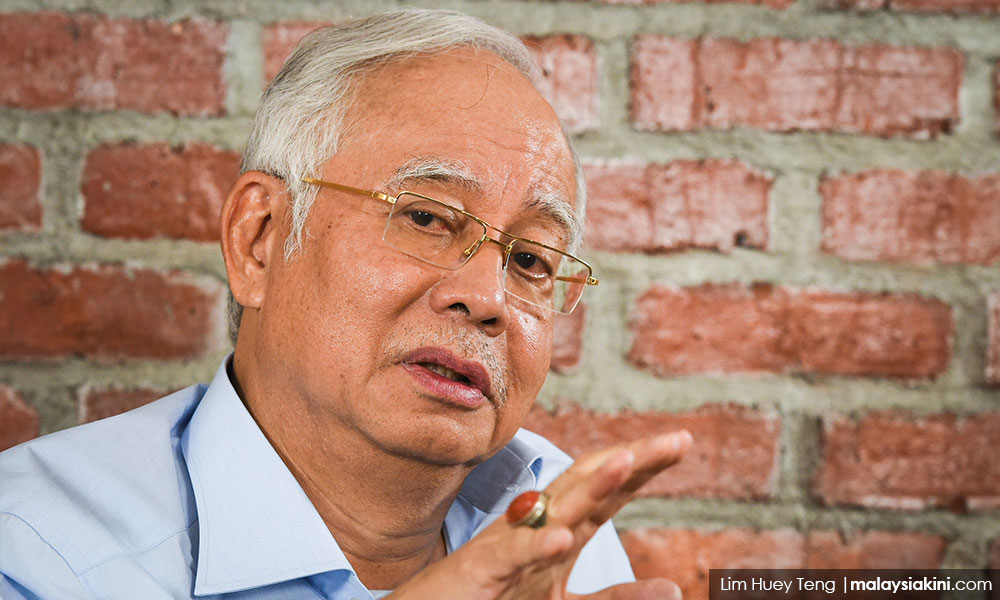

Former premier Najib Abdul Razak has warned Putrajaya against implementing a Capital Gains Tax (CGT) on the sale and purchase of shares.

He said imposing CGT would drive foreign and domestic investors to other markets, which do not have such a tax.

"At first glance, CGT on the sale and purchase of shares appears attractive and populist. Why should the rich who make a profit by 'playing shares' not pay tax? If we impose a tax on them, the gap between the rich and poor can be narrowed, correct?

"Such thinking is very populist and welcomed by the people, but its impact is huge. In the end, the economy suffers and so do the people," he added in a Facebook posting this afternoon.

Najib, who was also the former finance minister, said neighbouring countries like Singapore and Hong Kong have share markets which are more active than Malaysia's, but without CGT.

Prime Minister Dr Mahathir Mahathir had urged Malaysians to prepare to sacrifice with regard to the implementation of new taxes.

Following this, Finance Minister Lim Guan Eng said Malaysians must be prepared for "pain and sacrifice" due to new taxes to be introduced in Budget 2019.

Neither mentioned CGT, although some news articles have suggested that it would be a good move to generate revenue.

The new Pakatan Harapan administration had introduced a slew of cost-cutting measures in response to Malaysia's burgeoning debt, which the current administration estimated to be at RM1 trillion.

Meanwhile, Najib said companies which are listed and those planning to be listed on Bursa Malaysia would experience difficulties in issuing shares to secure the modal to expand their business or open new companies.

Due to this, he added, their businesses would not grow, and this would affect employment opportunities and economic activities.

“In this globalised age, it is easy for Malaysian companies to choose to be listed on the share markets of other nations. Those listed would move to other countries, and those not listed would not pick Bursa Malaysia.

“The biggest investors in Malaysia are institutions which we own, such as EPF, Tabung Haji, PNB... When the demand to acquire shares in Malaysia declines, the price of shares would fall, resulting in losses for these institutions.

“In the end, the people who have savings in these institutions would suffer losses..,” he added.

Najib said when he was prime minister, he did not consider implementing CGT on the sale and purchase of shares because he was certain of its negative impact.

In its election manifesto, Pakatan Harapan had vowed to end Umno and BN's “extortion of the people” through taxes due to its failure to manage the country's coffer responsibly and prudently.

“Harapan will review the national taxation system holistically, with the goal of making the rate of our income tax, corporate tax and other taxes, competitive compared to other Asean countries. We want to share the nation's wealth equitably, and not allow it to be squandered by some only.

“The rate of corporate tax and taxes on small business owners and part-time employees will be reviewed with the goal of reducing the burden of them. We will focus on small and medium-sized entrepreneurs, as SMEs contribute to almost 40 percent of GDP, and 97 percent of Malaysian company belong in this category.

“The Harapan government will help increase the income of the majority of Malaysians and expand the reach of business owners by creating a tax system that is friendly to SMEs, online traders, part time employees, and those working in the sharing economy.

“Personal income tax rate will be reviewed so that the burden towards the middle 40 per cent (M40) can be reduced. While those in the bottom 40 percent (B40) are already not paying income tax,” it read. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.