QUESTION TIME | In the forthcoming budget on Oct 11, we are already being promised schemes to make it easier for people to buy houses. It seems there are plenty of houses, but not enough buyers - the classic mismatch between supply and demand.

So, what is one of the steps the government is taking? It is trying to conjure up some magic by making those people, who are not bankable right now for home financing, somehow or other to become more bankable overnight by coming up with some kind of financing scheme.

If people can’t afford to buy a house, how can you make it easier for them to buy one via new financing schemes? You can have deferred payment schemes and you can have rear-ended higher payments, but eventually, you must pay the cost of the house with interest. You simply cannot run away from that.

If one remembers the subprime crisis of 2007/8 in the US, it was caused by easy home finance - no down payment was required and buyers could get financing for so-called house refurbishing and renovation. Sometimes, they could get financing for 120 percent of the cost of the house!

With all that easy financing, house prices rose and the risk of loan repayment increased. To get over that part about risk, smart (and devious) investment bankers packed housing loans together, saying they were less risky, and sold them to buyers who should have known better and who were lulled by guarantees made by famous big names such as AIG.

When prices slid down and the ability of housebuyers to repay evaporated into thin air, the crunch came - and what a crunch it was, which threatened to derail the entire world economy and put it into a depression that could have rivalled that of 1929.

History has taught us that we must be very suspicious about “innovative schemes” such as these which try to artificially increase demand when it is severely lacking, much like what is happening to our property market right now.

Ultimately, there are only two ways of making homes more affordable - raise incomes or lower house prices. The best would be a combination of both. Before we elaborate on this, let’s look at what the government might be proposing.

Earlier this week Deputy Finance Minister Amiruddin Hamzah (above) talked about possible measures in the forthcoming budget to deal with the mismatch between house supply and demand. Presumably, the houses on offer are priced too high, and a financing scheme will make it more affordable.

"What is important is to come up with a scheme for those who are less bankable to help them become bankable - with some innovative schemes. I am not supposed to give away anything here, but it would be something along that line,” he said.

There you have it - that word “innovative”. But what can you do about it? Precious little, actually. Best to allow the market to settle it - if units cannot be sold, developers will lower prices and in future make units that can sell and are more in tune with affordability levels.

Let’s look at the overhang situation, and then the income situation.

According to the Valuation and Property Services Department of the Finance Ministry, the residential overhang situation continued to increase to 32,313 units valued at RM19.86 billion in 2018, an increase in volume of 30.6 percent and 27.0 percent in value (24,738 units worth RM15.64 billion in 2017).

High-rise residential houses (condominiums and apartments) formed the bulk of the overhang units, representing 43.4 percent (14,031 units) of the total. Most of the overhang units were concentrated in Perak (2,905 units; 20.7 percent) and Kuala Lumpur (2,692 units; 19.2 percent).

Amiruddin, surprisingly, indicated that most of the unsold units were in the RM200,000-RM300,000 category. It is not clear if this is by volume or value. High-end units can easily exceed this by five times or more, and could well account for a bigger share according to value. Proper analysis is not possible without a more detailed disclosure, but part of the overhang and mismatch may be because developers targeted foreign buyers instead of the local ones.

Now, for the income factor. According to the Department of Statistics figures released in 2017, the median monthly household income per month for Malaysia increased to RM5,228 in 2016, compared to RM4,585 in 2014 with a growth rate of 6.6 percent per annum at nominal value. The median income indicates the level of central tendency, with roughly 50 percent of household income below this level, while 50 percent is above.

If you assume an average household size of five and break down expenses in terms of rent (say RM1,000), food (RM1,500 per month or RM50 a day), transport including vehicle payments (RM1,000 p/m) and miscellaneous (RM1,500 p/m), the total comes up to RM5,000. There’s not much left to invest in any property.

According to Bank Negara Malaysia (BNM), in their annual report for 2017, single citizens should be earning RM2,700 a month for a decent living. Meanwhile, for a family with two children, they should be earning at least RM6,500 for a living wage.

If a household buys an apartment for RM300,000, pays 10 percent or RM30,000 (where are they going to get that?) down, and takes a loan for 25 years, the monthly loan payment comes up to nearly RM1,500, way beyond the capacity of most households in Malaysia.

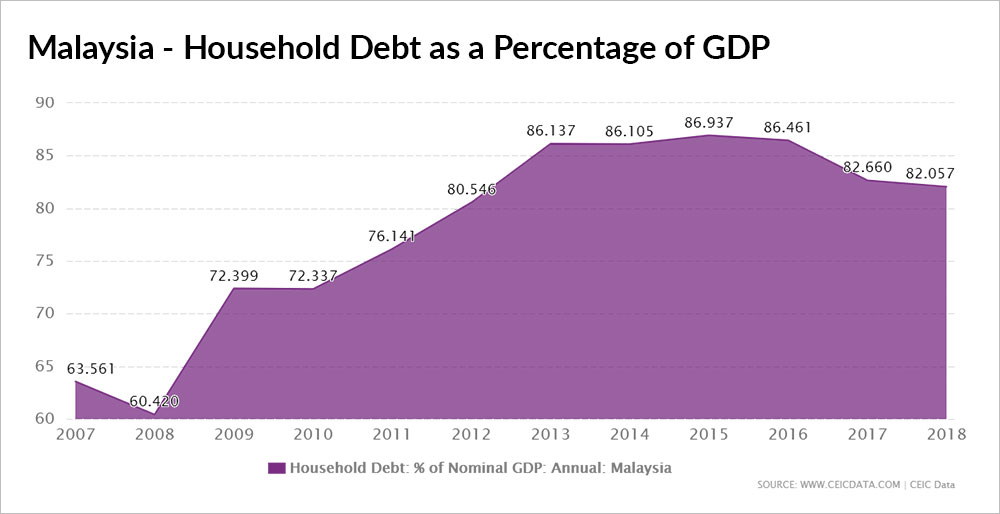

Then there is the thorny issue of household debt (see table below). Economists are concerned that as a percentage of nominal gross domestic product (GDP - goods and services produced in the economy at current prices), it has climbed from just over 60 percent to as high as nearly 87 percent, before declining slightly to just over 80 percent.

If we come up with “innovative” schemes to bamboozle unsuspecting buyers to think that they are bankable and hoist unwanted properties on to them, we are going down the perilous path of inability to pay in the future and a major systemic disruption.

We don’t want that. The government needs to ensure that any scheme to help buyers purchase properties assesses properly the ability or the inability of the purchaser to pay for the property in future. Don’t forget the risks involved in the haste to help developers sell their overhang.

It is better for the market to sort things out - developers may bring prices down if they can’t sell projects, and they may in future take more care to match their developments more with demands of the market place.

One of the prime considerations for the government should be to find ways and means to increase incomes and improve livelihoods for the majority of the people in the country. It would be interesting to see what measures, if any, the finance minister will propose with respect to this in the budget to be announced on Oct 11.

P GUNASEGARAM says that developers must build affordable houses to sell them. He is the editor-in-chief of business publication Focus Malaysia. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.