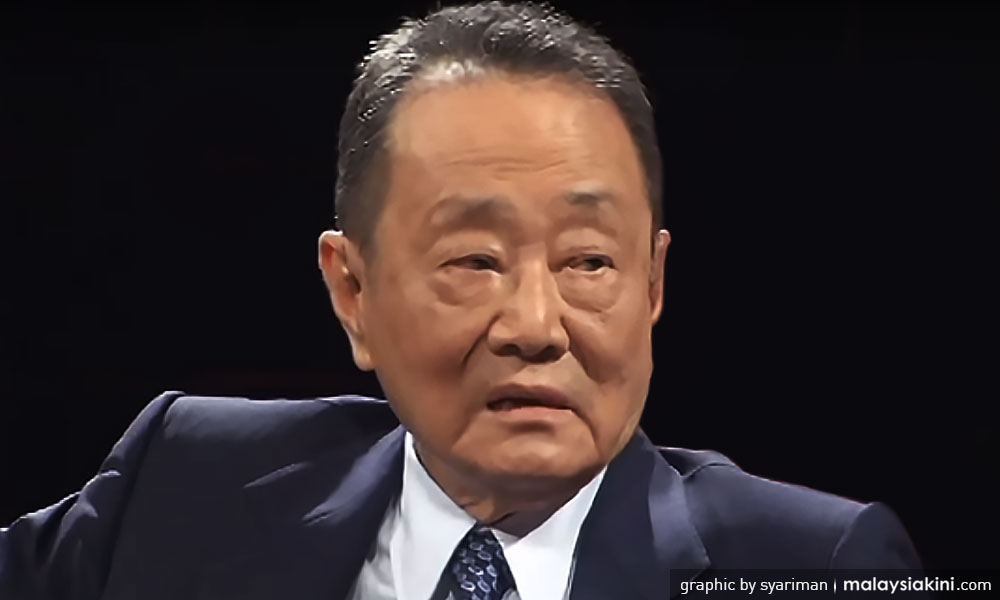

Asked to comment about how he would deal with the new government’s ‘council of elders‘ – which includes Robert Kuok (photo) – Lim said the billionaire was not able to come to Malaysia at the moment.

Other members of the group include former Bank Negara governor Zeti Akhtar Aziz, former Petronas president Mohd Hassan Merican, former finance minister Daim Zainuddin and economist Jomo Kwame Sundaram.

“I had no opportunity to meet the others in the council as after the announcement yesterday, I had to return to Penang to announce the new chief minister and attend the swearing-in ceremony,” he said.

“I have to pack up to make room for the new chief minister to go in so he can start his work immediately,” he added.

“We will not forget (to abolish) the GST, that is what we will do. We will not forget our promises but we need some time,” he stressed.

Asked about the current fiscal situation, Lim declined to comment until he was sworn in.

Lim said the finance ministry was a very important position, and any statement he made would impact the market situation.

He added the new government was prepared to face any situation as “we have a steady hand” and department officers were still on the job.

As for any instructions to the Customs Department director-general to abolish the GST, Lim replied: “I cannot give any instructions now but we take note of his spirited defence of the GST”. – M’kini

Dr M’s return may spur moves in these Malaysian stocks

KUALA LUMPUR ― Brace for a volatile day when Malaysia’s stock market reopens tomorrow after a three-day break that saw the opposition party win office for the first time in six decades.

Malaysia’s FTSE Bursa Malaysia KLCI Index was shut for three days last week as Tun Dr Mahathir Mohamad led an alliance to unexpectedly beat the ruling Barisan Nasional coalition. In his first remarks as prime minister of Malaysia, Dr Mahathir said he’d lead a business-friendly administration and find ways to boost the nation’s equity market.

Even so, market watchers expect equities to fall across the board, with government-linked companies, benchmark index stocks and infrastructure companies taking the brunt of a potential selloff. iShares MSCI Malaysia ETF, the biggest exchange-traded fund holding Malaysian stocks, fell 6.2 per cent this week. The FTSE Bursa Malaysia KLCI Index has corrected by 2.6 per cent after it reached a record on April 19.

Affin Hwang Asset Management Bhd is expecting a decline of as much as 8 per cent in the first few days of trading post-election, while CGS-CIMB Securities lowered its end-2018 target for the benchmark index. UOB Kay Hian Holdings Ltd and Nomura Holdings Inc are reviewing their views on the main measure and equities. On the flip side, Malayan Banking Bhd has expressed optimism for financial markets following the election.

Setting aside the main gauge’s potential move, here are the stocks to watch:

Construction

With Dr Mahathir’s campaign promise to review all infrastructure projects including the East Coast Rail Link project, keep an eye on Gamuda Bhd, IJM Corp, Malaysian Resources Corp and George Kent Malaysia Bhd.

Political ties

Companies with ties to either former prime minister Datuk Seri Najib Razak’s Barisan Nasional party or Dr Mahathir’s Pakatan Harapan might also get some trading interest.

― Family ties: CIMB Bank Bhd (chaired by Najib’s brother Datuk Seri Nazir Razak), Opcom Holdings Bhd’s chief executive officer Mokhzani Mahathir is Dr Mahathir’s son, Eden Inc Bhd and Thriven Global Bhd chairman Fakhri Yassin Mahiaddin is the son of Tan Sri Muhyiddin Yassin whom Dr Mahathir named home affairs minister yesterday

― Government services providers: My E.G. Services Bhd, Datasonic Group Bhd

― DRB-Hicom Bhd sold a stake in national carmaker Proton Holdings Bhd last year to China’s Geely Automobile Holdings Ltd. Dr Mahathir was opposed to giving foreign investors control over Proton

― Felda Global Ventures Bhd, the world’s largest palm oil producer and a vital cog in Malaysian politics.

― Media companies: Utusan Melayu (M) Bhd, Media Prima Bhd and Star Media Group Bhd. Utusan and Star Media are owned by United Malays National Organisation and the Malaysian Chinese Association. Media Prima’s group managing director Kamal Khalid previously ran the communications unit in the Prime Minister’s office

― Destini Bhd, a defence services contractor owned by Rozabil Rozamujib Abdul Rahman, a member of the United Malays National Organisation, a party in the outgoing ruling coalition

― KUB Malaysia Bhd: Majority shareholder Anchorscape Sdn Bhd’s director Abdul Rahman Mohd Redza is the incumbent state assemblyman who won the Linggi seat in the state of Negri Sembilan.

Consumer consumption

Dr Mahathir’s campaign pledge to nullify the nation’s current goods and services tax, fuel subsidies and minimum wage realignment could benefit the consumer sector, according to Gan Eng Peng, director of equities strategy and advisory at Affin Hwang Asset Management.

― Stocks to watch include Nestle Malaysia Bhd, Dutch Lady Milk Industries Bhd, Fraser & Neave Holdings Bhd, Heineken Malaysia Bhd, Carlsberg Brewery Malaysia Bhd, Padini Holdings Bhd.

Export oriented

Any impact on the ringgit will affect export-driven companies with products from rubber gloves to technology. Pay attention to semiconductor manufacturers Inari Amertron Bhd, Vitrox Corp Bhd, Unisem (M) Bhd, Malaysian Pacific Industries Bhd, Globetronics Technology Bhd; glove manufacturers Top Glove Bhd, Hartalega Holdings Bhd.

Flying under the radar

AirAsia Bhd founder Tan Sri Tony Fernandes’s open support for former prime minister Datuk Seri Najib Razak’s Barisan Nasional coalition could impact the company’s shares, according to Vincent Khoo, an analyst at UOB Kay Hian.

― Bloomberg

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.