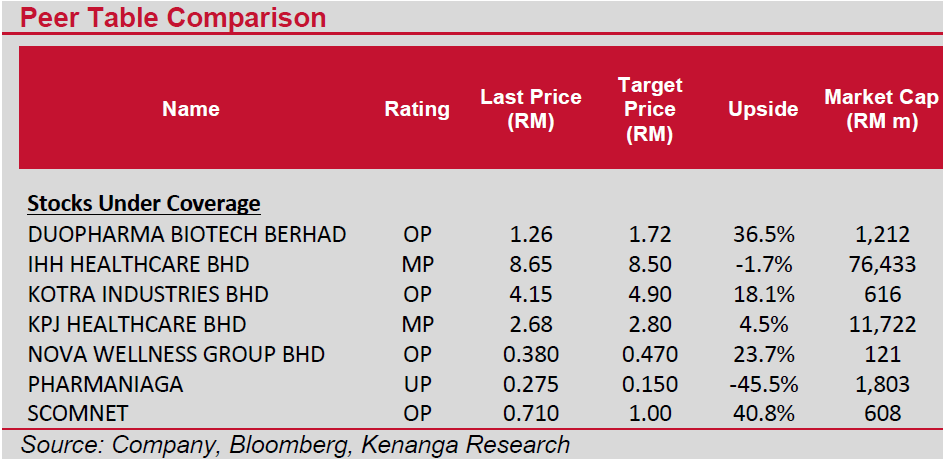

KENANGA is neutral on the healthcare sector, which could have less upside for now from an operational viewpoint.

Based on channel checks, insurance panels or payors are tightening measures such as stricter approval for hospital stays due to medical inflation, which may deter patients from using private healthcare providers.

The challenge here is, private healthcare operators could be exposed to periodic negotiations on pricing and discounts from insurance panels and their commitment to providing quality care at reasonable prices.

Separately, the Health director-general has issued a directive under Private Healthcare Facilities and Services Act 1998 requiring all Managed Care Organisations (MCO), including Third-Party Administrators (TPA) with contracts with private healthcare facilities or services, to submit information to the Health Ministry via online form no later than Jan 31, 2026.

“We believe this is alongside other measures to address medical inflation, and is likely to see hospitals prioritise clinical standardisation and cost efficiency,” said Kenanga.

Looking into the first half of calendar year 2025 (1HCY25), IHH IHH plans to add more than 4,000 beds (+30%) over the next five years across Malaysia, India, Türkiye and Europe.

Kenanga expects IHH’s earnings momentum to accelerate, underpinned by revenue intensity and rising demand in financial year 2025 (FY25).

This would be supported by higher yield services both in Singapore and Malaysia, return of medical tourists in Türkiye, and improvement in cost efficiency in India.

“We believe IHH has greater exposure to medical tourism by virtue of its vast overseas markets,” said Kenanga.

Its earnings are less susceptible to DRG-related regulatory concerns due to its exposure to earnings in various overseas markets it operates in.

Note that Malaysia accounts for 20% and 30% of the group’s topline and bottomline, respectively, based on FY24 numbers.

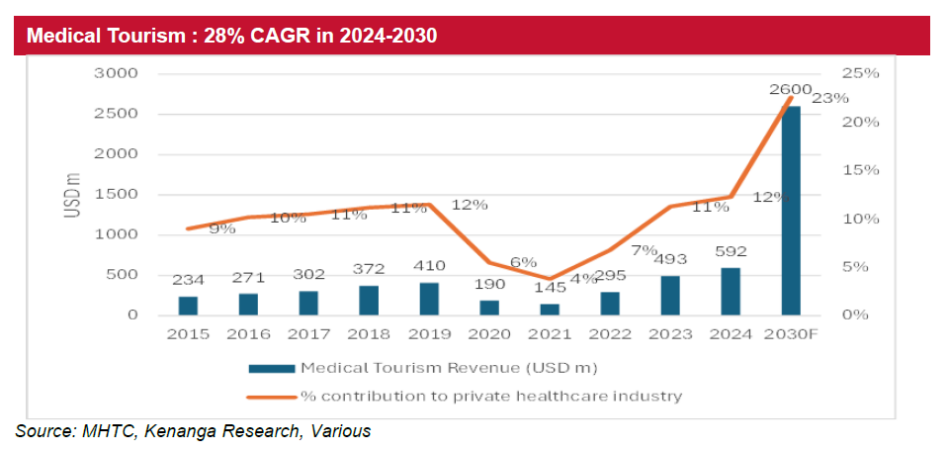

The propensity for medical tourism in Malaysia underpins growth potential for private healthcare operators.

To support the growth of medical tourism, the Malaysian government has implemented several strategic initiatives including establishing the Malaysia Healthcare Travel Council (MHTC) in 2005 by the MOH with the mandate to raise Malaysia’s medical tourism industry, thus elevating Malaysia’s private HCS.

MHTC has been actively promoting Malaysia’s medical tourism industry and launched initiatives such as the Malaysia Healthcare Travel Industry Blueprint 2021-2025, a strategic roadmap to guide recovery and rebuild momentum post-pandemic, and position Malaysia as the preferred medical tourism destination.

In 2023, the medical visa was introduced by offering shorter processing time (within two working days) and allows patients to bring two companions for stays of up to 30 days.

Malaysia also provides dedicated immigration lanes for medical tourists, healthcare concierge services and lounge facilities at major airports and a dedicated call centre to assist patients in the country.

These initiatives have strengthened Malaysia’s position as a medical tourism hub in SEA. Recognising the sector’s strong potential, MHTC has set a medical tourism revenue target of RM12 bil (USD2.6 bil) by 2030.

Generally, Malaysia’s medical tourism growth has been largely driven by patients from Indonesia, which accounted for an estimated 50%-80% of the total medical tourists historically.

An estimated 50% of Indonesians who make overseas medical trips annually choose Malaysia as the destination for their medical treatments, due to Malaysia’s relatively affordable prices, advanced medical infrastructure, high-quality medical professionals, linguistic similarities, cultural compatibility, geographic proximity and ease of travel due to frequent flights.

Moreover, many private hospitals in Malaysia have established a network of representative offices or collaborate with partner agents in Indonesia to support patient referrals and established international patient services teams to coordinate travel arrangements. — Focus Malaysia

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.