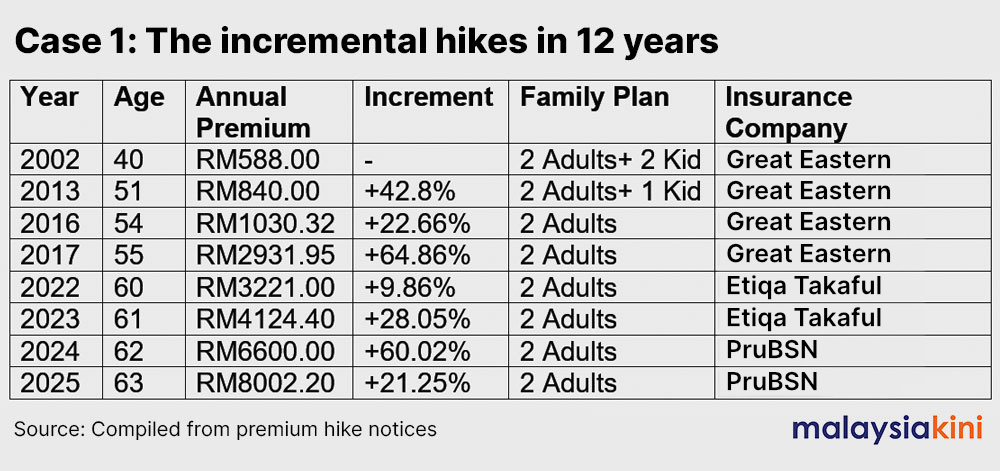

The National Union of the Teaching Profession (NUTP) has claimed that their voluntary group insurance policy rate has shot up, with some even rising to 852 percent in the last 12 years.

In a statement today, the union said many of its members took up the group insurance policy, known as NUTP Takaful Healthcare, as it was initially cheaper than individual coverage.

“But from the complaints we received, the insurer has changed several times.

“And those subscribing to the group premium also saw a rate hike in a period of time.

“There are some who saw their premiums rising by 852 percent in 12 years, some say they saw a rise of 190 percent between 2024 and 2024.

“And we also received a complaint that their premium will rise by 28 percent beginning April this year,” NUTP said, urging Bank Negara Malaysia (BNM) to intervene on the matter.

‘Expand premium hike cap’

On a related matter, PKR MP Sim Tze Tzin said several NUTP representatives voiced their displeasure at a public hearing on the matter held by the Public Accounts Committee in Parliament.

The Bayan Baru lawmaker pointed out that their insurance provider has changed several times - it being Great Eastern Bhd until 2016, then Etiqa Takaful, and as of 2024, Prudential BSN Takaful Bhd.

He also asked why group insurance policies such as the ones subscribed by NUTP were not included in the interim measure announced by BNM, where the premium hike was capped at 10 percent.

“We find this puzzling. So, we want this interim measure to be applied to all to ensure justice and balance in the insurance market,” he said in a press conference at Parliament today.

Also present were senators Amir Ghazali, Azam Hamzah, and Manolan Mohamad.

Sim then urged BNM to consider expanding its insurance premium hike cap to all policyholders.

“These are our teachers. We must protect their welfare and create a sustainable insurance market for all,” he stressed.

Last December, BNM limited premium increases to 10 percent for the vast majority of policyholders.

According to CodeBlue, the central bank said insurers and takaful operators will spread out the changes in the premiums of medical and health insurance/takaful policies arising from medical claims inflation over a minimum of three years for all policyholders affected by the premium increases.

This measure will remain in place until the end of 2026. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.