AS Malaysia recalibrates its fiscal strategy amid tighter revenue conditions and rising compliance pressures, attention has increasingly turned to the efficiency of tax collection and the diversity of our tax revenue base.

Yet, one long-standing leakage continues to undermine these objectives: the persistence of the shadow economy – and particularly – the illicit cigarette trade.

Recent data released by the Royal Malaysian Customs Department (JKDM) provides a useful snapshot of this challenge.

Between January and November 2025, the total value of seizures involving excisable goods, including unpaid duties and taxes, rose by 17.5% year-on-year (yoy) to RM1.8 bil.

Of this, cigarette-related seizures alone involved more than 526 million sticks with associated unpaid taxes exceeding RM360 mil.

To put this in perspective, the foregone tax revenue of RM360 mil is equivalent to at least 15% additional allocation to 22 million Malaysians under the SARA Appreciation programme.

On the surface, these figures reflect commendable enforcement capability and operational effectiveness.

Yet, when viewed through a broader economic lens, they raise a more poignant question: “Are rising seizure values evidence that the problem is being contained or are they simply a reflection of an illegal market that remains large, profitable and structurally resilient?”

Enforcement challenges

From an operational perspective, the data indicates sustained enforcement intensity and a more targeted approach that prioritises higher-value interdictions. This is a rational strategy in an environment of finite resources and increasingly sophisticated smuggling networks.

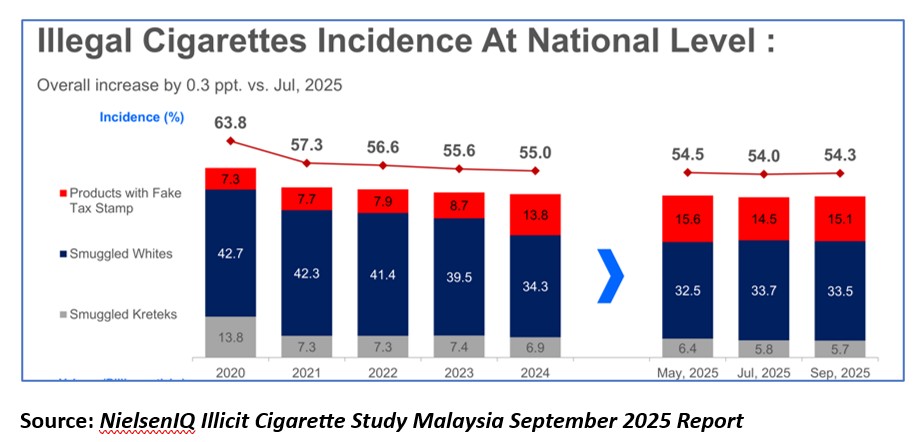

However, market outcomes tell us a more complicated story. Estimates suggest that Malaysia’s illicit cigarette market is worth up to RM5 bil annually.

This is not marginal leakage at the edges of the system. It points to a failure to materially shrink the demand for illegal products – even as supply-side enforcement becomes more advanced.

The paradox is difficult to ignore. If enforcement alone were sufficient, the size of the market should be declining over time. Instead, it appears to be adjusting.

Syndicates continue to innovate by using diversified channels and increasingly complex logistics to evade detection.

The use of private and luxury vehicles to transport illicit cigarettes, including a recent Terengganu seizure involving 352,800 sticks valued at RM319,228.80, illustrates how quickly the market adapts to enforcement pressure.

In this context, rising seizure values warrant careful interpretation. While they demonstrate interdiction success, they also suggest that illicit trade remains commercially viable and sufficiently lucrative to absorb enforcement pressure without losing significant momentum.

When success is solely measured by outcomes

Beyond enforcement, broader market dynamics continue to shape the persistence of illicit trade even as enforcement activity remains frequent and geographically widespread. JKDM reports have indicated regular high-value seizures across multiple states.

In December 2025 alone, JKDM Kelantan intercepted over 1.14 million illicit cigarettes valued at nearly RM1 mil while Pahang recorded seizures of non-duty-paid cigarettes and liquor worth RM3.7 mil across four cases.

In Sarawak, 3.43 million illicit cigarettes and over 70,000 litres of untaxed liquor valued at RM4.2 mil were uncovered at a residential property in Sibu.

Despite these efforts, pricing structures within the tobacco market – influenced in part by excise policy – continue to interact with consumer behaviour in ways that are difficult to address through enforcement alone.

Regional estimates suggest that Southeast Asian governments collectively lose approximately US$3.7 bil (RM15 bil) annually due to the illegal tobacco trade.

Managing the shadow economy effectively requires not only sustained enforcement but a policy architecture that steadily erodes the economic logic of illicit trade and reinforces the integrity of the formal system.

While government enforcement measures curb illicit cigarette supply, smuggled tobacco remains permeated in the informal retail sector.

Policy instruments must be assessed against outcomes (illicit prevalence), not just activity (seizure volumes & values) as enforcement efforts do not translate to recouping lost taxes.

Ultimately, success should not be measured solely by the value of contraband seized but by sustained reductions in market share, revenue leakage and compliance gaps.

As long as illicit cigarette market remains large and adaptive, the shadow economy will continue to impose a silent but significant cost to the government and its ability to generate additional tax revenues.

Pankaj Kumar is managing director of think tank Datametrics Research & Information Centre (DARE).

The views expressed are solely of the author and do not necessarily reflect those of

- Focus Malaysia.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.