THE positive bias on the consumer product sector is in line with RHB Research’s market strategy, which is to lean towards names with defensive qualities and domestic-centric earnings, in order to avoid prevailing external risks.

Improving liquidity should buoy the bullish sector sentiment and support a further valuation rerating.

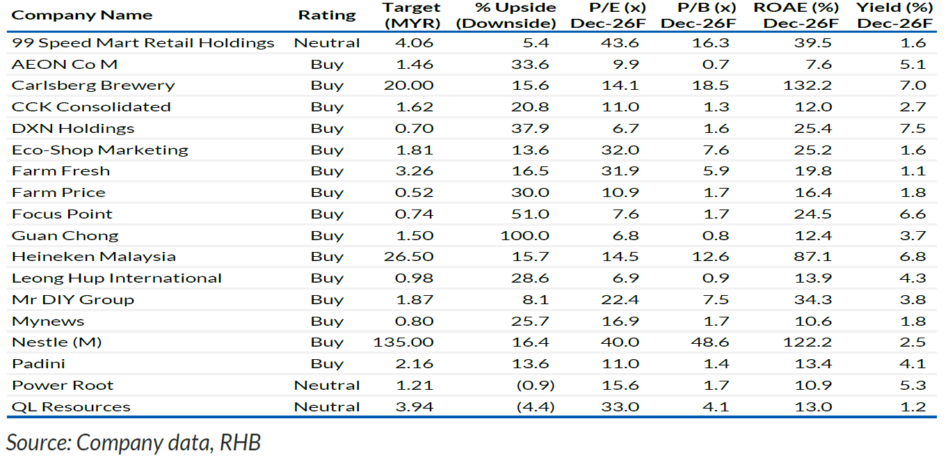

“We raise valuations for NESZ, 99 Speed Mart Retail (99SMART), and FFB, as we expect their promising growth outlook to continue garnering investor interest,” said RHB.

The sector will continue to provide a defensive shelter by offering earnings visibility amidst market volatilities, thanks to their domestic-centric earnings bases and resilient consumption.

Fundamentally, the rising prominence of the Sumbangan Asas Rahmah (SARA) initiative as a fiscal support tool should direct more spending to the sector, whilst the inclusive petrol subsidy rationalisation approach has removed a major overhang and cooled down inflationary risks.

In addition, the stronger MYR, healthy wage growth and the Visit Malaysia Year 2026 (VMY2026) campaign are other sector catalysts.

Meanwhile, easing commodity price trends and MYR strength should translate to lower input costs for food manufacturers going forward.

On the other hand, the recent announcement of the Sales & Service Tax (SST) rate for rental services being decreased to 6% from 8% is a relief for consumer retail companies.

The main beneficiaries of the Government’s fiscal policy will continue to be favoured by investors, including 99SMART and NESZ.

Meanwhile, FFB’s robust growth momentum and expansion headroom in regional markets should keep investors excited.

“Other than that, we highlight that a few quality consumer retail players – Eco-Shop Marketing, Mr DIY Group, AEON Co M and Focus Point – are trading at more reasonable or undemanding valuations,” said RHB.

This is compelling, as RHB believes discretionary spending could pick up in tandem with the improving consumer sentiment ahead.

Lastly, Mynews and two brewery stocks are the sector proxies under RHB’s coverage to capitalise on the VMY2026 theme.

Quarter three of 2025 (3Q25) sector results were broadly in line, with consumer sentiment showing signs of improvement or normalisation from trade tariff-induced jitters in 2Q25.

“We expect to see a sequential pick-up in 4Q25 sales, while earnings should be driven by favourable year-end seasonal factors,” said RHB.

Most of the companies under RHB’s coverage should deliver healthy year-on-year net profit growth, to reflect resilient private consumption on the back of stable employment and economic growth.

Downside risks to RHB’s outlook include weaker-than-expected consumer sentiment, a major slowdown in the domestic economy, and a sharp surge in commodity prices. — Focus Malaysia

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.