Umno Youth exco Shahril Sufian Hamdan warns that Malaysia is at greater risk of going bankrupt if Prime Minister Dr Mahathir Mohamad goes ahead with his plan to obtain soft loans from Japan in yen.

"The risk of the country going bankrupt is higher when we borrow in foreign currency such as the yen, as we are exposed to the fluctuations of currency exchange between the ringgit and yen, and also the interest rate in Japan," he said.

Shahril said only two percent of the country's RM700 billion debt is denominated in foreign currency, including yen.

In contrast, he added, borrowing in ringgit is unlikely to make the country go bankrupt.

"The issuance of ringgit is controlled by Bank Negara, so there is no issue that the country will go bankrupt from the 98 percent of the country's debt that is denominated in ringgit.

"The government has its own bank – the central bank, which can print ringgit at any time, as long as it does not go overboard to cause high inflation.

"So technically, any country cannot go into default or bankrupt from debt denominated in its own currency," he said.

Shahril also claimed that the country still owed Japan billions for project funding in the 1990s, such as for the construction of Universiti Malaysia Sarawak and Universiti Kebangsaan Malaysia.

"Mahathir's actions raise more questions than answers," he said.

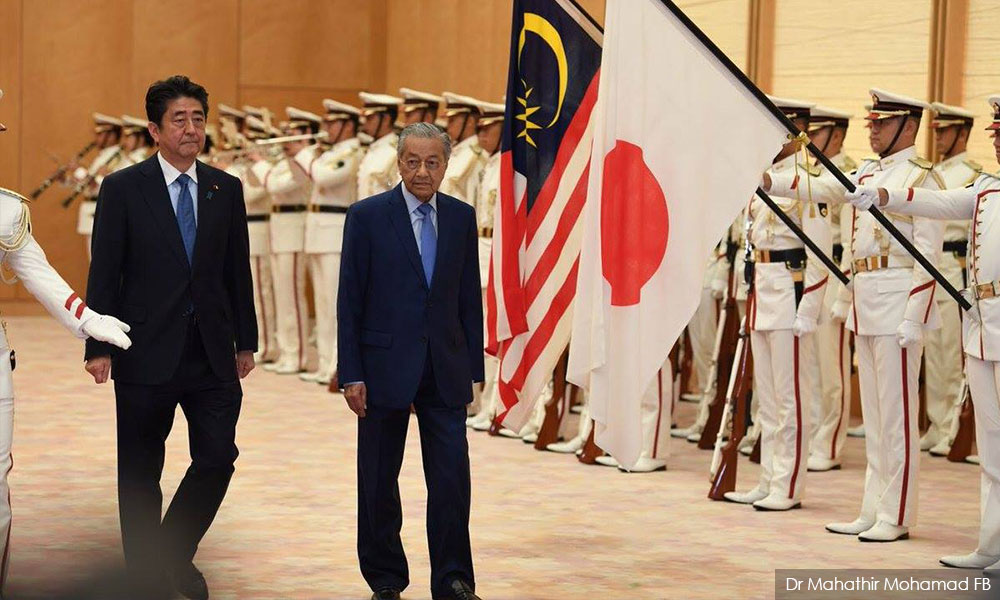

Mahathir, who is on an official visit to Japan, had mulled asking Japan for soft loans denominated in yen.

He said that during his first tenure as prime minister from 1981 to 2003, Japan had extended loans to Malaysia at a low-interest rate of 0.7 percent per annum.

These cheap loans, he said, can be used to pay off other loans taken out by the previous BN government, which were at unfavourable rates that go up to six percent per annum. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.