Malaysia’s “catch of the week” lies in the widening gap between intent and execution.

While macroeconomic anchors remain intact, institutional credibility and delivery capacity have become the market’s primary pricing mechanism as the country moves into 2026. Stability is no longer the question; implementation is.

On Jan 22, Bank Negara Malaysia kept the overnight policy rate unchanged at 2.75 percent, reinforcing a deliberate “stability-as-asset” posture at a time when external demand is uneven and global interest-rate expectations remain fluid.

The message is not one of aggressive easing or tightening, but of predictability. BNM is signalling that it intends to preserve a credible monetary floor so that competitiveness and growth upside must be generated through investment conversion, productivity gains, and execution discipline, rather than reliance on rate-driven stimulus.

Financial conditions are reflecting this stance. The ringgit’s recent firmness continues to be interpreted as a function of relative policy credibility, macro stability, and expectations of softer United States monetary settings ahead. The implications are constructive but demanding.

A stronger currency supports household purchasing power and reduces foreign-currency debt servicing pressure, yet it also removes the long-standing “cheap FX cushion” for exporters.

Firms are increasingly compelled to compete on reliability, technology upgrading, and productivity. Markets, in turn, are rewarding delivery credibility more than narrative momentum.

Regional diplomacy

Regional diplomacy has also entered sharper focus. In Parliament on Jan 20, Foreign Minister Mohamad Hasan stated that Asean would not endorse Myanmar’s junta-led election, including by declining to send observers. This was an explicit institutional signal that Asean would not “certify” the process.

For Malaysia, the immediate political-economic relevance lies in risk management. Regional credibility shapes investor perceptions of Southeast Asia’s political stability and supply-chain reliability.

Malaysia’s stance positions it as an advocate of rules and legitimacy, while simultaneously raising expectations that Asean diplomacy will be matched by consistent follow-through rather than declaratory statements alone.

Foreign policy more broadly is being reframed as economic statecraft. Malaysia’s engagement with Türkiye remains relevant to the week’s strategic narrative because it treats diplomacy as a delivery platform rather than symbolic outreach.

The emphasis is on structured, cross-ministry pathways encompassing trade, investment facilitation, defence-industrial collaboration, education, and technology cooperation.

The market-facing question is straightforward: can high-level frameworks be translated into bankable projects, measurable investment flows, and sectoral upgrading outcomes within clear timelines and accountable governance arrangements?

Domestically, opposition politics have introduced a different layer of uncertainty. Developments within Perikatan Nasional, including leadership recalibration signals linked to Muhyiddin Yassin, matter less for daily headlines than for parliamentary tempo, narrative discipline, and perceived political risk.

Investors can accommodate contestation; what they discount is unpredictability. If opposition dynamics sharpen policy scrutiny while remaining institutionally orderly, accountability can improve.

If factional bargaining generates episodic shocks, legislative scheduling uncertainty rises, and execution risk becomes priced into currency sentiment and longer-horizon investment decisions.

Governance credibility

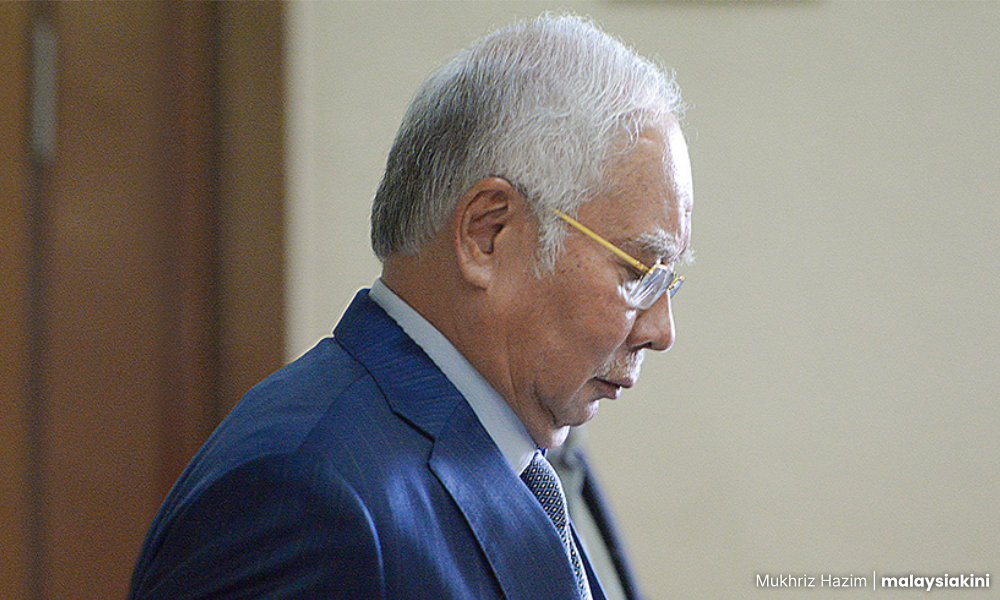

Governance and rule-of-law optics continue to reverberate through high-profile court developments involving Najib Abdul Razak. These matters carry significance beyond legal detail because governance credibility has become an explicit economic variable.

Markets are assessing institutional consistency, asking whether processes appear rules-based and predictable or politically elastic.

In a region where many economies compete on broadly similar fundamentals, governance clarity increasingly differentiates destinations for capital, influencing risk premia, capital inflows, and confidence in committing to long-duration projects.

Recent macroeconomic data continue to support a “stable-but-tested” narrative. Inflation remains contained, while trade and activity indicators keep the baseline outlook constructive. The strategic implication is that macro stability has created a window for structural delivery.

Faster permitting, disciplined utilities planning, stronger human-capital pipelines, and more reliable inter-government coordination are required so that investment approvals translate into commissioning, exports, and wage growth.

Without that conversion engine, the medium-term growth ceiling will be shaped less by demand conditions and more by capacity constraints and implementation friction.

Governance expectations

Finally, signals from GLCs and investment institutions underscore a familiar duality. Government-linked capital can crowd in private investment and accelerate national upgrading, particularly in strategic sectors. At the same time, it raises governance expectations.

Project selection discipline, disclosure standards, and outcome metrics must be robust enough to withstand political scrutiny and market scepticism. The closer an initiative sits to national strategy, the more markets demand transparent milestones and auditable delivery.

Taken together, the week’s developments point to a single conclusion. Malaysia’s challenge this year is not strategic imagination, but disciplined execution.

Monetary stability has bought time, diplomacy is being aligned with economic objectives, and investor interest remains present. The decisive variable now is whether institutions can consistently translate alignment into outcomes, with transparency, credibility, and speed. - Mkini

AZAM MOHD is an independent political and economic analyst.

The views expressed here are those of the author/contributor and do not necessarily represent the views of MMKtT.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.