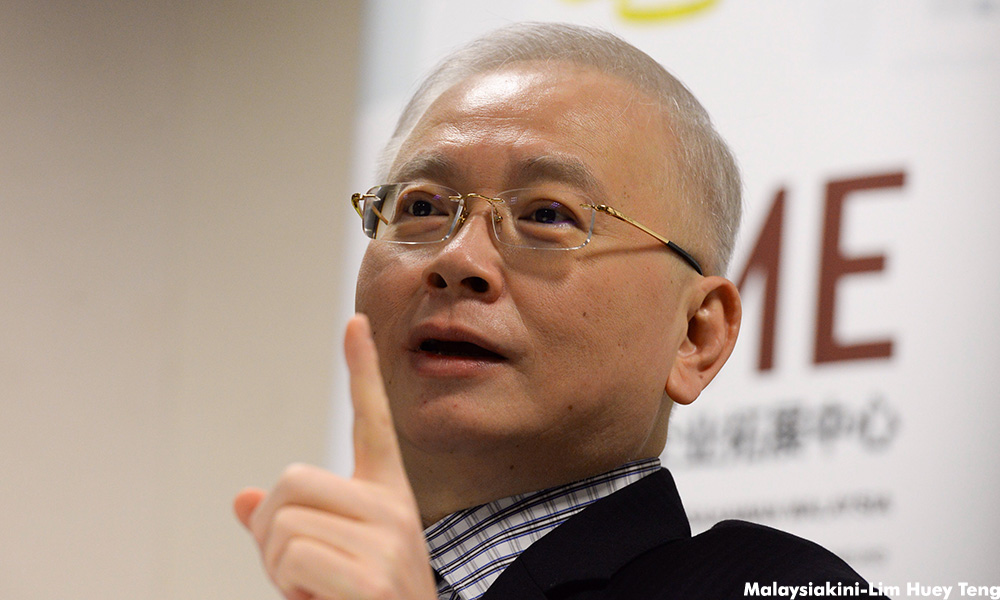

I refer to Wee Ka Siong’s statements here.

Wee says: “Stranger still is that the RM3.6 billion cost of the tunnel itself is to be paid based on a set number of acres of prime sea-side land valued at RM1,300psf in the year 2013.

“Although the Penang government will claim that the official land cost is just RM475 psf, absolutely no one should be fooled that such desirable seaside land along Gurney Drive only costs so little.”

Let’s examine the statements above.

'The Penang state government claims that the land is valued at RM475 psf, while Wee put the value at RM1,300 psf as of 2013.'

I don’t know how both sides obtained these numbers from, so I did a search from National Property Information Center (Napic) website.

This page contains details of property transactions above RM10mil from 2012 - 2017. There are several categories of properties e.g. residential, commercial, development land, etc.

I believe the best reference is the transactions under 'Development Land' category. Unfortunately, I couldn’t find any development land transactions at Gurney Drive, so I picked several transactions of land within its vicinity.

Case 1: Kawasan Jalan Kelawai, land size 1,115sqm (eq 12,001sq ft), freehold, transacted on Sept 1, 2016, transacted price RM11,933,314. That works out to be RM994 psf.

Case 2: Kawasan Jalan Kelawai, land size 2,404sqm (eq 25,876sqft), freehold, transacted on Dec 31, 2012, transacted price RM18,065,078. That works out to be RM698 psf

Case 3: Kawasan Jalan Kelawai, land size 2,404sqm (eq 25,876sqft), freehold, transacted on Dec 30, 2011, transacted price RM13,458,640. That works out to be RM520 psf

Case 4: Jalan Tg Tokong, land size 2,952sqm (eq 27,900sqft), freehold, transacted on Sept 26, 2011, transacted price RM15,887,500. That works out to be RM569 psf

Assuming the transacted prices above reflect the fair market value during which the transactions were recorded, and assuming these locations share more or less the same land value as Gurney Drive, then the fair value for the sea-side land to be reclaimed should be slightly above RM698 psf in 2013.

This figure is way higher than the RM475 price tag as claimed by the state government but still far lower than the RM1,300 price tag as claimed by Wee.

Next, Wee made the assumption that the sea-side prime land will enjoy 5% yearly appreciation in value.

Let’s take Case 1 as an example. Assuming the land value is RM1,000 psf at the end of 2016. With 5% yearly appreciation, the same land will worth RM1,407 psf by 2023.

Take note that the land is ready for use, with freehold status. On the other hand, the sea-side prime land to be alienated to the SPV has yet to be reclaimed.

Moving on. Wee says: “[...] the RM3.6 billion worth of land will be worth RM5.8 billion in the year 2023 if based on a mere 5% yearly appreciation. This means that the Penang people will have foregone another RM2.2 billion in land value.”

Why not we make this figure bigger? Let say the construction of all projects in the same package – the tunnel and the three paired highways only begin in 2023.

Given the state government is to alienate a total of 110 acres of reclaimed land to the SPV, which equals to 4,972,000 sq ft, the total land value will be 4,972,000 x RM1,407 = RM7 billion.

Then, as I mentioned earlier, the sea-side prime land has yet to be reclaimed, so we have to factor in the cost of reclamation work. As a civil engineer, Wee should know the cost better than others.

I did a quick search on Google, so let’s put the cost at approx. RM50 psf. So the total cost to reclaim 110 acres of land would be RM249mil. Given this cost is to be borne by the SPV, it will finally enjoy a net land value of RM6.75 billion.

Lastly, given the cost of the entire tunnel project as published by the Penang state government is RM6.34billion, the SPV will reap a profit of up to RM410mil, based on my assumptions and calculations above.

This figure is far from Wee’s calculation. Dear readers, please accept my apology if there’s mistake in my calculations, and feel free to judge Wee’s allegation on its own merit. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.