The criminal trial of former prime minister Najib Abdul Razak involving the alleged misappropriation of funds from SRC International Sdn Bhd enters its 15th day today at the High Court in Kuala Lumpur.

Malaysiakini brings you live reports of the proceedings.

KEY HIGHLIGHTS

- I've power to investigate, not to examine Najib - witness

- Suspicious transactions: Informing Najib amounts to 'tipping off'

- AmBank fined for not reporting suspicious transactions

- SRC didn't submit required information - witness

- Defence and witness continue to clash

I've power to investigate, not to examine Najib - witness

11.50am - Harvinderjit and Bank Negara officer Farhan start a fiery exchange on whether the 4th witness has the power to interview Najib in regards to the suspicious transactions seen in the former premier's accounts at Ambank Raja Chulan up to 2015.

The lawyer asks Farhan on whether the latter, belonging to Bank Negara's Financial Intelligence and Enforcement Department, could have interviewed Najib over the transactions.

The suspicious transactions were found by Bank Negara when it raided the commercial bank on July 6, 2015. Farhan was involved in the raid.

The bank was later fined for failure to report the transactions to the central bank.

Harvinderjit: You could have interviewed the account holder (Najib)?

Farhan: No.

When the lawyer makes reference to Sections 14 and 20 of the Anti-Money Laundering Act (Amla) in regard to Bank Negara's power of examination and investigation and equates to Farhan having the power to interview Najib over the transactions, the witness proceeds to correct him.

"We are talking about examining, not investigation, my learned counsel.

"Examining and investigating are two different things," Farhan says, triggering laughter from those present in court.

Farhan says that he only has the power to investigate, not examine the account holder Najib over the matter.

Suspicious transactions: Informing Najib amounts to 'tipping off'

11.10am - Bank Negara officer Farhan (below) says that even if Ambank Raja Chulan had reported suspicious transactions in Najib's account to Bank Negara as Suspicious Transaction Report (STR), the former premier would not be informed of this as it would amount to tipping off the account holder.

He is answering during cross-examination by Shafee, who is asking the witness if Ambank had done its job in submitting the STR to the central bank in 2015, then Najib would have been duly informed of it.

Farhan had overseen a Bank Negara team that raided Ambank Raja Chulan on July 6, 2015, and confiscated several bank documents, among them being ones on Najib's accounts.

The commercial bank later that year was fined by Bank Negara for failure to submit STR over the suspicious transactions.

Shafee: Do you agree that if Ambank had done their job in filing the STR, my client (Najib) would have been alerted as early as 2015 or even earlier on any suspicious transaction?

Farhan: I disagree as that is tantamount to tipping off.

Shafee: If Ambank had alerted (Bank Negara) on the transactions, and they got hammered with a fine (by Bank Negara), then it is possible that Bank Negara investigation or any other enforcement agency like MACC or police would have to call the account holder (Najib) to explain these suspicious transactions?

Farhan: I have no comment as that is an inference question.

When Shafee presses on with a similar question, Farhan breaks out into exasperated laughter, eliciting chuckles from others present in the courtroom.

AmBank fined for not reporting suspicious transactions

10.30am - Bank Negara officer Ahmad Farhan Sharifuddin testifies that subsequent to a Bank Negara raid on AmBank Raja Chulan on July 6, 2015, the commercial bank was fined over its failure to send a Suspicious Transaction Report (STR) to the central bank over transactions involving Najib's accounts there.

The 4th witness, who is recalled today for cross-examination by the defence, says this when questioned by Harvinderjit (photo).

Harvinderjit: In your investigation, was the bank fined?

Farhan: Yes.

Harvinderjit: Since it is directly related to your investigation, what was the infringement (by Ambank Raja Chulan branch in Kuala Lumpur)?

Farhan: It was for an offence of failure to submit Suspicious Transaction Report (STR) on Datuk Seri's (Najib) accounts (at the commercial bank).

Harvinderjit: For which transaction was it?

Farhan: I cannot pinpoint a specific transaction.

Harvinderjit: Was it for (transactions) pre or post 2013?

Farhan: (Transactions from) opening and closing of the accounts. All transactions (in the period).

Farhan was involved in the raid on Ambank.

SRC didn't submit required information - witness

10.10am - Amirul Imran Ahmat testifies that in his experience as KWAP officer, only SRC International had failed to submit documents and detailed information required by KWAP when applying for a loan with the retirement fund.

He tells prosecutor Ishak Mohd Yusoff that no other company could get away without similar submissions.

Ishak: In your experience serving with KWAP, was there any other company that did not submit all the documents and details of information like SRC, when they apply (for a loan) with KWAP?

Amirul: No.

Ishak: If they did not submit (the documents), their applications would not be approved?

Amirul: Yes.

During the cross-examination, the 29th prosecution witness is also asked why he disagrees with defence counsel Harvinderjit's suggestion that what SRC does with funds from KWAP is not the latter's business.

Amirul tells the court that the asset agreement between KWAP and SRC was "just a syariah method to facilitate syariah compliance".

He testified that this was why the agreement was called between "financier and customer".

The question by Ishak was in response to Harvinderjit's question yesterday put to Amirul that KWAP has no business to know what SRC did with its funds as the entities had a syariah-based agreement under which SRC sold its asset to KWAP to secure a loan from the latter.

Defence and witness continue to clash

9.30am - Witness Amirul Imran Ahmat and defence counsel Harvinderjit Singh continue to clash during cross-examination, reminiscent of yesterday's proceedings.

The latest clash comes over the utilisation of the RM2 billion loan facility by KWAP to SRC International in a manner that stretched beyond the initial agreement between the two entities.

Harvinderjit: If funds were released on the same day and the account shows crediting of funds, it is very difficult to determine unless they have a forensic audit report?

Amirul: It is not my job but it can be done.

Harvinderjit: This can be done via forensic audit?

Amirul: Among others.

Their clash continues over the issue of approval linked to the government guarantee for the RM2 billion loan. Harvinderjit tells the witness that the latter has changed his answer.

Harvinderjit: Yesterday you agreed. Now you change your answer.

Amirul: I am not agreeing with (the) earlier statement.

Harvinderjit: It is okay as you are changing your answer.

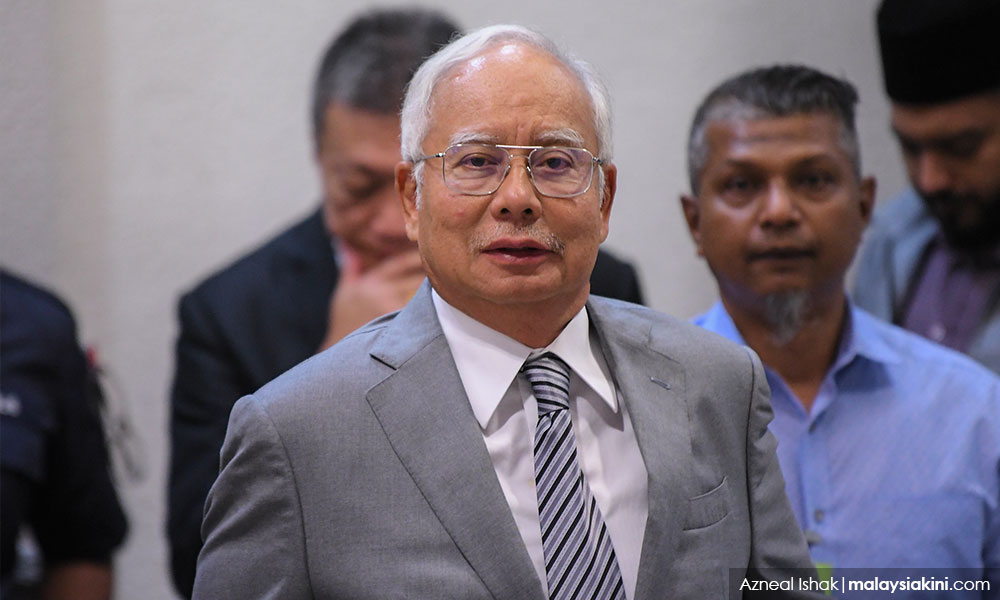

9.10am - Najib is seen entering the dock as Shafee takes a seat at the front. Justice Nazlan then enters the court to start today's hearing.

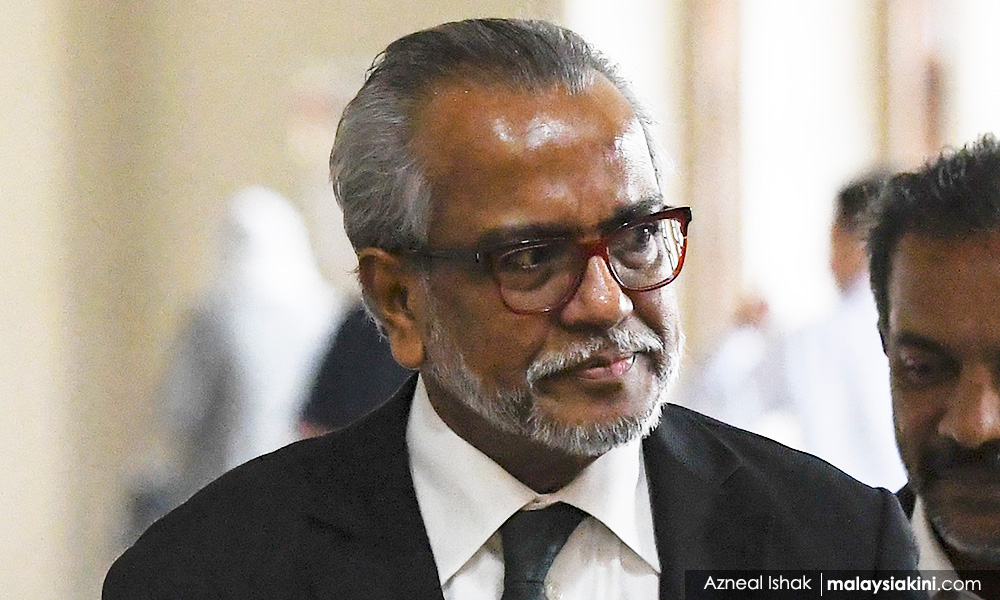

9.08am - Members of the defence team including Muhammad Shafee Abdullah (below), and his sidekick Harvinderjit Singh, starts filling in the seats.

9am - Clad in a grey suit, former premier Najib Abdul Razak enters the courtroom and takes a seat at the front row of the public gallery.

29th witness former Retirement Fund Incorporated (KWAP) officer Amirul Imran Ahmat is seen sitting in the witness stand while waiting to be cross-examined by Najib's defence team once proceedings start.

8.52am - Attorney-General Tommy Thomas enters the court and takes a seat at the front with other members of the prosecution team as they await the commencement of proceedings.

Najib Abdul Razak’s defence team will continue their cross-examination of a former Retirement Fund Incorporated (KWAP) officer on the 15th day of the former premier’s trial for abuse of power, criminal breach of trust and money laundering of SRC International Sdn Bhd’s RM42 million.

Lawyer Harvinderjit Singh is expected to resume his questioning of 29th witness Amirul Imran Ahmat when hearing before Kuala Lumpur High Court judge Mohd Nazlan Mohd Ghazali starts at 9am this morning.

Yesterday, Amirul, who was KWAP’s assistant vice-president (Fixed Income Department), testified that he had tried to limit the fund's loan to SRC International to RM1 billion in 2011, following its initial loan application for RM3.95 billion.

He said in that year, he was tasked by his superiors to prepare a paper for deliberation by KWAP's investment panel.

1MDB was SRC International's parent company at the time. KWAP is a pension fund for civil servants.

Also part of the 1MDB delegation at the time was the executive director of finance Terrence Geh, general counsel Jasmine Loo and SRC International CEO Nik Faisal Ariff Kamil.

Yesterday, amidst an occasional minor clash between Harvinderjit and Amirul, the 39-year-old witness testified that KWAP’s investment panel would have rejected the SRC International’s application for an RM3.95 billion loan if given the choice.

The former subsidiary of 1MDB was, in the end, granted a total of RM4 billion loan by KWAP between August 2011 and March 2012.

Amirul had also told the court that SRC International’s purported projects in the pipeline only looked good on paper when presented by its managing director Nik Faisal and finance executive director Geh.

Humour though managed to find its way through the normally serious proceedings when Amirul had the whole courtroom in stitches with his labelling of one Zahid Taib as a “multi-purpose guy for Nik Faisal”.

Zahid, whom Amirul testified had never produced a business card, was a person whose name constantly appeared in the witness’ emails and other correspondences with SRC International in regard to the loan.

Members of Najib’s defence team, the prosecution, and even the accused himself had a good laugh when DPP Ishak Mohd Yusoff showed Amirul a photograph of Nik Faisal for the purpose of identification, instead of the usual procedure of calling a witness to enter the court to be identified.

Nik Faisal continues to remain at large despite being wanted by Malaysian authorities as a key figure in the case.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.